Is It The Right Move To Deduct Interest On A Home Equity Loan

It depends on your personal circumstances.

The standard deduction has changed to $12,000 for single filers, $24,000 for married couples filing jointly, and $18,000 for heads of household. In addition, senior citizens and the blind can take additional standard deductions, depending on their current marital status.

In many cases, the standard deduction will provide a larger tax deduction than itemizing things like home equity loan interest.

Another influencing factor could be the exemptions set out for the AMT, otherwise known as the Alternative Minimum Tax. This applies mainly to high-income taxpayers so that theyre not using various tax credits to avoid paying their fair share of tax.

If you qualify, you must file a regular return and a special AMT return. Whatever amount is higher is the amount paid.

The TCJA ensured that fewer people would pay the AMT. The new exemptions are as follows:

- $109,400 for married couples filing jointly.

- $54,700 for married couples filing separately.

- $70,300 for other tax filing statuses.

These are significant increases on what the limits were before.

If you dont have to pay the AMT, you can still deduct mortgage interest. But you cant deduct home equity interest. So high-income taxpayers will find less benefit in opting to itemize their interest payments on home equity loans.

Heloc Tax Deduction Rules 2022

The rules for HELOC tax deductions have remained the same since the Tax Cut and Jobs Act was implemented in 2022. Tracing rules are still in place, and they determine your HELOC deduction based on how you used the funds. A HELOC on a primary residence used to improve that home is subject to the $750,000 total loan limitation for deductible interest.

What You Can’t Claim On Investment Properties

We’ll start off with what you can’t claim on an investment property before moving onto the good stuff.

The things that can’t be claimed on an investment property can essentially be boiled down to:

-

Any expenses relating to your personal use of the property: you can only claim expenses on parts of the house used for investment purposes, so tough luck if you live in it.

-

Any expenses paid for by the tenants: bills you pay for might be deductible, but anything the tenant themselves pay for are not.

-

Borrowing costs where you’ve borrowed against the equity in the property for personal use

-

Costs related to the purchase or sale of the property

In addition to these things, the principal amount borrowed is not tax deductible, but as we’ll explain below, the interest on an investment loan can be.

Also Check: Best Way To Invest For Income

Trade Or Business Interest

Trade or Business Interest is generally the interest you use within a business you materially participate. Typically, this interest is fully deductible as a business expense.

For example, you use your HELOC to buy materials for a renovation in your fix and flip business. This interest will be fully deductible as a business expense.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Rit Real Estate Investment Trust

