How To Run A Friends And Family Investment Round For Your Small Business

When youre starting a new small business, sometimes you dont have the cash to start with in order to get up and running. At this stage, entrepreneurs often either turn towards their own personal savings, or they ask those in their inner circle to help them grow their business.

In startup lingo, this is often referred to as the friends and family round, and typically occurs at the very beginning stages of starting the business. However, its not just for tech startups – small businesses from restaurants to plant nurseries and beyond can run a friends and family round.

Read on to find out how you can run a friends and family round for your small business – and how you can leverage these tips to make the most out of your crowdfunding campaign!

The Ins And Outs Of Raising Money From Friends And Family

Entrepreneur

What it is: It is one of the most common forms of startup funding out there. Banks and independent investors might not want to risk money on you. But those who are close to you and believe in you might be willing to take a chance on your fledgling business.

Related: How to Get Funding From Friends and Family

Upside: This is your best chance to secure money to get the business off the ground. If your friends and relatives don’t want to give you money, who will? If one or a few of them has business savvy, better yet. Bringing them on as investors transforms them into motivated advisors. Plus, they will likely be more forgiving than outside investors when it comes to your business’ ups and downs.

Raising money from your personal network can also be a step toward securing money from future investors, because it demonstrates that you are grounded in a network of family and acquaintances who have already bought into the business plan.

Downside: You risk lost friends and strained relationships with relatives. Your next holiday party won’t be as fun if half the people there think you fleeced them on a failed business venture, or are annoyed because you went on vacation before paying their money back.

That is why it is best not to get too informal about the business relationship. Be upfront about risks, lay out the business plan that the money will fund, and put the rules behind the investment in writing.

Related: How to Make the Kitchen Table Pitch

Friends And Family Simple Agreement For Future Equity Terms

- Convertible Note: A type of bond that you can convert into a specific number of shares

- Valuation Cap: Also known as conversion cap, represents a price ceiling for purchasing shares

- Maturity Date: A particular moment after which the company has to repay their investors

- Liquidity Event: A type of exit strategy such as asset sales, bankruptcy, merger, or acquisition

- Equity Round: A single event of offering equity to investors

- Startup Company: A new business in the initial stages of operations

You May Like: How To Invest In Honey

S In A Family And Friends Round

As the name family and friends round suggests, this round of capital raising may be less formal for the founder in terms of the documentation. In more formal rounds, the founder may need to provide forecasting and demonstrate a proven concept.

A family and friends round may not require your startup to have developed a product or service already. This is unlike a seed round of funding, which typically involves angel investors and early-stage venture capital firms. These investors are focused on this early stage of the lifecycle of a startup. Your family and friends may be content that you have a product or service idea that you believe in and wish to develop and be ready to take the leap to invest in your vision.

A family and friends round may appear less formal as the parties are familiar with each other. Even so, you should treat the round with caution, professionalism and with a long-term strategy in mind. Consider these steps as you approach your family and friends for investment:

Demerits Of Friends And Family Investments

It is true that family and friends can offer investments easily, at competitive interest rates, and can offer a more reasonable repayment plan. However, it is possible to run into a few problems along the way.

Money may change relationships between friends and family. Indebted family members may start exhorting power and control over the borrower.

The investor may start criticizing your business decisions and any business spendings. The casual relationship between the family and friends can become strained in the shift of power.

A loved one may feel compelled to offer a business investment even when they do not foresee the success of the business. The discomfort can manifest during family meetings, dinners and holidays, and create lasting tensions.

Any small misunderstanding may damage relationships and even the prospects for the business. Family and friendsâ loans lack some legal protections unless you take time to structure the family investments with your attorney.

When you work with banks and other venture capitalists, they set terms and conditions in advance before you can access the funding that protects both parties.

When there is no agreement a loved one may modify the terms of payment halfway through which may injure the success of the business. There can just be misunderstandings and separation in expectations. There may be no clear path to an amicable split.

