Venture Capital Fund Lifecycle

Venture capital funds have a long lifetime because it usually takes years for the portfolio companies to exit.

Venture capital funds are typically structured under the assumption that fund managers will invest in new companies over a period of 2-3 years, deploy all of the capital in a fund within 5 years, and return capital to investors within 10 years. Of course, thereâs tremendous variety with investment periods and return periods in practice.

Tips For Breaking Into Venture Capital:

Growth Of Silicon Valley

Due to the industry’s proximity to Silicon Valley, the overwhelming majority of deals financed by venture capitalists are in the technology industrythe internet, healthcare, computer hardware and services, and mobile and telecommunications. But other industries have also benefited from VC funding. Notable examples are Staples and Starbucks, which both received venture money.

Venture capital is also no longer the preserve of elite firms. Institutional investors and established companies have also entered the fray. For example, tech behemoths Google and Intel have separate venture funds to invest in emerging technology. In 2019, Starbucks also announced a $100 million venture fund to invest in food startups.

With an increase in average deal sizes and the presence of more institutional players in the mix, venture capital has matured over time. The industry now comprises an assortment of players and investor types who invest in different stages of a startup’s evolution, depending on their appetite for risk.

Also Check: I Want To Invest In Penny Stocks

Why Is Venture Capital Important

Innovation and entrepreneurship are the kernels of a capitalist economy. New businesses, however, are often highly-risky and cost-intensive ventures. As a result, external capital is often sought to spread the risk of failure. In return for taking on this risk through investment, investors in new companies are able to obtain equity and voting rights for cents on the potential dollar. Venture capital, therefore, allows startups to get off the ground and founders to fulfill their vision.

How Venture Capital Works

The popular mythology surrounding the U.S. venture-capital industry derives from a previous era. Venture capitalists who nurtured the computer industry in its infancy were legendary both for their risk-taking and for their hands-on operating experience. But today things are different, and separating the myths from the realities is crucial to understanding this important piece of the U.S. economy.

Todays venture capitalists are more like conservative bankers than the risk takers of days past. They have carved out a specialized niche in the capital markets, filling a void that other institutions cannot serve. They are the linchpins in an efficient system for meeting the needs of institutional investors looking for high returns, of entrepreneurs seeking funding, and of investment bankers looking for companies to sell.

Venture capitalists must earn a consistently superior return on investments in inherently risky businesses. The myth is that they do so by investing in good ideas and good plans. In reality, they invest in good industries-that is, industries that are more competitively forgiving than the market as a whole. And they structure their deals in a way that minimizes their risk and maximizes their returns.

In addition to analyzing the current venture-capital system, the author offers practical advice to entrepreneurs thinking about venture funding.

Read Also: Cash Out Refinance To Purchase Investment Property

How To Maximize Your Chances Of Hitting A Home Run

Given all of the above, the logical follow-on question should be how can VCs maximize their chances of finding a home run investment? This is a contentious topic to answer and I am going to frame it across two areas that are worth looking into.

I will address these separately, starting with the latter:

How Do Venture Capital Managers Add Value

Sector and geography focus: Venture capital managers generally hold deep expertise in a specific sector or geography, allowing them to better identify, source and build successful businesses. For example, a firm might invest only in B2B software in North America or healthcare in Western Europe.

Investor confidence: When an early-stage company receives investment from a trusted Venture capital firm, it adds credibility – both to other industry stakeholders and future investors.

Many Venture capital firms are run by former founders of successful startups, who put their industry experience and personal network in the hands of new founders.

Establishing strong management: Venture capital managers will guide companies through building successful management teams as the business develops, often utilising their relationships within a sector or region to find the best talent.

Exit planning: Like buyout and growth equity firms, Venture capital managers will leverage their network to prepare for the best exit avenue. If a company is ready for an IPO, the manager will guide them through the process or – if they are not ready – sell the stake to a later fund to retain ownership within the firm. Another common strategy is to lead the company through an M& A transaction to a strategic buyer .

start-sidebar

The Stages of Venture Capital Investing

Venture capital firms invest across financing stages, either focusing on one stage or reinvesting throughout, depending on their strategy:

Also Check: I Need Help Investing My Money

Venture Capital Is A Game Of Home Runs Not Averages

The first, and arguably most important, concept that we have to comprehend is that venture capital is a game of home runs, not averages. By this, we mean that when thinking about assembling a venture capital portfolio, it is absolutely critical to understand that the vast majority of a funds return will be generated by a very few number of companies in the portfolio. This has two very important implications for day-to-day activities as a venture investor:

To many, particularly those from traditional finance backgrounds, this way of thinking is puzzling and counterintuitive. Conventional financial portfolio management strategy assumes that asset returns are normally distributed following the Efficient-market Hypothesis, and that because of this, the bulk of the portfolio generates its returns evenly across the board. A 66-year sample analysis of 1-day returns from the S& P 500 in fact conforms to this bell curve effect, where the mode of the portfolio was more or less its mean.