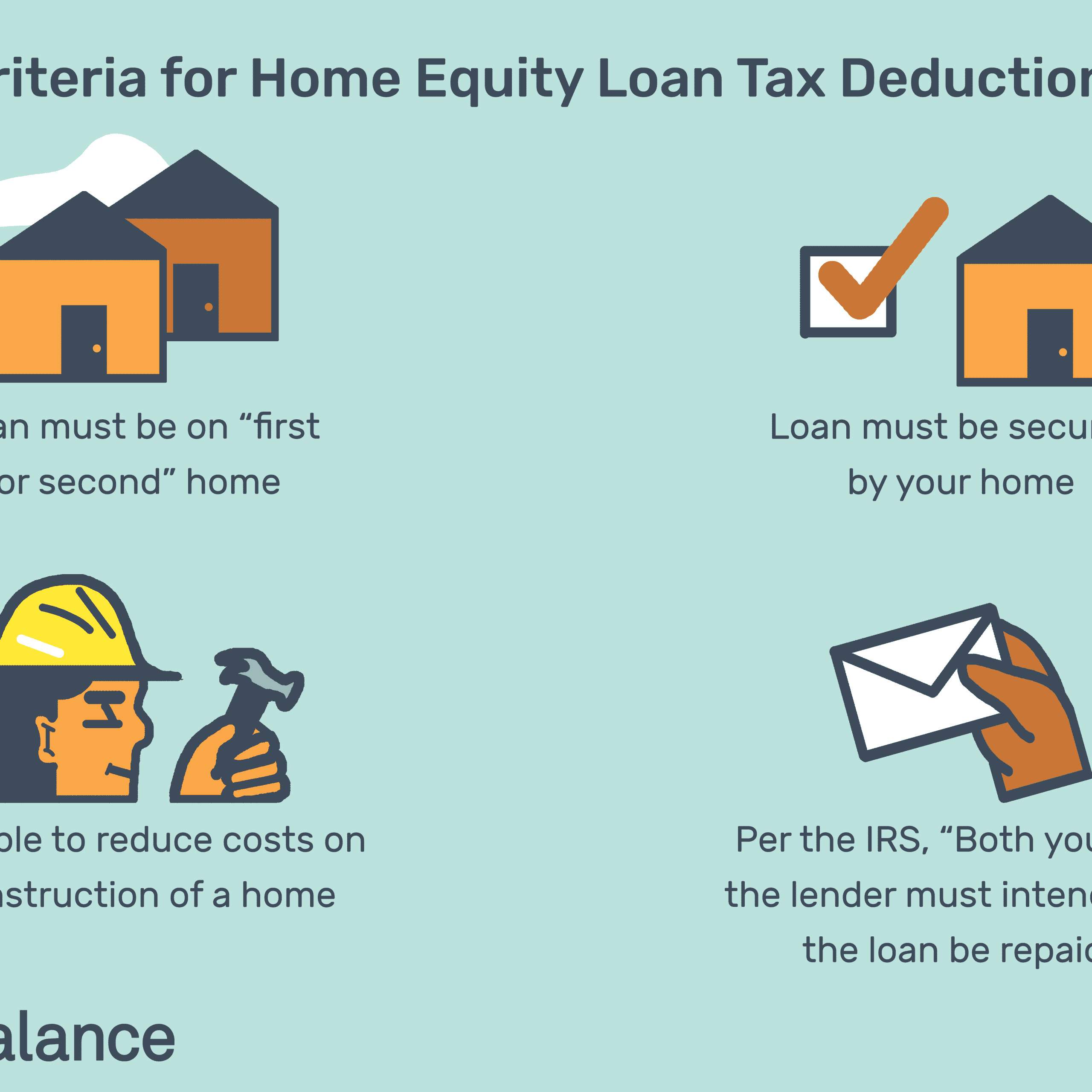

Make Sure Your Loan Qualifies

Before you deduct home equity loan interest, you must ensure your loans qualify. Heres what to consider.

- The mortgage debt doesnt exceed the limits. Any loans you have on a property shouldnt exceed a total of $750,000. This includes the first mortgage you used to buy the home and any second mortgages you borrowed, whether a HELOC or home equity loan. Determine when you borrowed the funds and correlate them with the limits of $750,000 after 2018 or $1 million before 2018.

- A qualifying residence secures the home equity loan. For your loans to count, they must be on a qualifying residence, such as your primary residence , or a second home, such as a vacation home. However, the home you used the funds to buy, build, or improve must be the collateral for the loan.

- The debt isnt higher than the qualifying home value. If you owe more than the homes value, youre upside down on your home. The IRS wont allow you to deduct interest on any loans that exceed the value of the collateral.

- The funds were used to buy, build or improve a qualifying home. To qualify for the mortgage interest rate deduction, you must use the funds to buy a property, build your own home, or renovate your existing home. A few examples of substantial home improvements include replacing the roof, adding a room addition, or remodeling the kitchen.

What Is The Home Mortgage

Every year, homeowners can choose to reduce to get a flat tax deduction, a standardized deduction, or take claim itemized deductions for things like mortgage interest, medical expenses, business expenses, etc.

In most cases, homeowners will choose which route they take based on their own personal circumstances, and which route will offer a larger deduction.

The home mortgage-interest deduction is a common deduction that will deduct interest from a primary or secondary mortgage off of your taxes.

According to the IRS, for you to take a home mortgage interest deduction, your debt must be secured by a qualified home. If you use any type of unsecured loan to pay for home renovations, this will not qualify you for a mortgage-interest deduction.

Also Check: Non Traded Real Estate Investment Trusts

What Youll Need To Claim The Home Equity Loan Interest Deduction

- Copy of the 1098 form. You should receive a form 1098 from your current loan servicer at the end of the year. The amount listed in Box 1 shows the amount of interest you paid.

- Copy of your closing disclosure. Youll receive a closing disclosure three business days prior to closing, which provides a breakdown of all the costs paid when your home was purchased.

- Copy of your loan application. Also called a uniform residential loan application, have a copy handy as added proof that the home you purchased was a primary residence or second home.

- Copies of home improvement expenses. Keep your invoice, receipts and work orders to prove you used your home equity loan funds for home improvements.

What Home Equity Loan Interest Is Tax Deductible

All of the interest on your home equity loan is deductible as long as your total mortgage debt is $750,000 or less, you itemize your deductions, and, according to the IRS, you use the loan to buy, build or substantially improve your home.

The IRS hasnt defined what exactly that includes. Its basically to make capital improvements on your principal or secondary residence, says Castelli. Anything thats going to improve the value of your home is going to be considered a capital improvement, for the most part.