See How I Can Help You With Your Fundraising Efforts

Recommended Reading: Best Investments Of The 1970s

Build Your Business Plan

Friends and Family investors typically invest in you and your passion more so than they invest in your actual business. However, that does not mean you should go in with just an idea on the back of a napkinat a minimum, you need some solid concepts and defined goals. You do not need a well-produced PowerPoint or a big-budget presentation, but being able to communicate clear plans for your first six to twelve months is ideal.

Include how you plan to use the initial funds, what equity options may be available, and of course plainly state the risks. Though you cant outright determine the value of your idea or business, comparing what you are doing in comparison to either competitors or similar markets may also be a useful component in convincing first investors to write the check.

Having A Weak Business Plan

Donât make the mistake of having a weak business plan, even when dealing with friends and family. One of the downsides to having individuals invest in you rather than your company is that they may not challenge your business plan to the same degree. While this may seem like less work for you to do, it’s not a good thing.

As in situations in which you’re entirely self-financing, a strong business plan is your road map for the future, ensuring that you’ve thought through the hurdles you may face.

Similarly, you are best off if you have a prototype to share with your friends and family in addition to the business plan.

Don’t Miss: Best Mutual Fund Investing App

Prepare To Mature Your Business Toward Traditional Financing

If your business starts gaining traction, it may be tempting to lean on your friends and family even more. And why not? They too may be starting to taste success, so why should you deny them more potential upside?

As tempting as that may be, its a crutch you should avoid. Your startup will likely do better over time if you go through the disciplined assessment required when pitching professional investors.

Friends And Family: The Secret To A Successful Crowdfunding Campaign

Fun fact: all of these previous points are just as applicable to crowdfunding as they are to any other kind of way to raise money for your small business.

We often encourage small business owners who crowdfund to reach out to family and friends first to make up the first 10 percent of their campaigns raise. This is because theyre often the people wholl be most willing to chip in and believe in your business, but their support also shows up to others and motivates a wider range of people to invest in your business.

The added bonus of including your friends and family in your crowdfunding campaign is that they will also be integral in marketing the campaign. Theyll want to shout-out your business every chance they get – not just because theyre your family and they love you, but because theyve invested in you!

Don’t Miss: Best Investment Apps For College Students

How Much Capital Should You Ask For

There is no right or standard number to go off of here as this completely depends on how much you need to get you through the first few months of your business until you either are making a profit or are ready to raise another round. Ranges are usually anywhere from $10,000 to $150,000 but can also go up to 2 million. Use modeling and advice from the market to get a ballpark idea. You can check out a template for modeling your early financials here.

How Do I Approach A Family And Friends Round

A startup seeking to raise external funding will often look to familiar, supportive networks for capital first. A family and friends round is typically the first round of capital raising for a startup. This is when family and friends first invest in exchange for equity. However, many startups successfully self-fund or bootstrap without taking on external funds. This article will explore how to approach a family and friends round, and the consequent task of securing external capital.

Read Also: Solar System Return On Investment

Rule #: Once The Money Is In The Bank Avoid Spending It On Full

It is extremely common at this stage for founders to over-leverage cash in lieu of not having a co-founder with the skills to develop/market/sell effectively. If your goal is to develop your initial web or mobile application, for example, and you arent able to find a full-blown co-founder, find a technology partner that has startup experience and is willing to work for a cash/equity split as an early co-founder with you. This way you dont need to burn through capital on market-rate services, and you gain a larger team can be on board with you for the long haul.

For planned spend on services like Google Adwords and Facebook marketing, use aggressive techniques to keep your costs to a minimum.

