Investa Best Investment App For Mutual Funds

Investagram started in 2015 as a social platform that provides learning resources, trading tools, and analytics to educate Filipinos on investing in the stock market.

The fintech startup, later on, launched an investment platform in 2021 called Investa. It has partnered with some of the top investment companies in the country, PhilEquity Management, Inc., Sun Life Asset Management, and BPI Investment Management Inc., as part of its commitment to bringing affordable and accessible investment opportunities to every Filipino.

How It Works

Investa users can choose to invest in more than 20 local and global mutual funds with varying risk levels and time horizons. The app provides appropriate tools and information such as performance charts, potential returns, and fund prospectus to aid in choosing the best-fit investment for you. Its user-friendly app shows your fund value, Net Asset Value Per Share , profit, day change, and portfolio value so you can track the growth of your money. You can cash in and withdraw your funds through major banks and e-wallets.

Minimum Investment and Costs

You can start investing in mutual funds for as low as 50. Redemption, management, and other fees depend on the selected mutual fund.

How To Start Investing

Once your account is approved, you can top up through BDO, BPI, Unionbank, Metrobank, or Gcash.

No Feedback On Account Setup

Acorns has since solved my problem, turns out they were simply experiencing a serious backlog to new accounts looking forward to the weeks ahead to see how much I can round up on my card transactions. old review below-Like everyone I was very excited to start rounding up sadly I never had the opportunity to experience any of the feature sets Acorns has to offer. The account setup was pretty easy and enjoyable although finding out after signing my certificate that it still would take 1 – 3 business days to verify my account was a bit disappointing but I get it. Here is where Acorns fell short, till this day 5 days later it still says I need to wait 1 – 3 business days for my account to be setup, uh hello its been 5 days! Like any American on day 3 I picked up the phone and called support, I was on the phone for about an hour before I got disconnected due to interruptions in service. I also tried email support but have heard nothing, no confirmation to my email over my support ticket nothing, maybe somethings up with my email but at this point I would prefer to speak with a human being and I think any service offering to make transactions from your bank account should support quick and easy customer service. I am open to changing my review if I ever get any support to rectify this rogue issue.

How To Spot Up

Before we jump in, here are two key requirements that we considered before adding a company to this lineup:

- Momentum: We first asked the question Does this company have enough momentum to grow for years to come? If we didnt think its sales would continue growing at a significant pace in the coming years, the stock didnt make the cut.

- Growing market: Any growth stock worth its salt has to be tapping into a potentially huge market. The companies listed below are doing exactly that.

In addition to those key elements, weve also added only companies we believe to be high-quality stocks. That means you wont find any penny stocks here .

But that doesnt mean our up-and-coming stocks are without risk. Investing in the stock market always comes with risk, and betting on high-growth companies adds an extra layer of it that investors should be aware of.

This means you should do your own homework before buying any stock. Not all of the companies on this list will appeal to you. And even the ones that do should undergo some scrutiny to see if they meet your own investing standards.

So without further ado

Price: $45.53

- Momentum: Robloxs sales increased 102% year-over-year in the third quarter of 2021

- Growing market: The global video game market will be worth an estimated $293 billion by 2027

However, even more impressive is the number of gamers who are logging into Roblox: more than 47 milliondaily average users. Thats daily. As in, every single day.

Recommended Reading: What Else To Invest In Besides Stocks

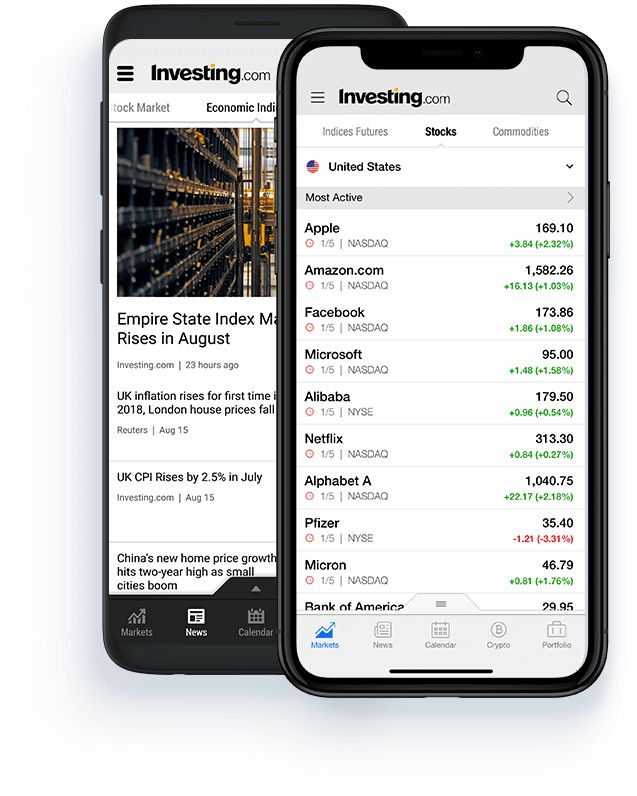

Build Your Portfolio And Track How It Performs

Invest on auto-pilot with recurring buys

Buy a little at a time on a regular basis so you can gradually increase the amount of stocks and bitcoin you own.

