Key Commercial Real Estate Metrics

Investing in commercial real estate is unlike other investments, like buying stocks, bonds, and mutual funds. Because of this, there are some critical commercial real estate metrics that those new to commercial real estate investing should know before they begin investing in real estate. Before long, they, too, will become a seasoned investor. Most of the metrics are similar to evaluating a residential rental property.

Commercial Loan Option #: Certified Development Company / Sba 504 Loan

Another commercial loan option: the Small Business Administration offers the SBA 504 loan.

The SBA does not work directly with lenders but partners with lenders and community development firms instead.

The 504 loan includes fixed rates and long repayment terms great for purchasing or renovating real estate.

How To Get Started In Commercial Real Estate Investing

The world of commercial real estate investment is vast. It consists of variousproperty types, asset classes, and investment opportunities. For newcomers, trying to navigate these complexities can be a daunting task. We are here to help.

In this article, we are going to define what commercial real estate is, review the pros and cons of investing in it, and highlight two common investment strategies that can be used to gain exposure to this asset class. By the end, readers should have all of the information they need to take their first steps towards making a commercial real estate investment.

At First National Realty Partners, we are a private equity commercial real estate investment firm who specializes in the acquisition and management of commercial retail centers. To learn more about our current investment opportunities,.

Also Check: Global Trends In Renewable Energy Investment 2020

What Are Investment Vehicles

An investment vehicle is any mechanism by which a person is able to invest in a product that generates a positive return. The most common forms of investment vehicles are stocks, bonds, options and futures. There are other forms of investment vehicles, though, including commercial real estate, ETFs and REITs , each of which we describe in more detail below.

Investing in a commercial property real estate ETF can be a smart way to make your money work for you. It is ahighly liquid way to invest in new commercial construction projects, for example. When you invest your money, it should be noted that you arent investing in specific projects. Rather, you are investing in the equity of real estate companies and real estate investment trusts .

Invest In A Building With World

Leadership in Energy and Environmental Design certification provides independent, third-party verification that a building, home or community was designed and built using strategies aimed at achieving high performance in key areas, such as human and environmental health, sustainable site development, water savings, energy efficiency, materials selection, and overall indoor environmental quality. Consider buying a new building or retrofitting a used building that is LEED-certified, as these might increase property value.

Although entrepreneurs scouting the market for LEED-certified buildings or retrofitting properties will usually pay a higher price up front, they can recoup costs by improving energy efficiency, and by increasing employee productivity through improved air quality and design.

Given the higher costs, ideally you might also try supplementing financing for LEED certification with subsidies and grants, suggests Prikker. Its important to find a balance between being a good corporate citizen and ensuring that your efforts are financially viable.

You can also consider green initiatives that are less costly than LEED certification, such as adding a green roof or upgrading your air quality system, he adds.

Don’t Miss: Best Way To Invest In Tips

When To Invest In Commercial Real Estate

Whether youre a bear or a bull about the economy, NOW is a great time to invest in commercial real estate.

As the number of investors seeking direct co-investment into real estate continues to rise, so does the opportunity to allocate capital on a deal-by-deal basis. Investors today also benefit from a steadily growing economy, interest rates that remain at historical lows, and commercial lenders willing to do whatever it takes to win borrowers business.

Here are five other reasons why now is the time to invest in commercial real estate:

1. Increased Demand for Office SpaceWith a maturing millennial generation entering its prime earning years, corporate giants growing even larger, and companies eager to get workers back into offices safely distanced after a year of working remotely, the demand for more square footage is clear.

2. Ongoing Cash FlowOne of the most important benefits of commercial real estate is the cash flow generated from rents. Secured by leases, commercial real estate investments can deliver consistent, passive income income that comes in regardless of market cycle.

3. Hedging Against InflationIn general, when inflation occurs, rents rise. This rise leads to an increase in operating income, which subsequently results in an increase in property values. The nature of this dynamic allows commercial real estate to serve as a strong hedge against inflation.

More reading:

Terms to Know

Two: Do Your Homework

Youll hear investors talk a lot about due diligence, and for good reason. Due diligence means researching how investing works, how the CRE market and its cycles operate, and how it differs from residential real estate.

Importantly, commercial real estate focuses more heavily on things like usable square footage, longer leases, and tenant types as compared to residential real estate. As you research and narrow down property types and locations, youll want to become a master in your areas of interest. Familiarize yourself with current deals and sellers, and note which ones look right for your goals.