For example, interest on your home equity loan would likely be deductible if you spend the funds on replacing a roof or siding, adding on a room, remodeling the kitchen, or even installing a pool.

Any home improvement project paid for with your home equity loan must be made on the home securing the loan.

Recommended Reading: Best Free Online Investment Courses

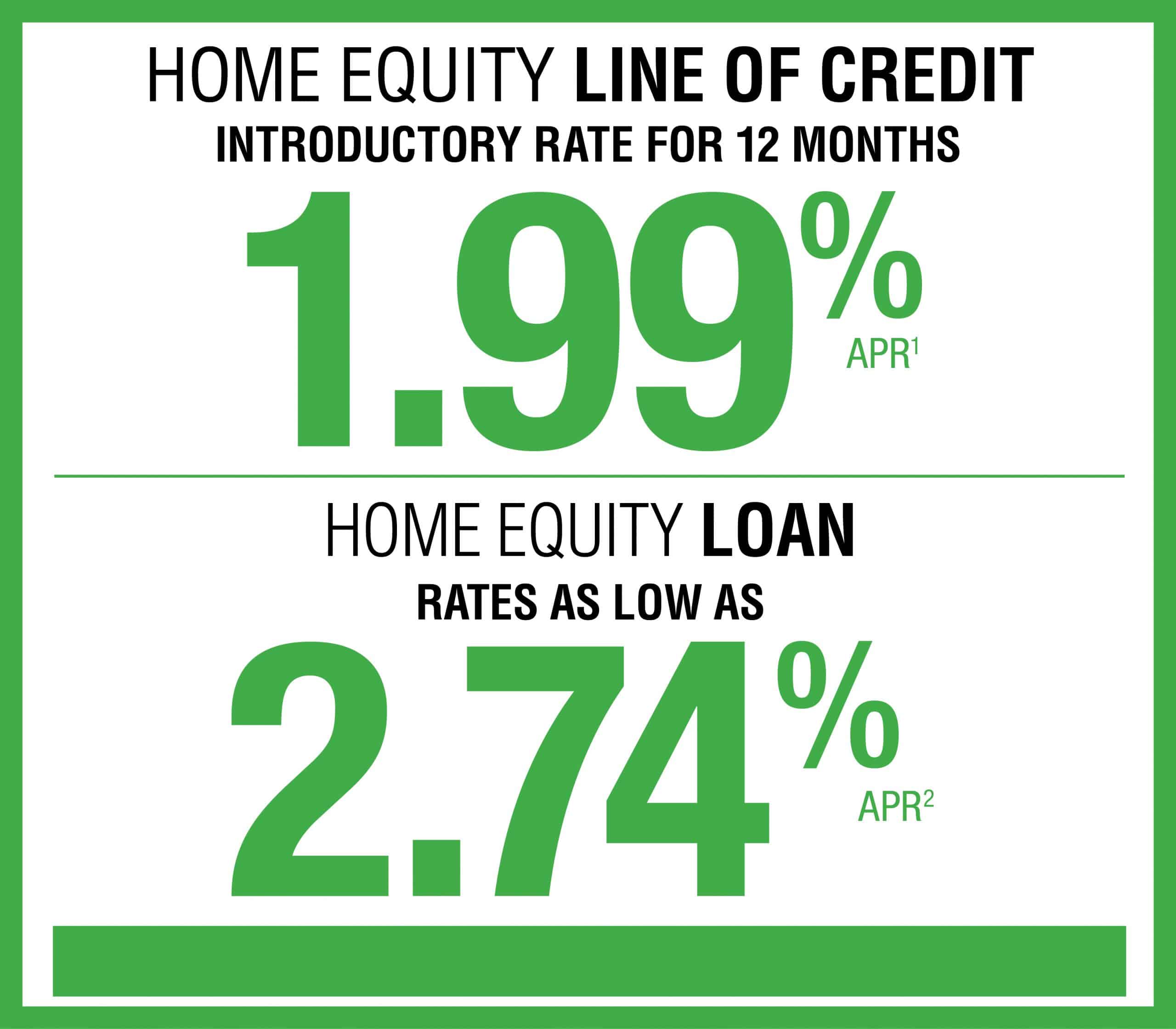

Other Benefits Of A Heloc

HELOC rates are only slightly higher than first mortgage rates, making HELOCs much less expensive than other loan options. Of course, whether a HELOC is a good deal or not can depend on the current interest rate environment. HELOC rates are usually set based on the prime rate, which in turn is influenced by the federal funds rate. If the Federal Reserve raises the federal funds rate, then the prime rateand HELOC ratescan follow suit.