Make informed decisions with metrics and insights

Now you can access earnings data, news, key stats and much more to help you decide on whats worth buying or holding.

Set your target price with custom orders

You decide how much you want to buy or sell for. Then set custom orders that only go through if stocks or bitcoin reach those price ranges.

Stay up to date with investing notifications

Get notified when bitcoin or the stocks youre interested in experience price surges or dips.

How To Monetize An Investment App

How to make an investment app profitable?

You should consider the monetization strategies before starting the development. Here are some popular ways:

Fees from various transactions

Most investment apps charge fees for depositing, withdrawing funds, or purchasing or selling assets. Robinhood, Ellevest, and Coinbase follow this monetization model.

Premium subscription

Users have to subscribe to start buying or selling stocks. Usually, apps offer monthly or annual subscriptions.

Advertising

Monetization models for an investment app

Don’t Miss: How To Invest In Real Estate In College

Can You Use Investment Apps To Trade Stocks

Some investment apps allow you to trade stocks and other securities, but that depends specifically on the kind of app and what its designed to do:

- For example, brokerage apps such as Robinhood and Fidelity Investments allow you to buy stocks and ETFs.

- Other apps such as those from robo-advisors Wealthfront and Betterment will buy stock funds and create a portfolio on your behalf.

- Still other apps such as Wealthbase and Invstr allow you to learn about investing or play investing games.

So the ability to buy stocks with an app depends on the app itself.

What Could Be Improved

Nothing but stocks

Cash App Investing allows investors to buy and sell stocks , but does not support mutual funds, stock options, or bonds. While these and other types of investments may eventually be offered, Cash App Investing is not an excellent option for people who want to invest in pretty much anything other than stocks and ETFs.

Tools and research

Cash App Investing offers some tools for beginning investors, such as its my first stock tutorial, but it doesnt offer access to stock research or thorough educational tools. The platform is designed for beginning investors and those who just want to dip their toes into the stock market. Investors who want to learn more or take a more analytical approach to choosing stocks may be better served with another brokerage.

IRAs or other account types

The only account type offered by Cash App Investing is standard, taxable, self-directed brokerage accounts. You cant open a joint account, and the platform doesnt support IRAs, solo 401s, trusts, educational accounts, UTMA accounts, or any other type offered by other brokerages.

No margin

To be clear, at The Ascent we generally discourage investors from trading on margin, which essentially means buying stocks with borrowed money. However, there are some cases where it can make sense, and many active investors like having margin access. At this point, Cash App Investing doesnt support margin trading.

Read Also: Real Estate Investing Best Sellers

What Are The Advantages Of Using An Investing App To Trade Stocks

The key advantage of using an investing app to trade stocks is accessibility. Investing apps have leveraged rapid mobile technological advancements to make it easier than ever to invest and trade stocks. Like most people now, you probably carry your mobile device with you all the time, allowing you to react to market movements and monitor your investments in places where it just wasnt practical before. The convenience of mobile trading has also made the market more accessible to users of all backgrounds, interests, and experience levels. You dont need a trading terminal with four monitors anymore. Increased competition among brokers and innovation in the form of new apps and platforms has reduced barriers to entry such as cost and education. With a supercomputer in your pocket, you have access to the same real-time market data on the go and can trade accordingly.

What Should You Look For When Choosing An Investment App

If youre looking for the best investment app, you may be new to the world of investing. That means youll want an easy-to-use platform with generous educational resources.

But because investing is all about the long gameyou could be investing for 40 years or more if youre saving for retirementyou also want an app that you can grow with. Thats why even as a beginner, you ideally should seek out a platform that offers robust research tools, a wide range of account types and low fees so you dont feel like you have to switch providers when youve become a more advanced user.

And, while ultimately, you want a good app experience, you also inevitably sign up for so much more when you open an account with an investment app. Thats why its important to consider the broader company powering the investment app you download.

Youll notice our top choices in this listing also rank highly in other brokerage, robo-advisor and crypto exchange listings weve conducted. Youll want to make sure whichever investment app you choose offers a quality web-based experience and customer service so that should you decide to expand past your investment apps main platform youll be well served.

Read Also: Can A Non Profit Invest In Stocks

The Best Investment Apps For Beginners

Our list of the best investment apps beginners can use focuses on apps with low funding requirements that are easy-to-use. We’ve also chosen apps and platforms with commission-free trades to help limit fees. Finally, many of these apps support numerous asset classes, like stocks and cryptocurrencies, to give you choices when it comes to building your portfolio.

Ways To Monetize Mobile Apps

- Display ads in mobile apps

- Let users buy it once

- Offer a subscription

- Include paid features on top of freemium

Any investor should make money from mobile apps to make sense of investing in them. To achieve this, a business has to focus on such aspects as expansion of the target audience and delivery of new features. On the other hand, mobile app developers may earn a living by developing apps directly or holding stock options in the company specializing in app development.

Direct and indirect methods of revenue generation from mobile apps constitute the primary income sources from mobile apps. A business would need to decide whether they want a template-based app or a custom app, and the former is usually cheaper and faster to develop but lacks many custom app features.

Outsourcing an experienced team of developers guarantees quality and post-development support. The decision to create mobile apps requires companies to decide on the app type, business model, and market size. Dont worry, weve got your back: from business analysis and to the actual launch.

Also Check: Fort Washington Investment Advisors Inc

Big Sticker Pack For Imessage

One of the biggest high quality sticker packs you will find on the app store.

Flying Teddy Bear Game is a nice game that you will enjoy playing.

Jump to the highest possible floor. Character will jump from the edge of platform automatically.

Flying Pink Princess Game is a nice game that you will enjoy playing.

Fly and avoid from the enemies and shoot them to protect yourself.

You are in the helicopter. And your enemies on the ground. Watch out them!

Collect coins and get high score to compete with your friends.

Acorns Best For Automatic Savings

Acorns was one of the original investing apps, but its still around and thriving for a reason. The Acorns app makes saving and investing easy and automatic, which is suitable for both beginner and advanced investors.

One of Acorns main benefits is its round-up feature, which links to your bank account and sweeps excess change from each purchase into your Acorns account. So if you spend $3.30 on your morning coffee, it automatically rounds up to $4.00 and deposits $0.70 in your savings account.

While its not the same as learning how to make extra money, its close to finding free money in your couch cushions! By working behind the scenes to add to your savings, you dont even have to think about it, which often helps people save more with less effort.

Once the money is in your account, investing with Acorns is pretty simple too. Depending on your age, investing goals, and time horizon, the app recommends one of five different portfolios. While the lack of control over your investments may be a con for some, it adds to the apps hands-off approach to help you save and invest.

Read Also: How Can I Invest In Reits

Roblox Will Start Earning Money From The Millions Of Free Players On The Site

Roblox is one of the pioneers of the metaverse. The company is expanding how it monetizes its user base by adding advertising to the mix. This video discusses the implications of that decision for the business.

Stock prices used were the afternoon prices of Sept. 09, 2022. The video was published on Sept. 10, 2022.

Parkev Tatevosian has positions in Roblox Corporation. The Motley Fool has positions in and recommends Roblox Corporation. The Motley Fool has a disclosure policy.

Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through fool.com/parkev, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

Recommended Reading: Goldman Sachs Healthcare Investment Banking Team

Buying Your First Stocks: Do It The Smart Way

Once youve chosen one of our top-rated brokers, you need to make sure youre buying the right stocks. We think theres no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. Youll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisors average stock pick has seen a 686% return more than 4.5x that of the S& P 500! . Learn more and get started today with a special new member discount.

Recommended Reading: Canadian Investing In Us Real Estate

Figure Out How Much You Have To Invest

If you don’t have a lot of cash to get started, look into a “micro-investing” platform, like Acorns or Stash. These specialize in “fractional investing,” meaning you can buy into part of an exchange-traded fund. So even if you can’t buy a full share, for example, your Acorns portfolio can get you started investing with only a few cents.

If you have a little bit more to invest and care about what your money supports, options like Swell and Betterment offer socially-conscious portfolios that invest in renewable energy, clean tech and more.

While more than three million people use Robinhood, the commission-free stock trading app, Rabinovich says this is an option for a more “sophisticated” investor. Because Robinhood allows you to select particular stocks and you can even invest in cryptocurrencies it requires a bit more investing know-how. Many of the other options will do the investment picking for you.

Remember that you don’t need a ton of money to invest. As long as you’re managing your money well in other areas of your life, there’s no such thing as starting too soon.

“For a college student who has the means and the desire to start investing and start learning about it, I say go for it,” Rabinovich says.

Apps For Learning How To Invest On Your Phone

You can start investing and learning how to invest on your phone. One basic form of investing that works wonders, dollar cost averaging, involves buying a set dollar amount of a stock or etf, regardless of the market.

You can, and should, start dollar cost averaging now. You can do this even if youre in high school.

Capital is how you get rich. By setting aside some small capital each week and investing it, you can be rich, too.

Trading is gambling, and investing is investing. Below are five apps to help you learn how to invest, and invest from your phone.

Don’t Miss: How To Invest In Cryptocurrency 2020

What Types Of Accounts Are Supported In The App

We currently support most account types, but we’re still working to fully support and Inherited IRAs.

529 and 403 plans aren’t available in the app yet. If you have a 529 or a 403 plan, you’ll need to visit vanguard.com to make transactions or view your account details.

Currently, we don’t plan to support non-brokerage mutual-fund-only accounts within the Vanguard app. You can access that type of account on vanguard.com.

Best Investment Apps Of 2022

The stock market has never been quite as accessible as it is today. A system, historically seen as one reserved for use only by experts, has been opened to the masses, thanks to the Internet and subsequent technological innovations surrounding it.

The days of having to pick up the phone and call a financial advisor or registered investment adviser are in the past, with retail investors moving to online brokerage accounts where theyre managing their own investments.

Nearly every quality online broker now offers a mobile application designed to give investors and traders a way to access the market on the go.

But with so many choices, how do you decide which app to use?

Don’t Miss: What Is The Best Loan For An Investment Property