It Wont Provide You With An Income

If youre seeking an income from your investments, gold wont pay you any interest, nor will it provide you with any dividends. Instead the hope is that gold will provide you with long-term capital returns, although as with other forms of investment, there are no guarantees and you could get back less than you put in.

Your Free Guide To Investing And Trading In Gold Thanks To Blackbull Markets

|

Gold Retreats From Strongest Rally Since 2020 Peak

The gold price underperformed analysts projections for much of 2021, as expectations of multiple interest rate hikes offset concerns about the economic recovery from the Covid-19 pandemic and high inflation.

Investing in gold is typically considered to be a hedge against inflation, as it retains its value while the buying power of fiat currencies erodes. But it becomes less attractive when interest rates rise, as investors do not receive interest or dividend payments for holding gold.

The gold market has come under pressure as central banks such as the US Federal Reserve , European Central Bank and the Bank of England have lifted interest rates aggressively in 2022, with more increases expected heading into 2023.

The war in Ukraine initially drove up demand for gold, with the price climbing from $1,800 an ounce at the start of this year to $2,043.30 on 8 March its highest level since it set a record high above $2,070 per ounce in August 2020. Falling global equity and bond market prices added to golds lustre for investors looking for a way to preserve their capital during increased turbulence on the financial markets.

Inflows into gold exchange-traded funds totalled 269 tonnes, equivalent to $17bn during the first quarter of 2022 the highest quarterly total since the third quarter of 2020. First-quarter US Mint sales of gold coins hit their highest level since 1999, according to data from the World Gold Council.

Also Check: Stock Investing Apps For Beginners

Different Forms Of Physical Gold For Investment

Several different types of physical gold exist when it comes to investing in gold. One of the most common types of physical gold is bullion. Most bullion takes the form of a slip of gold. A miniature bar that is made up of .999 purity gold.

Gold coins can also be considered bullion. A bullion coin is a standard piece of gold that is commonly trade. In general the purity is the same as a slip of bullion.

On the other hand there are numismatic coins that can also be invest in. These coins have more value than just the precious metal that they contain. That is because these are the type of coins that collectors trade in. While they may be a great option for when the financial world is doing well, if you want to be safeguarded, they are not a good option.

If the financial world isnt doing well, buyers are looking to pay for the precious metal, not the collectors piece. This can make it hard to get the full value of a numismatic coin.

Also Check: Investing Your 401k In Real Estate

Gold As A Diversifying Investment

In general, gold is seen as a diversifying investment. It is clear that gold has historically served as an investment that can add a diversifying component to your portfolio, regardless of whether you are worried about inflation, a declining U.S. dollar, or even protecting your wealth. If your focus is simply diversification, gold is not correlated to stocks, bonds, and real estate.

You May Like: Long Term Life Insurance As An Investment

Streaming & Royalty Companies

Streaming and royalty companies are another way to invest in gold through stocks. These companies will provide cash upfront to mining companies for the right to buy gold in the future. Think of them as financing companies who receive their profits in gold. This form of investment also requires inventors to learn more about the risks of gold mining and the companies associated. The level of research required to successfully invest in streaming and royalty companies can be a barrier to entry for some.

Pushy Salespeople Or Unfriendly Customer Service

If a salesperson is overly aggressive, it may be an indication that you should reconsider your decision. A good corporation will never make you work for them instead, they let their work speak for itself. It is also up to you whether or not to work with the company, and no one should force you. If you ever get that feeling, you won’t be able to trust that company.

The company appears shady when a salesperson oversells a product or leads you into agreeing with them. So please don’t fall for their ruse because it could be a firm attempting to defraud you.

Before deciding on a company, you should look at its customer service. Good customer service would come from people who are more concerned with your comfort than their financial well-being.

The companies in this guide also offer customer service to put you at ease when working with you, which is something you should look for in your chosen company.