The benefits of all this work return in multiple: CRE investors experience a higher income, less competition, and less volatility than most other investors. Commercial real estate investment also comes with tax benefits in addition to securing future wealth and diversifying portfolios. A little work up front goes a long way for years to come.

Recommended Reading: What Is The Best Way To Invest 1000

Commercial Real Estate Investment Trusts

REITs are a niche market in the commercial real estate industry. They are publicly traded organizations that invest in income-producing properties, mortgages, and mortgages. REITs are typically used by individuals with large amounts of capital to invest in real estate without the need for any management expertise.

How To Invest In Commercial Real Estate

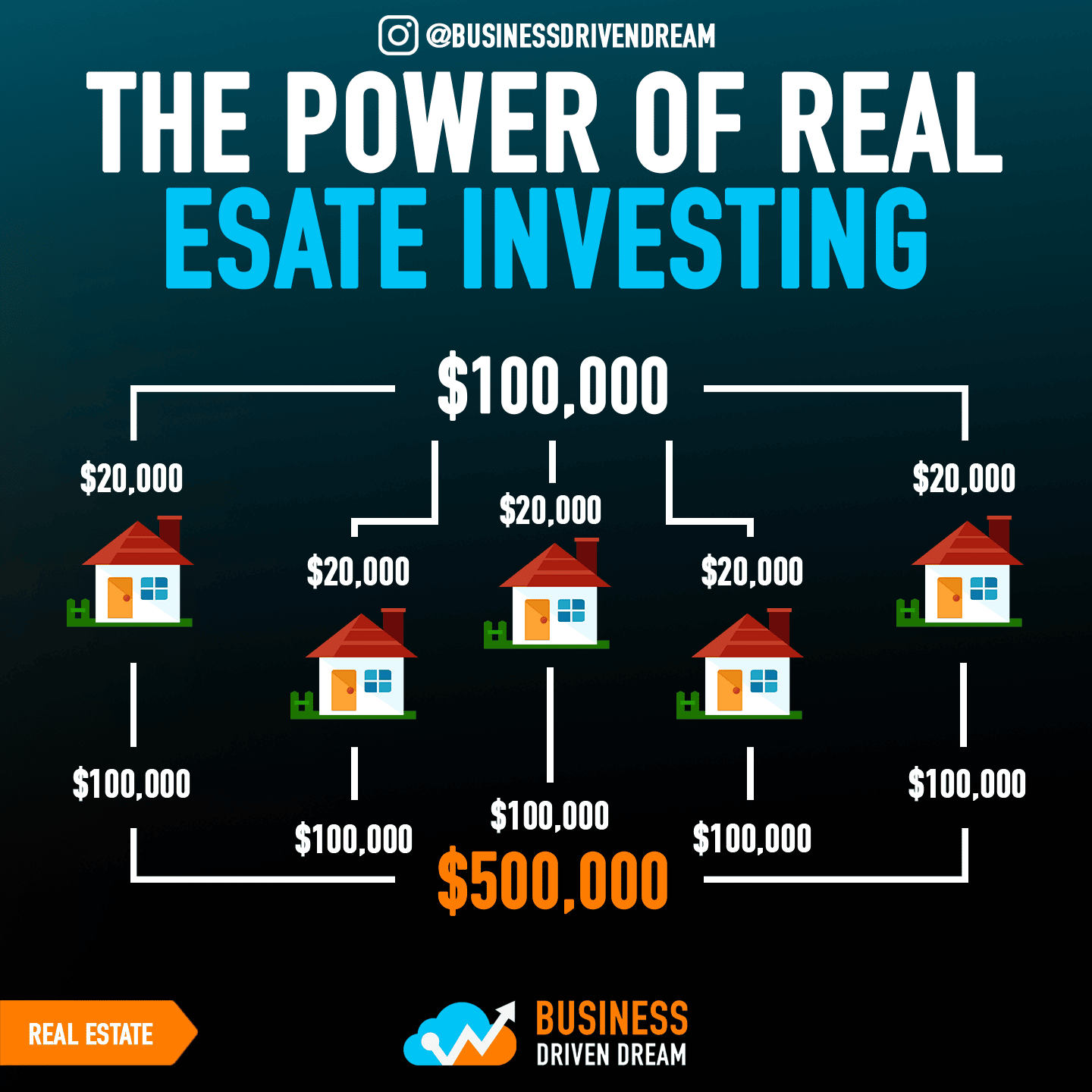

When investing money in commercial real estate, there are two primary options direct and indirect investments. Direct investment is owning a building personally or through an entity, like a partnership or real estate LLC. Indirect investment is buying shares in a company that owns properties, as you do with REIT investing or real estate crowdfunding.