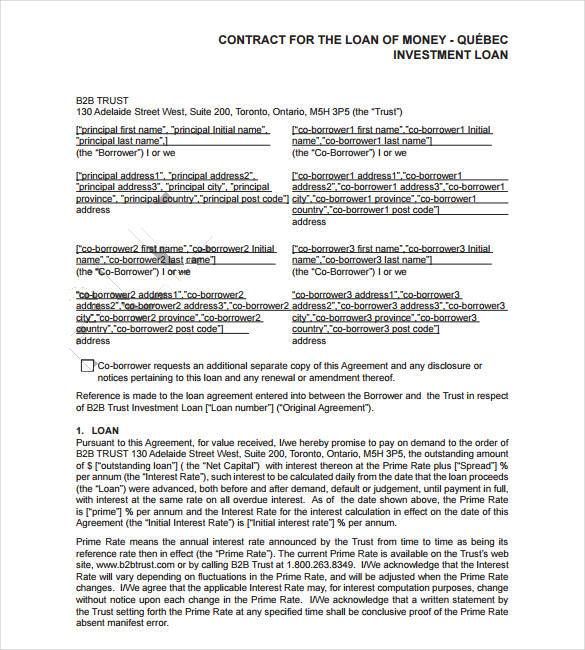

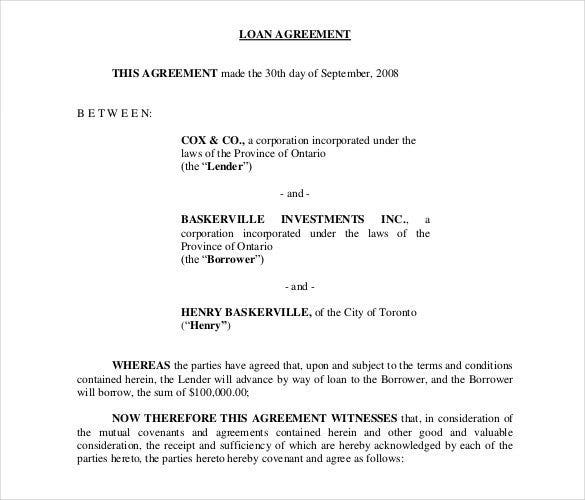

Legal Agreements With Friends Or Family

If you decide to finance your business from a friend or family member’s investment, you can prevent misunderstandings by having a formal agreement in place. The agreement should be witnessed by an independent person.

Key elements to include in a written agreement are:

- the nature and timing of return on the investment – such as how much a loan is for and whether an investor is to receive profits or a share in the business

- a repayment schedule or timed plan of dividend payments – include dates, amounts and interest on loans if applicable

- respective responsibilities – for an investor this should state whether they are to have a role in the business or any liabilities

- how any problems will be resolved

This will ensure both parties are clear about the terms on which the money will be transferred.

You should both consider getting legal advice if the loan amounts involved are substantial for either of you. For professional advice you can search the Law Society of Northern Ireland’s solicitor directory.

For loans, you can reduce the cost of legal advice by preparing a draft agreement to discuss with your legal adviser. Some websites will prepare a draft promissory note – a legal document that is less formal than a full loan agreement, but which still sets out all the relevant details clearly.

Don’t Miss: How To Make Money From Gold Investment

What Is Friends And Family Funding

When you’re trying to get a new venture started, friends and family funding is often the first place you turn to raise some capital.

In essence, friends and family investors are a form of crowdfunding. You might take small amounts of money from several family members or close friends, to raise a more significant overall sum.

Friends and family investors may be willing to put money into your business venture on an interest-free basis. Alternatively, you might draw up a friends and family investment agreement that promises interest, an equity stake or some other form of reward for lending you the money you need.

What Are Important Provisions To Include In Any Contract With Family And Friends

The obvious essential provisions to include in any contract for investments from friends and family are the rate, term, amount, and repayment provisions for the investment. In addition, it is vital to create a promissory note for a loan investment or a purchase agreement for an equity investment.

It is critical to structure the contract and expressly state in the contract what type of investment it is so that every person involved knows exactly what to expect from the investment. It is also important to include a business plan for the investment with details such as the risks associated with the investment and the business, a Strengths, Weaknesses, Opportunities, and Threats analysis, and any information relevant to the product, the purpose of the investment, and due diligence that relates to the business

When creating the contract for investment from family and friends, it is essential to include information that memorializes the relationship and any negotiations that occurred.

