Choose How To Invest In Stocks

There are a variety of accounts and platforms that you can use to buy stocks. You can buy stocks yourself via an online brokerage, or you can hire a financial advisor or a robo-advisor to buy them for you. The best method will be the one that aligns with how much effort and guidance youd like to invest in the process of managing your investments.

Keep in mind that no matter the method you choose to invest in stocks, youll most likely pay fees at some point to buy or sell stocks, or for account management. Pay attention to fees and expense ratios on both mutual funds and ETFs. Dont be shy about asking for a fee schedule or chatting with a customer service representative at an online brokerage or robo-advisor to advise you on fees you might incur as a customer.

Should I Trade Stocks Now

You should consider your attitude to risk and develop a strategy first. Decide how much money youre willing to put on the line and how much time you have to trade. Successful trading requires a large time commitment, particularly if you want to try scalping or day trading.

The rewards on offer can be large if you stick to a plan and keep a clear head. There are thousands of stocks available to trade and almost as many different strategies to choose from. Stock trading can be a full time job, or something you do on the side.

A free demo account is a good place to start if youve never traded stocks before. Any broker worth its salt will offer one and it gives you the opportunity to practice and test your strategy before putting real money on the line.

Ways Around The Pdt Rule

There are a couple ways around the PDT rule like opening an account with a broker who is offshore or outside the regulations of the United States.

Some that you can consider are TradeZero or CMEG.

You can also look at day trading futures. They are not required to follow the PDT rule like stocks are so you can day trade as much as you want

Also Check: Best Way To Invest Home Equity

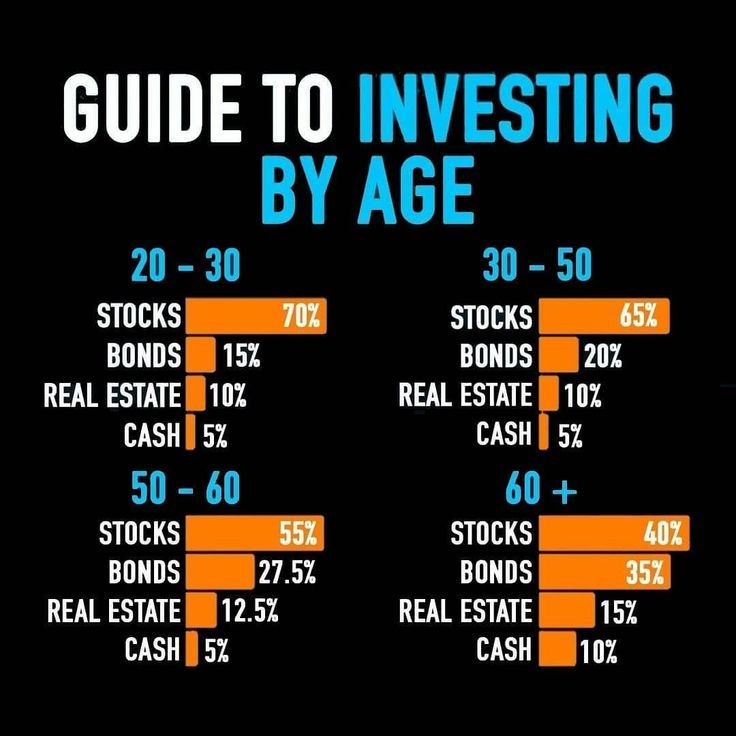

Define Your Tolerance For Risk

What’s your tolerance for risk ? Stocks are categorized in various ways, such as large capitalization stocks, small cap stocks, aggressive growth stocks, and value stocks. They all have different levels of risk. Once you determine your risk tolerance, you can set your investment sights on the stocks that complement it.

Find Out The Tax Implications

Its best to know going in how your day trading profits will be treated at tax time, so talk to your financial advisor, accountant, or a tax specialist. In many countries, the tax treatment may depend on whether you are seen as an investor or a trader who does this for a living. There may be rules around the length of time between trades, how capital gains and losses are treated, and what qualifies you to be a professional day trader.

Recommended Reading: Chuck Hughes Investment Software Systems Inc

Who Is A Pattern Day Trader

According to FINRA rules, you are considered a pattern day trader if you execute four or more “day trades” within five business daysprovided that the number of day trades represents more than six percent of your total trades in the margin account for that same five business day period.

There are two methods of counting day trades. Please contact your firm for more details on how they count trades to determine if you are a pattern day trader.

The rules also require your firm to designate you as a pattern day trader if it knows or has a reasonable basis to believe that you will engage in pattern day trading. For example, if the firm provided day-trading training to you before opening your account, it could designate you as a pattern day trader.

In general, once your account has been coded as a pattern day trader account, a firm will continue to regard you as a pattern day trader even if you do not day trade for a five-day period because the firm will have a reasonable belief that you are a pattern day trader based on your prior trading activities. If you change your trading strategy to cease your day trading activities, you can contact your firm to discuss the appropriate coding of your account.