Recommended Reading: 401k Loan To Buy Investment Property

Diversifying With Gold Assets

Diversification in finance means to allocate funds to various asset classes and investments. The diversification of a portfolio increases depending on the variety of the asset classes and assets held by the investor. Since typically distinct asset classes and individual assets perform differently, the performance of a diversified portfolio of investments is more balanced than the performance of a less diversified portfolio or just one single asset.

Gold is an asset class in its own. Gold investments have also different characteristics than investments in other commodities or precious metals. That means the value of a gold asset often shows a low correlation with other investments and asset classes. Investing in gold can therefore be a suitable way to diversify a portfolio.

Investors seeking to avert risk should diversify their portfolios across several different asset classes and assets. Studies from Mercer and Oxford Economics come to the conclusion that investing 5% of a portfolio in gold investments is a good way to diversify. Depending on assumptions about future inflation or deflation and economic growth rates as well as individual risk preferences, higher allocations to gold investments could also be sensible. Typical recommendations range from 5 15%.

Further information on portfolio diversification from the World Gold Council.

How Much Gold Should I Have In My Portfolio As Opposed To Silver

Choosing between gold and silver ultimately comes down to investor preference. Some investors will use technical analysis to determine whether gold or silver is a better investment at that point. Others prefer gold, no matter what’s happening with the market, due to its long history as a store of value. Another strategy is to invest in mining companies or metals sector ETFs that offer diversified exposure to many different kinds of metals.

You May Like: Selling Investment Property Capital Gains

Think In Value Instead Of Percentages

Think in terms of percent instead of value is not necessarily a good choice. In fact, in the worst case scenario of a financial crisis, you will need absolute numbers, not percentage. Therefore, the numbers stated above would not be necessarily appropriate. In fact, the lower your overall net worth, the less meaningful percentages are.

Always keep in mind that if you buy gold, it is in order to re-sell it in the future and convert it. You will convert your proceeds to buy undervalued investment, or building a family house, buying a vacation home or supplementing your income during crisis. This point represents the stating point to know if you will have enough ounces. Ask yourself would my precious metals holding be sufficient to support my standard of living in case of a crisis ?.

Buying Gold Mining Stocks

If you can’t get your hands directly on any gold, you can always look to gold mining stocks. Keep in mind however, that gold stocks don’t necessarily move in concert with bullion prices, because mining companies succeed or fail based on their individual operating performance and how they deploy their capital and generate profits. You don’t have the security of physical possession of the metal if the companies you buy are unsuccessful.

Don’t Miss: How To Open A Charles Schwab Investment Account

Five Things You Need To Know About Gold

2 minute read

Gold is often perceived as a safe haven during turbulent times, although it can itself be very volatile. We look at five things you need to know about the precious metal.

Who’s this for? All investors

The value of investments can fall as well as rise and you could get back less than you invest. If youre not sure about investing, seek professional independent advice.

When To Invest In Gold Other Asset Classes

There are other investment assets and classes that might present an alternative to physical gold while retaining the same benefits and protections, of course. Property and 10/20 year bonds are both long-term investments with a high degree of security, while shares in FTSE 100 companies are relatively reliably profitable. However, these forms of investment may not be as stable as they currently appear.

Property, for example, has previous form for being susceptible to a slump during the Global Financial Crisis, and the prospect of more interest rate rises following the first rate rise in December 2021 may impact on borrowers ability to repay their mortgages.

Banks, where most of us leave our wealth in order to protect it, presents counter-party risk.

However, over the past two decades gold has demonstrated higher average returns on investment than any of these investment mediums, growing over 10% per year on average since 2000, compared with 4.1% for the FSE 100 and 5.3% for property .

Recommended Reading: Top Real Estate Investment Companies In Usa

When To Invest In Gold Global Politics

The price of gold is influenced by a variety of political, economic and social factors, and knowing what world events are likely to affect major players in the investment market will provide a good understanding of when to invest.