How can a startup lawyer help me when raising investments from friends and family?

Contact Newburn Law now to learn about how we can help you raise through friends and family investments while ensuring you make the best decisions for you and your business.

Read Also: How To Invest In Property With Little Money

Structuring Friends And Family Investments

Receiving startup funds from friends and family is a common practice in many entrepreneurial ventures. Even venture scale businesses usually contemplate raising money from friends and family, and then angel investors, before approaching VC firms.

NOTE: For our purposes, when we say friends and family, we are talking about unaccredited investors. When we say angel were talking about Accredited Investors – individuals with a net worth excluding their primary residence of $1 million or more or income over $200,000 per year or $300,000 for a married couple. If you have a friend or family member investor who qualifies as accredited, consider them angels to understand the reasoning in this article.

This article will answer some key questions about friends and family investments and we will explain why we like to issue common stock rather than the more typical structuring for these transactions.

Do I need an attorney for friends and family investments?

Can anyone invest in my company at the friends and family stage?

It frankly will make your life easier if all of your investors are Accredited Investors. Bootstrapping until you can get an angel investor is nice, if achievable. However, if you must get contributions from friends and family, there are of course ways to do it. Read on.

Instruments

| Related Articles: |

Rule #: Discuss Convertible Note Options With Your Attorney If Your Friends/family Are Requesting Equity In Your Startup

Convertible notes are a simple debt instrument similar to a standard loan that also have the option to convert into stock at a later date. When a funding round occurs that places a valuation on the company , convertible note holders are granted stock per the terms of the agreement.

Ill discuss more about convertible notes in a later post in this series, but for now, assuming your friends/family throwing money in meet the qualifications of an accredited investor, its generally a good idea to suggest going this route .

You May Like: Can I Get A Loan For An Investment Property

Advantages Of Friends And Family Funding

There are many clear advantages of getting your funding from people who know. They know your potential and understand the probability of your business succeeding.

Friends and family lending can take place on a much larger scale and on a formal basis. Peer-to-peer websites, angel investments, venture capitalists, and bank loans often have stricter legal requirements. They have criteria that have to be met before the investments can be secured.

Friends and family investments are a much more flexible solution for your startup. Friends and family investments are easier to raise compared to all other investments.

It is possible to gain investment from friends and family even before the completion of the business plan. Youâll secure the investments from mutual trust rather than the validity of the idea on paper.

Conventional sources often require proof of the profitability of the business, sales, and other more technical factors. Those requirements make it hard for a business that requires funds to set up. Thatâs because it is hard to prove that a business concept would earn money without any real trial.

Family and friends already know the character and circumstances that you are bringing to the table. And may not require an extensively detailed business plan.

They offer investment on their knowledge of abilities. Hence one does not have to prove to the family member or friends what they are really capable of doing.

Investment Partnerships And Global Families

Families and investment opportunities are increasingly global. Financial success provides individuals the freedom to choose the place they will live, raise a family, invest, and accumulate wealth. IP structures frequently try to accommodate families with members residing and investing in multiple jurisdictions. Serving the needs of increasingly mobile families and their global investment portfolios creates additional administrative and regulatory burdens. It is critical to evaluate structural alternatives to accommodate the needs of global families.

Some of the critical issues include:

- Choice of the appropriate entities and jurisdictions to accommodate non-US investors and investments

- Foreign and state income tax filing requirements

- US and state income tax withholding on foreign or non-resident investors

- Effective planning for the use of foreign tax credits to reduce the impact of investing in multiple jurisdictions

- Risks associated with investments denominated in currencies other than the dollar

- Foreign bank and financial account reporting

- Foreign estate, gift, and wealth taxes

You May Like: Socially Conscious Investing Mutual Funds