Learn To Play Defense

As a new trader your focus should be on how to mitigate losses. Once you learn how to lose less, then you can focus on making your winners bigger.

Defensive Tip: Set a stop loss immediately after entering a position and then leave it alone. The worst habit to get into is constantly moving orders around because of what you think is happening during the trade.

Before you get into a trade you should already know where your risk is and how much you could lose. Having this understanding before you get into a trade is not only crucial for trade management but also your mindset.

Read Also: How To Start A Crypto Investment Fund

What Broker Do Most Day Traders Use

The best platform for day trading will depend on your trading style. Some traders only trade stocks and ETFs, others trade stocks and options, and some of the most fearless and well-capitalized might trade futures. In our 2022 Stockbroker Review, we found the five best platforms for day trading were Fidelity, TradeStation, TD Ameritrade, Interactive Brokers, and E*TRADE.

Best Stocks For Beginners

The process of picking stocks can be overwhelming, especially for beginners. After all, there are thousands of stocks listed on the major U.S. exchanges.

Stock investing is filled with intricate strategies and approaches, yet some of the most successful investors have done little more than stick with stock market basics.

That generally means using funds for the bulk of your portfolio Warren Buffett has famously said a low-cost S& P 500 index fund is the best investment most Americans can make and choosing individual stocks only if you believe in the companys potential for long-term growth.

The S& P 500 is an index consisting of about 500 of the largest publicly traded companies in the U.S. Over the last 50 years, its average annual return has been more or less the same as that of the market as a whole about 10%.

Don’t Miss: Framework For Investment Contract Analysis Of Digital Assets

Determine Your Investing Style

Some investors want to take an active hand in managing their investments, while others prefer to set it and forget it. Your preference may change, but decide on an approach to get started.

- If you’re confident about your investing knowledge and capability, you could manage your investing and portfolio on your own. Traditional online brokers, like the two mentioned above, allow you to invest in stocks, bonds, exchange-traded funds , index funds, and mutual funds.

- An experienced broker or financial advisor can help you make your investment decisions, monitor your portfolio, and make changes to it. This is a good option for beginners who understand the importance of investing but may want an expert to help them do it.

- A robo-advisor is an automated, hands-off option that typically costs less than working with a broker or financial advisor. Once a robo-advisor program has your goals, risk tolerance level, and other details, it automatically invests for you.

What Are The Risks Of Day Trading

The allure of the stock market is strong for many investors, but because of the many risks associated with day trading, most should stick with a more traditional buy-and-hold strategy instead. Here are some of the pitfalls to watch out for:

- You may be subject to a margin call: If you exceed your buying power limitation, your broker will issue a that requires you to deposit enough funds to meet the firm’s requirement. If you don’t, your account may be subject to trading restrictions.

- You’ll face higher risks: Heightened risk almost always accompanies the potential for greater returns. Stocks can be very volatile in a market day, and it can be difficult to keep track well enough to take advantage of price swings. If a stock’s price drops when you expected it to rise, you could experience a quick and potentially significant loss. And because day traders typically borrow on margin to trade, losses can be magnified.

- Expenses can add up: Day traders tend to spend a lot on trading commissions, tools, training and other expenses necessary for the job. This means that you need to earn a certain return just to cover your entry costs. If you can’t, these expenses just add to your losses.

- The stress can be immense: Day trading often involves watching price trends for dozens of stocks, which can be stressful. If you can’t manage the stress, it could be easy to make mistakes. That’s particularly true if you struggle to leave emotion out of your investment decisions.

Recommended Reading: Investing In Life Insurance Policies

Beyond Your Geographical Boundary

With any portfolio, it’s important to diversify. That means looking beyond your own backyard. Consider other stocks listed on other exchanges including the Hang Seng Index in Hong Kong or the London Stock Exchange . Going global will give you access to foreign stocks and potentially cheaper alternatives.

Cf Industries Holdings Inc

YTD Return as of October 20: 48.35%

Number of Hedge Fund Holders: 52

CF Industries Holdings, Inc. operates as an agricultural chemicals company worldwide and markets hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and industrial activities. On October 12, CF Industries Holdings, Inc. declared a quarterly cash dividend of $0.40 per share of common stock. The dividend is payable on November 30 to stockholders of record on November 15. As of October 20, CF Industries Holdings, Inc. is offering a forward dividend yield of 1.59% and has gained 48.35% year to date.

Wall Street sees material upside to CF Industries Holdings, Inc. . This October, Citi analyst P.J. Juvekar raised his price target on CF Industries Holdings, Inc. to $120 from $117 and maintained a Buy rating on the shares.

