Where Is Your Money Going

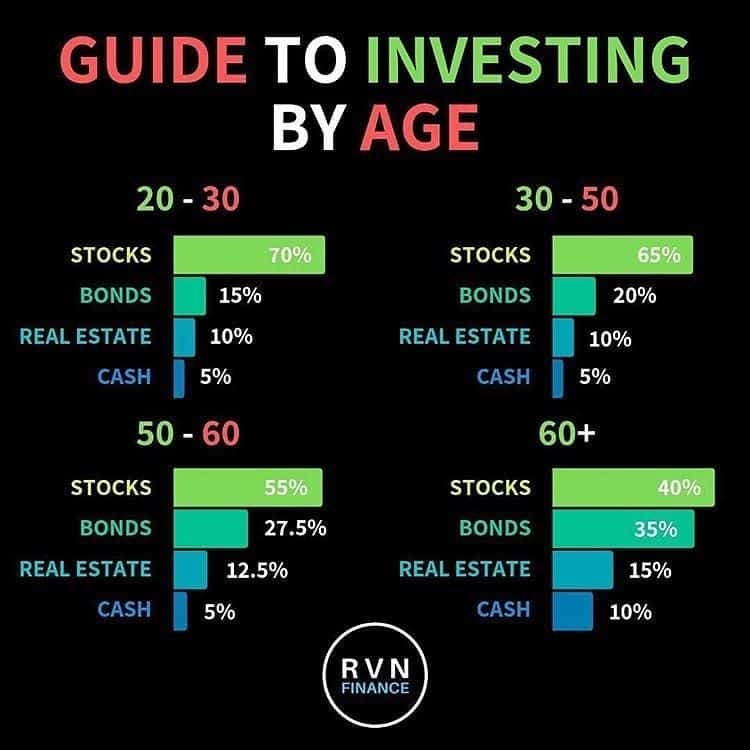

First things first. Before you can start your investment portfolio, you need to determine your asset allocation. Many beginners utilize whats known as the 60/40 portfolio. This just means 60% of your assets goes to individual stock investments, while 40% goes to lower-risk bonds.

Its an easy way to get started, and you can always make adjustments later if you feel its necessary. Of course, you may want your allocation to be much different. After all, its your money. And if youre in debt or you have a limited budget, you may have no choice but to start out small.

Even if youre young, you are putting your various types of assets at risk any time you deal with stocks. This is true whether you are dealing with your savings account or money market funds. And due to that fact, you want to be careful with your investments. That said, seasoned investors with substantial income or high job security can afford a greater risk level.

But even if you are young and have a stable job, it is often difficult to deal with instability, or volatility. In this case, it may be better if you have less equity exposure. Or, at the very least, amass defensive stocks for your portfolio.

How Are The Applicable Interest Rates In Ssy And Ppf Accounts Determined

Since the SSY and PPF accounts are government-sponsored, the Ministry of Finance reviews the applicable interest periodically. Accordingly, the Ministry of Finance notifies the applicable rates every quarter of the financial year, valid until the quarter ends. Consequently, the standout feature of the mechanism is that the rates are consistently higher than other investment instruments.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Savings Ira Vs Investment Ira

Open Up A Brokerage Account

In order to invest, youll need to open up a brokerage account with a firm like Vanguard, Schwab, or Fidelity. Once you have an account, you can begin buying and selling stocks, bonds, and other securities.

Over time, youll want to build a diversified portfolio with various asset classes. But to get started, its important to focus on the basics and not get overwhelmed.

Start Investing With Strong Portfolio Diversification

Portfolio Diversification: Diversification in investing is important because not all markets are created equal and diversified stocks will react differently to different market events.

Poor Diversification: All your Assets are imbalanced into one stock, bond, sector, commodity, or fund.

In the first half of 2020, tech stocks saw a meteoric performance. The natural inclination of individual investor would be to pour their assets into the tech sector to capitalize on this trend.

Now, lets say millions of investors have the same idea and allocate all of their assets into tech over a long period of time. At some point, tech stock prices will become inflated due to the enthusiastic market behavior and not the underlying fundamentals of a stock. And now you have a bubble.

And all it takes is one instance of socio-economic turmoil, like a new trade war or the stocks price becomes too high and a massive sell-off ensues, popping this bubble and sending this sector to the ground.

If all of your assets are in the tech sector during this time, you are going to be S.O.L.

Proper Diversification: All your assets are balanced into uncorrelated holdings or sectors protecting you from major down-turns in any one investment.

An example of this is stocks vs. bonds. If the market performs well, stock go up and bonds go down. If the market performs poorly, bonds go up and stocks go down. Having a good balance of both stocks and bonds can protect you from any poor performing sector.

| Investment |

Don’t Miss: Investing Basics Planning For Retirement

Ready To Pick Your Investments

Our Wealth Shortlist has a list of funds which is designed to help our clients select their investments and build a diversified portfolio. Funds are a collection of investments which are chosen and run by a professional fund manager, so youll benefit from the managers knowledge, expertise and research into lots of different companies.

Before investing its important to check the funds objectives align with your own, understand the funds specific risks and if theres a gap in your portfolio for that type of investment.

Remember, all investments go down as well as up in value, so you could get back less than you invest.

Building your own portfolio from scratch isnt right for everyone though youll need the time and know-how to do this. For a more hands-off approach, why not leave it to the experts by investing in a ready-made portfolio?

Figure Out What You’re Investing For

You might be thinking, “But wait, shouldn’t my first step be to find some hot, secret stock picks that I can ride to the moon?” But in truth, successful investing generally starts with what you’re investing for, not what you’re investing in.

Lots of people start off by investing for retirement. In fact, we believe that for many people, investing something toward retirement should be pretty high up on your financial to-do list .

Although answering this question may not be as exciting as hunting down stock tips, it can help all the other pieces of your investing puzzle fall into place.

Don’t Miss: Best Markets For Investment Property

Beginners Guide To Asset Allocation Diversification And Rebalancing

Even if you are new to investing, you may already know some of the most fundamental principles of sound investing. How did you learn them? Through ordinary, real-life experiences that have nothing to do with the stock market.

For example, have you ever noticed that street vendors often sell seemingly unrelated products – such as umbrellas and sunglasses? Initially, that may seem odd. After all, when would a person buy both items at the same time? Probably never – and thats the point. Street vendors know that when its raining, its easier to sell umbrellas but harder to sell sunglasses. And when its sunny, the reverse is true. By selling both items – in other words, by diversifying the product line – the vendor can reduce the risk of losing money on any given day.

If that makes sense, youve got a great start on understanding asset allocation and diversification. This publication will cover those topics more fully and will also discuss the importance of rebalancing from time to time.

Lets begin by looking at asset allocation.

Choose An Account Type

What you’re investing for can also help you pick an account to open. Chances are, you’ll want to start investing with one of these 3 main account types:

Brokerage account: When people talk about trading stocks, they’re typically talking about doing so in a brokerage account. You can think of a brokerage account as your standard-issue investment account. Here are the basics:

- ProsFlexibility. Anyone age 18 or older can open one.1 You can add as much money as you want to the account, whenever you want, and have access to a wide range of investment options. You can also generally withdraw any cash in the account whenever you want.

- ConsTaxes. While a brokerage account may be the simplest to open and start using, it’s typically the most expensive come tax time. That’s because you generally have to pay taxes on any investment profits every year .

- When to consider. If you’re investing for retirement, it generally makes more sense to first start with one of the next 2 account types. That said, as long as you choose an account with no fees or minimums, there’s no harm in going ahead and opening a brokerage account so you have it at the ready.

401: This is an employer-sponsored plan account for investing for retirement. You can generally only invest in one through work. If you’re not sure if you have access to one, check with your employer’s HR department. Some people may instead have access to a 403 or 457 account, which are similar. Here are the tradeoffs:

Also Check: How To Invest In Salt

Putting Principles Into Practice

Understanding your investment strategy is one thing. Sticking to it is another.

In times of uncertainty, its important for investors to hold their nerve and think long term. History tells us market falls have tended to happen around every 5-10 years, but its impossible to predict exactly when they will happen. By selling your investments after theyve fallen in value, you miss out on the potential for them to bounce back when prices eventually recover.

And while we dont know whats around the corner, we do know investing for the long term, and sticking to your game plan offers investors the best chance of achieving their goals and securing a better financial future.

Pick An Investment Strategy

Your investment strategy depends on your saving goals, how much money you need to reach them and your time horizon.

If your savings goal is more than 20 years away , almost all of your money can be in stocks. But picking specific stocks can be complicated and time consuming, so for most people, the best way to invest in stocks is through low-cost stock mutual funds, index funds or ETFs.

If youre saving for a short-term goal and you need the money within five years, the risk associated with stocks means you’re better off keeping your money safe, in an online savings account, cash management account or low-risk investment portfolio. We outline the best options for short-term savings here.

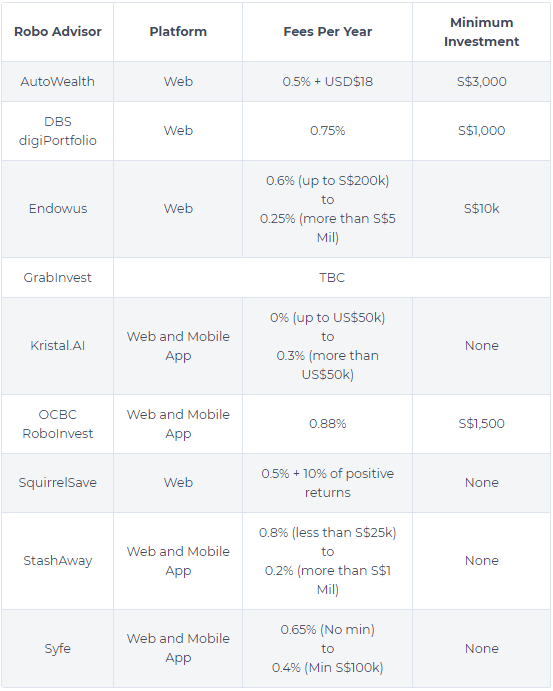

If you can’t or don’t want to decide, you can open an investment account through a robo-advisor, an investment management service that uses computer algorithms to build and look after your investment portfolio.

Robo-advisors largely build their portfolios out of low-cost ETFs and index funds. Because they offer low costs and low or no minimums, robos let you get started quickly. They charge a small fee for portfolio management, generally around 0.25% of your account balance.

Read Also: Investing In Portland Real Estate

Are You Building Wealth That Lasts

Larger-than-average returns almost always require you to take larger-than-average risks, and there are no free lunches in investing. As you work to build wealth and secure your financial future, stay focused on three long-term investment musts:

Build a just in case nest egg: Nearly one-quarter of Americans have no emergency savings. Dont let yourself get caught in that trap. Retirement savings accounts are critical savings vehicles, but tapping into them before retirement typically brings steep tax penalties. To prevent this from happening, build an emergency fund as described earlier that amounts to roughly three to six months of your living expenses.

One of the most significant things you can do for your financial future is to make saving automatic that is, have your bank automatically direct a portion of your paycheck into an account specifically for saving. This ensures you save consistently instead of forcing you to make an active choice to set money aside.

This sum should stay somewhere with low risk like a bank account, and it should remain liquid to ensure you can access it if you ever need it. Once youve established an emergency fund, invest future savings based on your risk tolerance.

If youre just starting to invest, I believe you should look at mutual funds or ETFs rather than individual stocks because it will be easier to create a diversified account using funds if the account in question is small.

The Connection Between Asset Allocation And Diversification

Diversification is a strategy that can be neatly summed up by the timeless adage, dont put all your eggs in one basket. The strategy involves spreading your money among various investments in the hope that if one investment loses money, the other investments will more than make up for those losses.

Many investors use asset allocation as a way to diversify their investments among asset categories. But other investors deliberately do not. For example, investing entirely in stock, in the case of a twenty-five year-old investing for retirement, or investing entirely in cash equivalents, in the case of a family saving for the down payment on a house, might be reasonable asset allocation strategies under certain circumstances. But neither strategy attempts to reduce risk by holding different types of asset categories. So choosing an asset allocation model wont necessarily diversify your portfolio. Whether your portfolio is diversified will depend on how you spread the money in your portfolio among different types of investments.

Also Check: Investment Firms In Hong Kong

Get Started Investing As Early As Possible

Investing when youre young is one of the best ways to see solid returns on your money. That’s thanks to compound earnings, which means your investment returns start earning their own return. Compounding allows your account balance to snowball over time.

How that works, in practice: Let’s say you invest $200 every month for 10 years and earn a 6% average annual return. At the end of the 10-year period, you’ll have $33,300. Of that amount, $24,200 is money you’ve contributed those $200 monthly contributions and $9,100 is interest you’ve earned on your investment.

There will be ups and downs in the stock market, of course, but investing young means you have decades to ride them out and decades for your money to grow. Start now, even if you have to start small.

If you’re still unconvinced by the power of investing, use our inflation calculator to see how inflation can cut into your savings if you don’t invest.

In this episode of NerdWallet’s Smart Money podcast, Sean and Alana Benson talk about how to get started investing, including digging into your attitudes around investing and different types of investing accounts.

Maintaining Your Asset Allocation

To help keep your portfolio on track to meet its objectives, youll need to make sure its rebalanced regularly.

Rebalancing involves selling a little of whats done well and reinvesting elsewhere assuming your risk level and objectives havent changed. That way, you will stick to your strategy, keeping the ratio of different asset classes in your portfolio steadier over time.

Sometimes thatll mean selling bonds and buying shares, and sometimes itll mean doing the opposite. In some cases, you might also want to rebalance between individual holdings. If one of your investments does especially well, it might become a larger portion of your portfolio than you initially intended.

Read Also: Buying Investment Property For Airbnb

Weigh Your Comfort With Risk

Assessing your comfort with risk is important because its unlikely youll reach your long-term goals if you abandon your strategy during the inevitable short-term market decline. Determining and periodically revisiting your comfort level with risk can help you avoid some emotional investing mistakes, such as chasing performance.

Growth investments, such as stocks or stock mutual funds, may experience more market volatility than more income-oriented investments, such as bonds or bond mutual funds, but can provide opportunities for higher returns. Appropriate diversification across quality, long-term investments can help align the risk of your portfolio with your comfort level. Finding that right balance can help you stay on the path toward your investment strategy. Typically, your financial advisor will ask you to complete a questionnaire that can gauge how you might react to risk in different situations. If youre building an investment portfolio with your partner or spouse, this is an important topic to discuss with each other.

Investment Portfolio: What It Is And How To Build A Good One

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Like any industry, investing has its own language. And one term people often use is “investment portfolio,” which refers to all of your invested assets.

Building an investment portfolio might seem intimidating, but there are steps you can take to make the process painless. No matter how engaged you want to be with your investment portfolio, theres an option for you.

Recommended Reading: How To Invest In Us Share Market