Taking a HELOC also means that you only borrow as much as you neednot a lump sum, as is the case with a home equity loan. This allows you to only pay interest on the amount of your that you actually use, which can be a more attractive option if you want to keep costs to a minimum. In addition, sometimes a HELOC features an option to lock in a fixed interest rate to repay the outstanding balance.

HELOCs can help you to unlock larger sums of money than you might be able to borrow with a personal loan or a . As a homeowner, youre able to borrow up to a specified amount based on the combined loan-to-value ratio. That includes the outstanding balance from a first mortgage plus the additional requested funds.

Assess Your First And Second Mortgages

To determine if you can take the interest deduction, look at the most recent statements from your first andsecond mortgage. The loans must not exceed $750,000. It takes only a few minutes to determine if your loans qualify. Any amount above $750,000 wont be eligible.

If you arent sure of your loan amount, you can contact your lender or reference your closing documents to determine how much you borrowed.

You May Like: Buying Investment Property In Chicago

How Do You Claim A Home Equity Loan Tax Deduction

You must keep careful records to claim the home equity loan tax deduction. First, determine if your loans meet the IRS requirements, including:

- Both loans must not exceed the $750,000 limit

- The loans must be for your primary or secondary home

- The loans must be less than your homes value

- You must use the funds to buy, build, or improve a home

Are Home Equity Loans Tax

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you borrow on your homes equity, there may be a bonus: The interest you pay each year is tax-deductible up to a government-imposed limit, as long as the borrowed money goes toward improving your home.

Don’t Miss: Can I Get A Loan For An Investment Property

Real Estate Investment Risks

Nobody can predict the future of the housing market with 100% accuracy, but it does appear that the wild growth rate of the last several years is starting to slow down as interest rates are rising quickly. Investing in real estate as the market is slowing means that it could be difficult for you to make money in the near future after accounting for closing costs, high interest payments, and any renovation expenses you may have.

While real estate investing has been a relatively easy way for people with even minimal knowledge to have fantastic gains over the last several years, dont confuse someone elses luck investing in a hot market with true success. Learning to analyze real estate markets, rental markets, and potential return on investment takes skill and specialized knowledge that many spend decades building.

If youre looking to invest so you can flip houses, that may be more difficult to currently profit from. If youre interested in purchasing investment property to rent out to tenants, then you need to be very thorough in your research on the rental market and the rules and regulations in the area in which youre investing. You should especially familiarize yourself with some of the eviction moratoriums introduced due to the coronavirus pandemic.

It All Depends On How You Use The Money

Morsa Images / Getty Images

A home equity line of credit is a common way for homeowners to borrow money at affordable rates by tapping into their home equity. It works similarly to a credit card in that you have a line of credit you’re free to draw from as needed and you only owe interest when you borrow.

You used to hear people talking more about the benefits of HELOCs because you once were able to deduct all of the interest paid on these loans, unlike many other loan options. But with changes made in 2018, that may not be the case anymore. Instead, what you use the funds for and the size of your loan are among the determining factors. We’ll help you understand how it all works.

Read Also: Investment Accounts You Can Withdraw From

Should I Take Out A Home Equity Loan For An Investment Or Rental Property

Using a home equity loan for an investment property isnt right or wrong. Instead, youll need to consider all the pros and cons, how those align with your goals and budget, and your overall tolerance for risk.

You should also consider the process for these loans. While their rates are often more attractive than other financing options, the process is often more complex and longer, and it may be more difficult to find a lender than it would be for other types of loans.

To be sure youre making the right choice, you should also consider alternative forms of financing.