At the close of Q2 2022, 52 hedge funds held stakes in CF Industries Holdings, Inc. . The total value of these stakes amounted to $1.33 billion. As of June 30, Soroban Capital Partners is the leading investor in CF Industries Holdings, Inc. and has stakes worth $213.28 million in the company.

Here is what Carillon Carillon Tower Advisers had to say about CF Industries Holdings, Inc. in its first-quarter 2022 investor letter:

You May Like: What Is An Impact Investment Fund

Can You Trade Stocks With Cfds

An investor can always trade stocks not through a stock exchange but by purchasing leveraged CFDs on over-the-counter trades. The investor also has an opportunity to use any trading strategy which suits him/her best. This type of trading is becoming more and more popular among both beginners and professionals.

How To Day Trade Stocks 5 Steps

If youre eager to start day trading stocks today, then follow this five-step guide to do so.

- Step 1. Choose a stock trading platform To start day trading stocks you need a trading platform. It doesnt get any better than an FCA-regulated stockbroker.

- Step 2. Deposit To speculate on the price direction of stocks you need capital to do so.

- Step 3. Research the market When trying to find the most popular stock to day trade, you need to have a broader understanding of what the overall stock market is doing. By researching the market you can identify which sectors are performing the best to then select the most popular stock well show you how to do it below.

- Step 4. Choose which stocks to trade To find stocks to day trade you will want to focus on your learnings from the broader market and then use a high probability trading strategy to identify entry and exit points. Five of these strategies are covered in more detail further in this guide.

- Step 5. Trade When day trading volatile stocks speed is essential.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Also Check: Invest In Visa Or Mastercard

How Much Do Day Traders Make

This is a pretty broad question because a lot of different variables come into play how much capital you trade with, your skill level, market conditions, etc.

Highly skilled traders can make 7 figures a year while new traders that are profitable can be anywhere from $200-$500 a day.

The markets are open about 253 days per year so if youre average $200 per day, thats $50,600 a year. Not bad!

If youre doing $500 in profits a day, thats $126,500 for the year!

Why Do I Have To Maintain Minimum Equity Of $25000

Day trading can be extremely riskyboth for the day trader and for the brokerage firm that clears the day traders transactions. Even if you end the day with no open positions, the trades you made while day trading most likely have not yet settled. The day trading margin requirements provide firms with a cushion to meet any deficiencies in your account resulting from day trading.

Most margin requirements are calculated based on a customer’s securities positions at the end of the trading day. A customer who only day trades does not have a security position at the end of the day upon which a margin calculation would otherwise result in a margin call. Nevertheless, the same customer has generated financial risk throughout the day. These rules address this risk by imposing a margin requirement for day trading calculated based on a traders largest open position during the day rather than on open positions at the end of the day.

Firms are free to impose a higher equity requirement than the minimum specified in the rules, and many of them do. These higher minimum requirements are often referred to as “house” requirements.

Don’t Miss: Best Investments For Accredited Investors

Tip : Diversify As Much As You Can

Diversification, then, is the opposite of putting all of your eggs in one basket. In other words, rather than investing in just one or two companies, a well-diversified portfolio would consist of dozens, if not hundreds, of different stocks. In addition to this, you will be investing in various industries, thus avoiding overexposure to one specific niche. For example, lets say you have $5,000 to invest in the stock market.

An inexperienced investor might invest the entire $5,000 in one company

A wise investor would probably purchase shares of 100 different companies at $50 each. The investment would also cover multiple sectors.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Hotel Real Estate Investments And Asset Management

What Is Day Trading Exactly

If you buy and sell a security within the same day, you are day trading. Day traders leverage fluctuations in an asset’s daily price with a goal of turning a profit. It is quite common for day traders to buy and sell the same security a number of times a day.

They base their decisions on knowledge of the market and current trends. While stocks are the most common, traders in Canada have the choice of trading US stocks, Exchange-Traded Funds , and options. There is no minimum investment amount required to start day trading, however discount brokerages may set their own trading minimums and margin requirements.

All Day Trading Strategies Require Risk Management

Imagine a trader who has just taken 9 successful trades.

In each trade there was a $50 risk and $100 profit potential. This means each trade had the potential to double the risk which is a great 2:1 profit loss ratio. The first 9 successful trades produce $900 in profit.

On the 10th trade, when the position is down $50, instead of accepting the loss the untrained trader purchases more shares at a lower price to reduce his cost basis.

Once he is down $100, he continues to hold and is unsure of whether to hold or sell. The trader finally takes the loss when he is down $1,000.

This is an example of a trader who has a 90% success rate but is still a losing trader because he failed to manage his risk.

I cant tell you how many times weve seen this happen. Its more common than youd think.

So many beginners fall into this habit of having many small winners then letting one huge loss wipe out all their progress.

Its a demoralizing experience, and its one that Im very familiar with!

Read Also: Apps For Investing For Beginners