Recommended Reading: Senior Living Real Estate Investment

The Pros And Cons Of Investing In Commercial Real Estate

Why is commercial real estate investing so appealing? There are a host of benefits to consider, but there can also be some downsides. Its important to be familiar with both the pros and cons before you commit to putting any money into an investment.

CRE investment benefits include:

- More income: In most cases, CRE has a higher potential rate of return on your investmentanywhere from 6% to 12% compared to 14% for residential real estate.

- Longer lease terms: Most commercial leases carry a longer term of years than residential leases. That helps reduce turnover and improve cash flow and stability of future revenue projections.

- Lower inventory : Because each prospective commercial tenant has fewer properties to consider, youve got a better shot of landing a good tenant.

- Better working hours: If youre processing tenant requests, complaints, and maintenance tasks yourself, instead of hiring a management company to do it for you, youll enjoy the more limited work hours, since your tenants by and large keep business hours themselves.

- Less risk: Poses less risk than investing in the stock market

Direct Real Estate Investment

- Is not a passive investment

- Requires large amounts of capital

- A relatively illiquid investment that can be costly or difficult to buy or sell

Direct real estate investment is well suited for investors who want to manage the property themselves or work with a property manager to handle day-to-day activities. These investors generally have a high net worth and want the tax benefits from the property’s depreciation.

Before going big into a deal, investors may consider learning how to invest 10K into a crowdfunded deal first. Then, take that knowledge to determine how to invest 20K into the next deal. Progressively increasing your investments allows you to get closer to your investment goals while you learn the process from experienced investors.

You May Like: Family Offices Investing In Life Sciences

The Key Elements Of Commercial Real Estate Investing Are:

Location: Choose a location that has good access to transportation systems and is located in a neighborhood with positive economic growth. Choose a property in a tourism area. Choose a property that has demand for that type of business.

Type of property: You can choose from various types of properties such as office buildings, warehouses, single tenant retail and apartment complexes

Rental rates: Rents should be stable, increasing at a moderate rate over time. Find an expert with a formula you can model your business after.

Management: You need a good management firm who will manage your property for you so you dont have to worry about it day-to-day. AND you can consider NNN leases, as this lease takes pressure off the building owner and the tenant takes on responsibility. Win, win.

Financing: Financing options vary depending on the type of property you are purchasing but can include loans from banks or private lenders as well as equity financing .

Type of property: Commercial properties can be divided into four categories: office buildings, retail stores, industrial warehouses, and multifamily housing complexes. The type of investment you make depends on your financial goals and what type of returns you want to achieve.

Office Buildings

Retail Stores

Industrial warehouses

Multifamily housing complexes

Final Thought

Learn the Steps to Invest in Commercial Real Estate Like a PRO by becoming a part of Cherif Medawars Commercial Real Estate Mastermind

Commercial Vs Residential Investing: What’s The Difference

The most important difference between commercial real estate investing is the method of valuation.

Valuation of residential is based on comps, or comparison sales.

Comparison sales are recent transactions of similar properties in similar areas.

While commercial real estate valuations can use a market-based methodology, they are more likely driven by net operating income and cap rates.

As a commercial investor, you will focus on the profitability of the commercial property, which isnât the case with a residential property.

You May Like: Best Investment Site For Small Investors

Office Building Investing Basics

Office buildings come in all shapes and sizes and exist in nearly every commercial real estate market in the US. According to Cushman & Wakefield, there are over 5.5 billion square feet of office space in the country, with more than 93 million square feet currently under construction.

Because the office building asset type is rather broad, investors often categorize office buildings by class, size, and tenant type or use:

Office buildings classes

- Class A: New or like-new trophy properties with the latest features and amenities, usually located in the central business district of large urban areas, occupied by the best tenants.

- Class B: Slightly older office buildings well maintained and in good condition, often occupied by local or regional tenants. May offer the opportunity for value add improvements to generate additional rental income.

- Class C: Older office buildings requiring significant remodeling and updating, sometimes located in business areas that have lost their luster. Class C office buildings may be good candidates for repositioning into mixed-use projects or conversion into multifamily property.

Size of office buildings

Office building types

Office building types are often characterized by the types of office tenants leasing the space. According to the Appraisal Institute, office buildings types include:

- Other office space such as mixed-use developments with office, retail, and residential space

Create & Follow A Long

Once new investors have settled on their goals for investing in commercial real estate, they should map out a long-term plan to ensure they stick to their goals. Commercial real estate investing presents many opportunities, not all of them good ones. Having a long-term plan in place will help investors filter out deals that dont meet their criteria and keep them on track to achieving their goals. Some things to include in a plan are financing strategy, steps to build relationships with realtors and management companies, holding period, exit strategy, and so on.

Recommended Reading: Can You Invest In Ira If You Have 401k

Purchasing And Managing Commercial Real Estate

If you want more control and potentially higher returns, you can invest in commercial real estate yourself. An experienced commercial real estate agent and property manager can alleviate the burden and take care of the tasks you cant or dont want to.

Annual rental income for commercial properties ranges between 6% and 12% of the purchase price. Thats in addition to any property appreciation you realize. According to the Commercial Property Price Index , for example, industrial property prices have increased 18% over the past 12 months. If you earn 12% annual rent and 4-5% yearly appreciation, thats a healthy 17% annual return.

Commercial Property Private Reits

Besides REITs traded on stock exchanges, private REITs are also available to investors. Some of the most accessible ones are crowdfunded investments for non-accredited investors.

The advantage of private REITs is the ability to invest in specific real estate market sectors where one may not have the expertise. Private REITs can be tailored towards investing in apartment buildings, mobile home investing, self-storage investing, and several niche areas.

Fundrise has one of the lowest minimums (only $10 for the Fundrise Starter Portfolio and is available for accredited and non-accredited investors.

DiversyFund is similar to Fundrise, offers a low $500 minimum, and is available for accredited and non-accredited investors.

Streitwise is similar to Fundrise in offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high skin in the game, with over $5M of capital invested by founders in the deals.

Recommended Reading: Best Place To Buy Investment Property In California

Share Expertise On The Various Commercial Investment Types

A good buyers agent will educate you on the different types of commercial properties, including the associated risks and benefits. Each asset class exists within a certain stage in a broader cycle a knowledgeable buyers agent can advise you on the solidity of your investment for years to come. Or, theyll have rental income calculator tools at their disposal to assist you.

Is Investing In Commercial Real Estate A Good Idea In 2022

2022 has been characterized by rising interest rates and high inflation. A few things make commercial real estate a strong option for investors in this type of environment.

Better deals: Generally, as interest rates increase, asset value decreases. This means that as interest rates move higher, investors may find better deals on commercial real estate than they have in recent years. Savvy investors wont be intimidated by price cuts, and will capitalize on these opportunities.

Inflation protection: One of the biggest reasons why investors like commercial real estate is that it is a good inflation hedge. Property values tend to increase over time along with general prices. Many landlords include rent escalators in their leases so that rents automatically increase every year. This ensures that the gross rent income increases to offset the negative impact of inflation.

Tax advantages: Commercial real estate has always been valued for the tax advantages that investors receive from owning it. Notably, depreciation allows investors to expense wear and tear on the property every year, which reduces their tax bill on the income generated by the property.

Don’t Miss: Crm Technology Allows Companies To Make An Investment In

Follow Proper Due Diligence

When a property is advertised for sale, it is common for the marketing documents to portray it in the most positive light possible. In reality, every property has strengths and weaknesses and it isup to the potential buyer to verify/identify them.

From the moment that a property is placed under contract, the buyer is on the clock to conduct their due diligence, which involves a significant amount of research and verification to ensure the property is as advertised in the marketing documents. When doing so, buyers, particularly those who are acting on behalf of investors , have a responsibility and an obligation to be as thorough as possible to prevent any major surprises down the road.

Because there are so many tasks to complete in a relatively short period of time, it is common for experienced buyers to use a Due Diligence Checklist to ensure no stone is left unturned. Our buyerdue diligence checklist has been developed through years of experience and dozens of transaction repetitions.

Get My Ccim Designation

CCIM is an organization that provides investment education for anyone interested in commercial real estate.

These classes are largely taken by brokers, but its not uncommon for lenders, property managers, and anyone that interacts or invests in commercial real estate to go through with their designation.

Youll be learning how to underwrite investments, analyze markets, negotiate, and more.

Getting your CCIM is expensive – I definitely wont try to sugarcoat that. Each class can range from $1,500 to $2,000, and thats before travel and board!

However, the knowledge youll gain and the resources you take away will bring you far more than that.

In fact, shortly after I completed my CCIM 104 class, I was able to underwrite an investment opportunity for a client in Chattanooga for over $1.8m, on which the commissions, alone, covered the cost of all of my classes and some.

Recommended Reading: Certificate In Finance And Investment