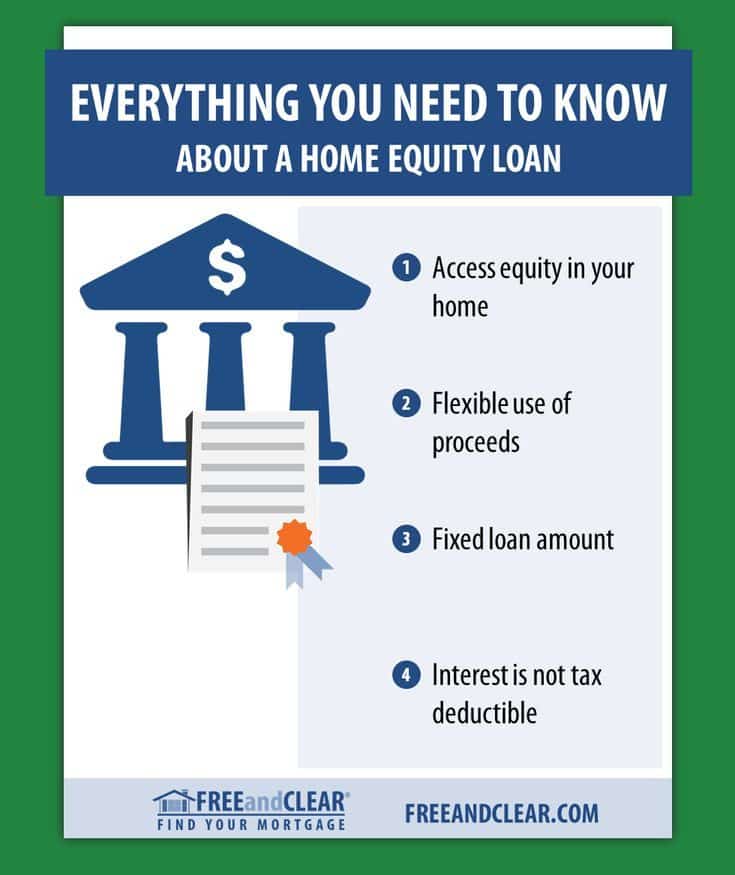

What Are The Benefits Of A Home Equity Loan

Home equity loans are attractive for a number of reasons. First, they’re easy to qualify for, provided the equity in your home is there. Second, you’ll generally snag a competitive interest rate on a home equity loan, and a fixed interest rate at that, making your monthly payment on that loan predictable. Finally, a home equity loan can serve as a tax deduction — but only in limited circumstances, as we’ll discuss below.

You May Like: What Is An Impact Investment Fund

Claiming A Home Equity Loan Interest Deduction

Claiming the deduction isn’t difficult. To deduct the interest paid on your home equity loan or on a home equity line of credit, known as a HELOC, youll need to itemize deductions at tax time using IRS Form 1040.

Thats worth doing only if your deductible expenses add up to more than the amount of the standard deduction for the 2021 tax year:

-

$25,100 for married couples filing jointly.

-

$12,550 for single filers or married people filing separately.

-

$18,800 for heads of households.

» MORE: Learn more about tax deductions for homeowners

Limits On Investment Interest Deduction

If you claim your deduction on Schedule A, your deduction for investment interest cannot exceed your net investment income for the year. For example, if your net investment income for the year prior to your investment interest deduction is $4,000, and you have $5,000 of investment interest paid during the year, youre only allowed to deduct $4,000. However, you can carry forward the remaining $1,000 to the next tax year, so the deduction isnt lost completely.

You May Like: Broker Dealer Vs Investment Advisor

Not All Home Equity Loan Interest Is Deductible

Depending on when the loan originated, the IRS allows interest deductions on up to $750,000 or $1 million in mortgage debt . That limit applies to the combined amount of all loans secured by a qualifying property whether they are first or second mortgages.

For 2021, you can deduct the interest paid on home equity proceeds used only to buy, build or substantially improve a taxpayers home that secures the loan, the IRS says.

That rule went into effect for the 2018 tax year and was a big change from prior years, when you could deduct the interest regardless of what you used the money for.

Projects That Add Value

If youre building an addition to your homesuch as an in-law suite or deckthe Internal Revenue Service says HELOC interest is deductible because those projects can help to boost the propertys value.

Many other projects can push up the potential sale price of your house, too. Think of results that will make your home more attractive to buyers, such as installing central air conditioning, energy efficient windows or a tankless hot water heating system.

- energy efficient windows

Read Also: Best Investment Property Loan Rates

What Is A Substantial Home Improvement

If youre using mortgage debt to fund home maintenance and minor repairs, this is not considered a substantial home improvement, unfortunately.

Minor repairs and maintenance include things like:

-

Energy efficient Equipment

-

Medical expenses that were paid out of pocket and not reimbursed by your health insurance plan, including:

- Construction of ramps, widening doorways or hallways for wheelchair access, and installing modifications to bathrooms or stairways like lifts and handrails.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How To Start Investing In Oil

Using A Home Equity Loan To Invest In Real Estate

Home equity loan proceeds can be used on anything you choose, including investing in real estate. To use a home equity loan to invest in real estate, youll need to have some equity in your existing property, decent credit, and proof of income sufficient to pay back the loan.

Once your home equity loan has closed and you have picked out an investment property, you can use the proceeds from your home equity loan in any way you choose on your investment property, or anything else. The cash is yours to use as you wish after the loan closes.

However, just because you can use your home equity loan to invest in real estate doesnt mean you should.