The massive rise in the gold price following the Nixon Shock is a good example of this, as is the consistently high UK gold prices following the political turmoil of Brexit and the surge at the height of the pandemic.

Answering the question when to invest in gold politically is easier than economically, as the trends are clear: political uncertainty favours gold, but the interruption to the global economy when the Covid lockdowns began was also a clear case of buyers favouring gold.

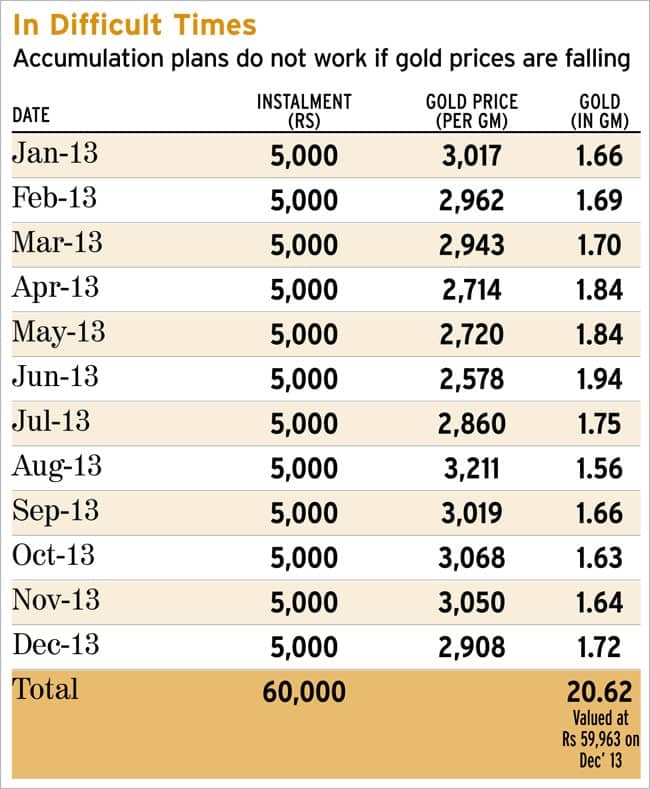

How Much Gold Should I Buy And How Often

The table below shows you how practical gold can be and how it can be used to protect your wealth.

We draw the table below to give you a better understanding of how much gold you should buy, depending on how long is your investment plan. Bear in mind that the prices below assume that the gold price will keep up with inflation. However historically, gold is likely to surpass Customer Price Index . As a result, it would be possible that you would need less than what is shown is this table.

| Monthly Purchase |

|---|

Don’t Miss: I Want To Start Investing My Money

Playing Rising Gold Prices With Etfs

Given the popularity of gold, many ETFs can add exposure to your portfolio. But they vary, says Todd Rosenbluth, mutual fund and ETF strategist at CFRA.

SPDR Gold Trust and iShares Gold Trust are the largest gold ETFs by assets, holding $75.1 billion and $29.3 billion, respectively, Rosenbluth says. But theyre also the most expensive, with SPDR Gold Trust charging 0.4% annually and iShares Gold charging 0.25%.

The highly liquid and heavily traded funds like SPDR Gold and iShares Gold are used more by institutional investors, Rosenbluth says.

A new class of gold ETFs with lower fees helps investors add low-cost exposure to their portfolios. The SPDR Gold MiniShares and Aberdeen Standard Physical Swiss Gold Shares give investors gold exposure for just 0.18% and 0.17%, respectively. They have much lower expense ratios and lower share prices that appeal more to cost-conscious retail investors, Rosenbluth said.

How To Figure Out How Much Gold To Invest

If youre interested in investing in gold, you need to figure out how much of it you want to buy. How much you should invest will depend on several factors, such as your financial situation and the expected return on your gold.

One way to figure out how much gold you should buy is to use a spreadsheet. You can use this spreadsheet to track your investment over time, ensuring that you dont overshoot your goal and end up undercapitalized. If you arent comfortable tracking your investments yourself, you can also use a gold investment management service.