Turning away from the more liquid public markets, investment strategies in private markets also strongly emphasize the need to balance a portfolio carefully and manage the downside risks. In an interview with Bloomberg, legendary private equity investor Henry Kravis said this:

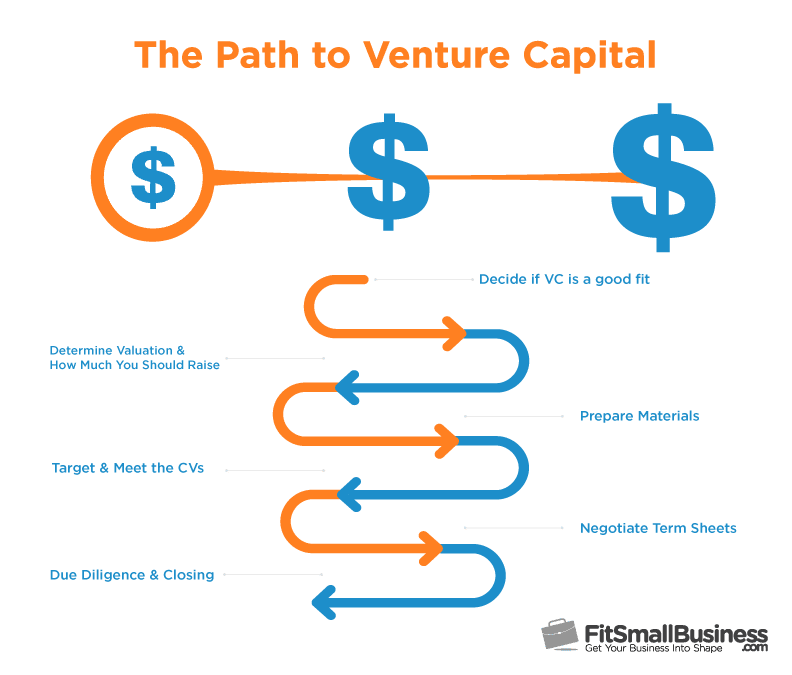

What Is The Usual Vc Investment Process

Before venture capitalists even meet with a startupâs founders, they generally conduct some pre-screening process to select proposals that meet their VC companyâs standards.

Startup founders and early-stage business owners seeking venture capital funding have to fill out an application and provide a variety of information about their company for pre-selection.

For example, they have to send information about their product or service, business model, management team, and any revenue they are already generating.

Basically, anything that shows their company has potential for growth and profit and meets certain criteria can help land a meeting with VC investors.

After VC firms select successful applicants, they schedule meetings with the founders or co-founders to review their business plans and hear their pitch. This is when startup founders have a chance to share their pitch decks with investors in person.

If the meeting goes well, the venture capitalists then do further due diligence and look closely at all aspects of the company, including the teamâs background and financials, to ensure everything checks out and that they are not being misled in any way.

The investors will also do a deep dive into the industry to look at competitors and the current market to better understand growth and profit potential.

Once the venture capitalists and startup founders agree on a deal, they draw up and sign all the required legal documents to make the partnership official.

Don’t Miss: A Type Of Income Investment

Lots Of Bets Few Big Wins

Startup failure rates are extremely high. At least 9 out of 10 new business attempts fail in the first few years. Most do not even make it 12 months.

This means that the majority of companies that venture capital investors put their money into will go bust. Even though they may be very selective in the companies they provide funding to.

Imagine if they split a fund into 10 equal investments, one must return at least 10x to help the fund break even at maturity.

In order to deliver 100% return over the life of the fund, they must find some huge winners, without outsized success.

Whats The Difference Between Vcs And Angel Investors

Angel investors are private investors who use their own money to invest in companies while VC firms have a team of professional investors that invest money from a VC fund.

VCs usually have stricter conditions and requirements when investing than angel investors and are usually more focused on the companys exit.

Don’t Miss: Are Short Term Investments Current Assets

Venture Capital Investment Returns

A venture capital investment pays off when the new company being funded is successful enough to return the initial investment plus interest and the equity grows in value. Occasionally, a venture capitalist hits a home run and the resulting returns make up for a lot of losses.

The risks of investing in venture-backed companies are much greater than investing in public companies. For that reason, VC funds need to outperform the public stock markets. Also, the management fees are significant and the investors money is tied up and illiquid for longer holding periods. And, because of the failure rate of new businesses, losses can be substantial.

The National Bureau of Economic Research says the average return on a venture capital investment is 25 percent, and most venture capitalists expect to receive at least that and much more. A 2020 working paper by the bureau reported that half of all VC funds outperformed the stock market, which has made VC investing more attractive. But given the run-up in the stock market, the edge enjoyed by VCs has shrunk.

How To Invest In Venture Capital

Typically, the limited partners of VC firms are institutional investors such as foundations and endowments, insurance companies and pension funds or family offices. However, high net worth individuals who are accredited investors meaning your net worth alone or with a spouse surpasses $1 million, or your earned income exceeds $200,000 for the past two years can also participate in venture capital funds and direct investments.

The minimum investment and qualifications required differ with each venture capital fund offering. You can check with your brokerage firm or financial advisor to see what venture capital options are available on their platform.

With the popularity of venture capital investing, other avenues such as crowdfunding platforms have opened up that allow both accredited and nonaccredited investors to gain access to venture capital funds and investments.

Don’t Miss: How To Invest Money In Gold

Construct A Convincing Social Profile

This relates to the previous point. Being an early adopter and a well-known tastemaker can only assist you. It also shows that you have a firm grasp of what works and what doesnt in the ecosystem.

See Also: Strategies to improve employees development

In conclusion, there are no right or wrong ways to raise funds as a Venture Capitalist. Along with these paths, many other factors might affect your course, so the odds may or may not turn out to be up to the mark. Nevertheless, there is no disadvantage in trying these techniques for your journey.

What Do Vc Firms Look For In A Startup

Each VC firm has its own set of guidelines on what they look for in a company. There are, however, some fundamental characteristics that all VC firms will want to see if youre applying for funding.

Fundamentally, VC Firms are looking for a great return above all else. They need to be able to see that your startup has the potential to return 10-50x their investment. This means proving you have a product or service people will pay for, a large enough market to sustain a £50M+ exit and that youre the right team to win the space. Unlike angels, most VCs will expect you to be generating revenue by the time they invest

Top tip:

Don’t Miss: Investment Grade Fixed Income Securities

Venture Capital: What It Is And How It Works

Kaylin Sullivan

Venture capital is a popular source of funding for startups. As a founder, it can give you access to large amounts of capital as well as the expertise of your investors.

In this article, well explain what venture capital is, how it works and what investors look for in founders.

How Do Venture Capital Funds Deploy Capital

VC funds typically make investments according to a particular thesisâfor example, supporting startups in a particular stage, industry, or geography.

They typically have an initial investment window of 1-3 years in which they find and invest in companies.

In a typical startup financing round, one fund will be the âleadâ investor of the round. Itâs the lead investor that often negotiates the price and other key terms of the round. Other funds and/or individual angel investors may choose to participate, usually on similar terms as the lead investor .

Recommended Reading: Silicon Valley Startups To Invest In

What Is Venture Capital Investing

Venture capital investing is putting money into early stage companies or startup companies that show potential for long-term growth. The people who make these investments are known as venture capitalists . Venture capital investments are made when a venture capitalist buys shares of such a company and becomes a financial partner in the business.

VC investing is a subset of private equity, a form of business financing that takes place away from the glare of the publicly traded financial markets. Private equity investors raise pools of capital from limited partners. When theyve achieved their fundraising goal, they close the fund and use their money to buy an entire company or a controlling interest. Private equity is all around us: PetSmart, Ancestry.com and Arbys are among the well-known companies back by private equity.

Although venture capital is a form of private equity, they have significant differences. Private equity typically buys mature companies, while venture capital is given to younger businesses that are earlier in their growth curve. And whereas private equity takes a controlling interest in a company, venture capitalists typically hedge their bets by investing in a number of companies so that if one goes belly up, they havent lost everything.

So, what makes a venture capitalist, and how does that differ from an angel investor?

What Are Venture Capital Funds

A venture capital fund is a type of private equity fund thatâs structured as a limited partnership. Essentially, investors can put their money into a joint fund for investing in early-stage companies, and each person who contributes to the fund is designated as a limited partner.

A single partner manages venture capital funds, called the general partner, and decides what companies to invest the fund in, based on specific criteria.

In other words, the general partner essentially puts the limited partnersâ money to work for them, with little effort needed on their part.

VC fund investment criteria may include things like growth and liquidity benchmarks, market position, uniqueness of the product or service, and strength of the companyâs management team.

Many venture capital funds focus on investing in specific sectors or industries. For example, there are clean energy, health care, and IT funds.

When venture capital funds get invested, they take a minority share of equity in return.

They then aim to grow the value of this equity and profit by selling it to another company or by taking the company they invested in public and selling their shares on the market.

When a venture capital fund makes a return on an investment, the profit is split between all the limited partners, and the general partner earns a management fee in addition to a share of the profit.

Also Check: Investing Your 401k In Real Estate

Accredited Investors And The Sec

In order to invest in venture capital funds and other investments that don’t file registration statements with the SEC to trade as public companies, an individual must qualify under SEC regulations as an accredited investor. That typically means that you need to meet at least one of the following conditions:

- Income of $200,000, or joint income with a spouse of $300,000, in each of the past two years.

- Net worth of more than $1 million, excluding the equity in your principal residence.

- Insider-type interest in the company in which you’re investing, such as being an executive officer, director, or general partner.

If you meet those guidelines, then you can theoretically invest in venture capital funds. If you locate an upstart business or a venture capital company seeking funding, then you’ll be able to provide that funding directly without either you or the company violating SEC guidelines.

How Do Venture Capital Funds Raise Capital

Funds begin with a capital-raising period, where the venture capital firm seeks out LPs for the new fund. Depending on the firmâs reputation, market conditions, and fund strategy, the process can take months or even years.

Once the targeted funding amountâs been reached, the fund is typically closed to new investors.

You May Like: Family Offices Investing In Life Sciences