Another way to figure out how much gold to buy is to examine your situation. For example, if the government is expected to increase taxes or reduce expenses in the coming years, you may be able to justify buying more gold than usual. Similarly, if the economy is expected to grow rapidly in the near future, you may want to buy less.

If you decide that youre ready to invest in gold, you can calculate how much you need to cover your expenses for a year. To do this, youll need an estimate of your annual expenses, such as your monthly rent, monthly car payment, insurance, etc. Once you have this figure, you can divide it by 12 to determine how much gold youll need to cover your expenses.

Read Also: How To Invest In Gta Stocks

How To Start Investing In Gold: A Beginners Guide

Gold is one of the best-known items of value in the world. It goes across cultural boundaries, and throughout history, gold has played numerous roles from currency, to essential materials in electronics, to jewellery with artisanal value. To many investors today, gold maintains its allure as a one-of-a-kind asset, which offers an alternative to conventional stock and bond markets.

The precious metal is considered a safe haven asset and its highest demand is seen during volatile times such as the current COVID-19 pandemic. At its last peak in August 2020, gold broke US$2,000 for the first time. This was up from just US$1,485, at the same time in 2019.

Gold also acts as a hedge against inflation. As the general cost of goods rise, gold values rise along with them. This is partly because gold is available in such finite quantities and because of this, gold owners can better preserve their purchasing power, even as low interest rates drive up prices.

Today, there are different ways in which an investor can gain exposure to gold. Not all of them involve having to own the precious metal, nor require large amounts of initial capital.

What Are The Main Use Cases For Gold

Gold is predominantly used in jewellery and as an investment vehicle. Global gold demand totalled 4,021 tonnes in 2021, jumping by 50% during the fourth quarter, according to the World Gold Council.

Jewellery fabrication accounted for 2,220.95 tonnes, and gold bars and coins 1,180.37 tonnes. Central banks and other financial institutions bought 463.07 tonnes. Technology applications, such as electroplating in electronics devices, accounted for 330.16 tonnes.

Global holdings in gold ETFs fell by 173 tonnes in 2021 after soaring by a record 874 tonnes in 2020.

Oil – Crude

| 0.33 |

Jewellery is also often used as a form of physical investment in gold. That is particularly the case in China and India, the worlds two largest markets, where consumers invest in gold jewellery to store their wealth and give as gifts during festivals and weddings.

You May Like: Best Place To Invest In Gold

Asset Diversity In Your Portfolio

If you dont think bonds and stocks provide enough diversity, adding a little gold can help you feel more comfortable. Gold often moves in the opposite direction of the stock market. So, if the stock market drops, gold often heads higher. If you want to add some balance to your portfolio, gold can be one way to do it by diversifying your assets in a way that can partially protect you from a market event.

What Is The Best Way To Invest In Gold

Finding the most suitable gold investment for your portfolio depends on your resources and investment goals. Larger investors looking for direct exposure may opt to invest in gold bullion, but this involves paying a premium and storage costs. ETFs and mutual funds that track the price of gold offer low-cost exposure with low minimum investments. However, because funds vary in their investment strategies and expense ratios, it’s important to do your research before buying these shares. Investing in gold mining companies can provide another form of exposure to the metal, but these stocks don’t always track gold’s long-term performance very closely. Finally, buying jewelry can be a satisfying way to own gold, although it is less likely to generate investment profits.

Don’t Miss: Best Place To Buy Gold For Investment

Gold Exchange Traded Funds

Just like gold mining stocks, you dont exactly buy gold, but youre investing in the ETF thats backed by gold instead. Its a commodity ETF that tracks and reflects the gold price. This is a great investment tool for investors who want to gain exposure to gold.

Lets say, youve invested in several stocks that are heavily influenced by dollars and youre trying to reduce the risk, gold ETF is the right option for that. Its because the gold ETF can help shield you from the downside.

Here are some of the gold ETFs you can invest in: