What Is Esg Investing

ESG stands for environmental, social, and governance. ESG investing takes these three factors into consideration when determining how a company’s practices alter the investment’s performance.

This means that ESG investing still prioritizes profitability, despite the social awareness that surrounds it.

Interesting, I think the term works great. But I define ESG as being for the purpose of improving risk adjusted returns and reserve SRI and Impact Investing for indicating that one places values and impact on, at least equal footing, to profit.

Dave-o-leartern

Investments receive ESG scores, with a high score meaning that the security is more likely to profit and a low score meaning that it’s more likely to flop.

Experts base the scores on a list of predetermined factors.

- Environmental factors include energy consumption, pollution, climate change, waste production, natural resource preservation, and animal welfare.

- Social factors include human rights, child and forced labor, community engagement, health and safety, stakeholder relations, and employee relations.

- Governance factors include quality of management, board independence, conflicts of interest, executive compensation, transparency and disclosure, and shareholder rights.

Some examples of ESG funds to invest in are the ESG U.S. Stock ETF , the Global ESG Select Stock Fund , and the iShares ESG Aware MSCI EAFE ETF .

Heres The Difference Between Esg And Impact Investing According To Experts

Worth

If youre reading this, chances are you already know what ESG is. In fact, you might even be invested in companies that meet ESG standards. And while using ESG can help investors invest more responsibly, it is not the same as impact investing. Whereas ESG is a set of criteria, impact investing is a strategy, and not necessarily one as focused on financial gain as much as positive social and/or environmental change.

I think what a lot of people dont understand about ESG is it usually is really focused on looking at those environmental, social and governance factors that are going to have a material financial effect on the company, says Kim Griffin, member engagement director at Toniic, at the recent Health + Wealth of America conference. So its really still rooted in looking at the financial impacts of the company, which may or may not meet expectations of investors who want to solve the climate crisis and have more flexibility on financial risk and financial return expectations.

Ad A

Griffin often finds people think ESG is a broader framework than it actually is. Andrew Lee, managing director and head of sustainable and impact investing at UBS, continued with that thought, explaining that he thinks the terminology trips people up, but he wants investors to be more concerned with determining what their goals are with their investments and making sure their portfolio is set up to align with those intentions.

Ad B

Examples Of Our Partnership With Clients

Client DescriptionA $2 billion Minnesota-based family foundation. The clients mission is to improve the quality of life for present and future generations by dedicating its resources to support, unite, and empower those it serves. Client ObjectiveIn 2013, the board embarked on a process to discover how the endowment could be restructured to further its mission. After committing in 2014 to investing 10% of its endowment to mission-aligned strategies, the client sought specific investments that would generate financial return, meet its fiduciary duty and drive program learning. |

GSAM SolutionWe worked with the client to source, diligence, recommend and manage mission-aligned investments, including public and private funds, direct investments and some program-related investments . Following the Investment Committees designation of an additional $100 million to a carbon efficiency strategy, we worked with the client to help design a less-carbon intensive Russell 3000 strategy. This resulted in relationship-building between the Foundation and CEOs of carbon-conscious companies. The client has committed more than $150 million of capital and we have a dedicated annual review of the portfolio to identify opportunities to further refine impact alignment. |

Recommended Reading: What Does An Investment Fund Manager Do

Types Of Esg Investments

As mentioned above, environmental, social and governance criteria are a set of standards for a companys operations that socially conscious investors use to screen potential investments. ESG-minded business practices have gained more traction and investment firms are increasingly tracking their performance, providing different options for investors.

Esg Vs Sri Vs Impact Investing: Know The Difference

What are the different types of responsible investing and how do they work?

Susi Weaser

min read

What’s the difference between ESG, SRI and impact investing?

A quick google into âhow to invest responsiblyâ and youâll quickly find that these investing terms are often used interchangeably.

But look closer, and youâll find that ESG, SRI and impact investing actually mean quite different things.

You May Like: Stock Market Investing Strategies For Beginners

What’s The Difference Between Esg & Impact Investing

ESG and impact investing these terms are often used in tandem and, with interest levels reaching all-time highs in 2020, now regularly appear in the media and investment prospectuses.

ESG funds captured $51.1 billion of net new money from investors in 2020, the fifth consecutive annual record, according to a Morningstar Landscape Report. This was more than double the $21 billion investors funneled into ESG funds in 2019. Meanwhile, dedicated impact investing funds have grown exponentially in the past few years, jumping from $502 billion in assets under management in 2019 to $715 billion in 2020.

Both impact investing and ESG investing can provide competitive financial returns while supporting investments in a better society. However, there are some important distinctions to be made. Understanding these distinctions can help investors make better judgments, businesses position themselves more appropriately, and improve reporting and transparency.

A Reality Check: Impact Data Shows Theres Room For Improvement

Unsurprisingly, a recent review of our impact data shows that only a limited set of companies have meaningfully pivoted their business models to contribute to a more sustainable future. My colleague Adam Fleck, director of equity research, ESG, at Morningstar, recently found that only 1,329 of the more than 12,000 companies in Morningstars ratings universe have revenues that are aligned to any of Morningstar Sustainalyticss Impact Themes, and only 449 have more than 50% of revenues aligned to one or more of these themes . There are many reasons for this, including the absence of consistent corporate disclosure, the difficulty for companies to expand their sustainability data, and the cost of scaling the solutions themselves.

Nonetheless, at Morningstar Sustainalytics, our goal is to help interested investors successfully implement an impact lens to their investment approach by easily identifying and evaluating the positive and negative real-world impact of companies, funds, and portfolios.

Also Check: Investing In Notes And Mortgages

Know Your Own Esg Criteria

ESG has some pretty clear boundaries, especially in comparison to ethical investing or socially responsible investing, but that doesnt mean it fits perfectly with your beliefs. Values differ from person to person, so take a little time to identify some of the values most important to you, and see if any fall outside of what ESG entails. If they do, make sure youre looking for investments that also incorporate those ideals. For example, Muslim investors may want to ensure that their investments comply with Islamic law.

» Is sustainability just a label? Learn about greenwashing

How Do Esg And Impact Investments Perform

The majority of investors care about their bottom line first. A study conducted by the University of California found that the median internal rate of return for impact funds is 6.4% only slightly lower than traditional funds, which have a median internal rate of return of 7.4%.

Similarly, an examination of 1,000 studies of ESG and financial performance found an overall positive relationship that became more pronounced over time. There is also some evidence to suggest that low-risk ESG funds are more resilient in periods of uncertainty. For example, in the first year of the pandemic, ESG funds outperformed the S& P 500.

Recommended Reading: How To Invest In Cryptocurrency 2020

Esg As A Regulatory Tool

The popularity of ESG and SRI investment funds has led several governing bodies to adopt regulations requiring ESG reporting. The United States, European Union, and several Asia-Pacific countries are leading the way in rolling out these regulations.

The EU is leading the way with both proposed and enforced ESG reporting requirements in an effort to drive industries in their region to meet 2030 and 2050 climate goals.

In the U.S., the social factors within ESG have been at the forefront of policy coming out of industry and government.

Changes coming out of the Asia-Pacific region reflect some of the urgent climate issues faced by member countries, as well as a push for more sustainable investment portfolio opportunities.

Regulations are aimed at a number of outcomes:

- Reducing corporate greenwashing and creating transparency around corporate sustainability activities.

- Increasing due diligence around human rights, environmental, and social issues across value chains.

- Increasing mandatory disclosures and create stringent definitions of sustainability activities.

- Requiring more organizations to participate in ESG disclosures.

Many of these regulations take into consideration the amount of time an initial ESG assessment can take, with some regulations offering 2-3 years to meet compliance.

The Difference Between Esg And Impact Investing And Why It Matters

Environmental, Social and Governance and Impact Investing strategies are booming right now. According to JP Morgan, ESG-related investing could reach $45 trillion by the end of 2020, and a recent report by IFC suggests impact investing could total as much as $2 trillion. Trends analysis from the Global Impact Investing Network suggests that impact investing AUM from the same set of investors grew by annual growth rate of 17% over the last five years and continues to accelerate year on year.

Around the world, more people are seeking ways to deploy their money in ways that create financial return across a spectrum of return expectations while also responding to global challenges like climate change, disease and the rising inequality issues that have been exacerbated by business as usual and passive investment decisions.

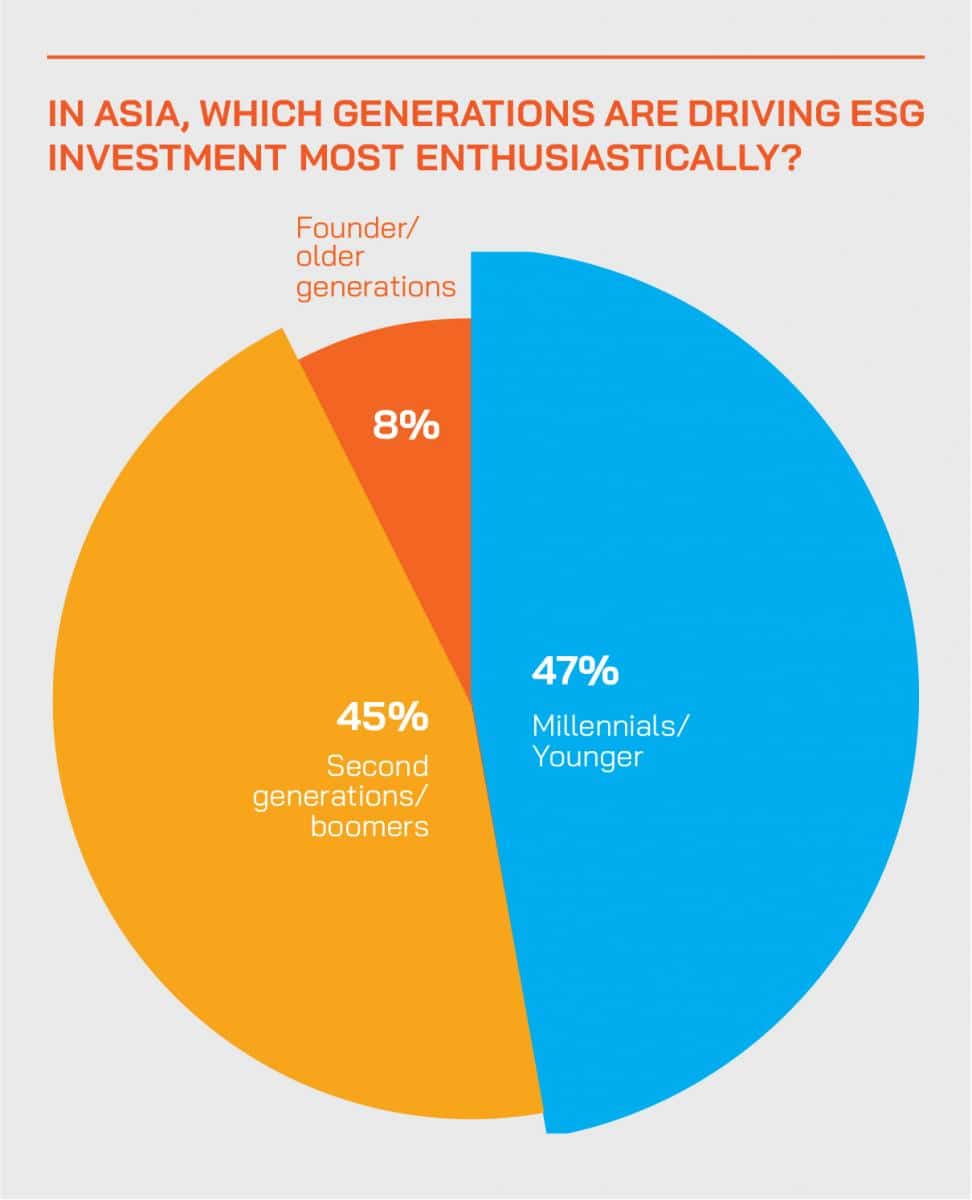

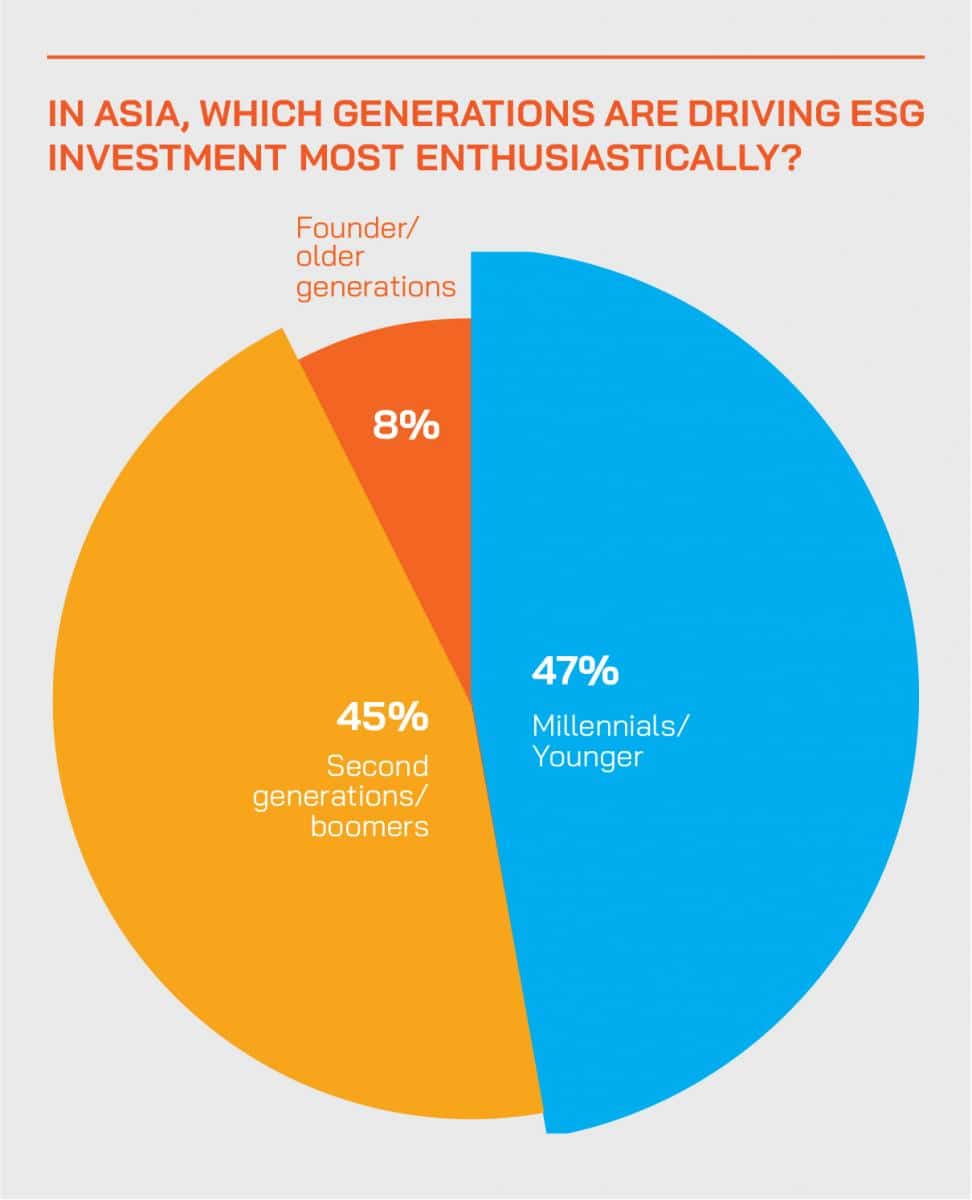

Thanks to demand from Millennials and Generation Z, the investment landscape is starting to take a new shape. To make better informed choices and help recruit more capital into investments that will make a difference, we must unpack the differences between the two. In many instances, these terms are grouped together, and by calling out the differences, we create the room to help investors make better decisions on how to contribute to the worlds biggest problems.

The ABCs of ESG and Impact Investing

Enough room for everyone

Figure 1: Comparison of actions taken at each stage of typical investment process by ESG and impact investing strategies

Recommended Reading: Is Socially Responsible Investing Effective

How Cfa Institute Can Help

CFA Institute offers a variety of resources to help you demonstrate mastery of ESG investing in practice.Earn the Certificate in ESG InvestingThe Certificate in ESG Investing offers you both practical application and technical knowledge in the fast-growing field of ESG investing.

Review the Global ESG Disclosure StandardsCFA Institute has developed the Global ESG Disclosure Standards for Investment Products which aims to build a framework for investment managers to better communicate to their clients the nature and characteristics of ESG-centric funds and investment strategies.

Esg Investing May Lead To High Returns

A 2019 white paper produced by the Morgan Stanley Institute for Sustainable Investing compared the performance of sustainable funds with traditional funds and found that from 2004 to 2018, the total returns of sustainable mutual and exchange-traded funds were similar to those of traditional funds. Other studies have found that ESG investments can outperform conventional ones.

JUST Capital ranks companies based on factors such as whether they pay fair wages or take steps to protect the environment. It created the JUST U.S. Large Cap Diversified Index , which includes the top 50% of companies in the Russell 1000 based on those rankings. Since its inception, the index has returned 15.94% on an annualized basis compared with the Russell 1000s 14.76% return.

» MORE: Check out these ESG-based portfolios

Recommended Reading: Stock Market Investing Jason Kelly

What Are We Doing As A Company

As one of the worldâs largest financial institutions, we take a key role in building a more resilient future. Through our strategy of responsible growth, we are deploying capital towards a more sustainable economyâhelping to create jobs, develop communities, foster economic mobility, and address societyâs biggest challenges around the world.

Learn more about what weâre doing to foster sustainability and have a positive impact.

Is Esg Investing The Same As Impact Investing

ESG investing, or environmental, social, and governance investing, is the umbrella term for investments that consider ESG factors when making decisions. ESG factors can include a companys greenhouse gas emissions, its treatment of employees and human rights record, and its involvement in community initiatives.

Impact investing is a subset of ESG that takes things one step further, aiming to generate specific social or environmental benefits as well as financial returns. Impact investors might target companies or projects that provide affordable housing, clean energy, or healthcare access, for example.

Recommended Reading: Different Coins To Invest In

The Sustainable Investing Ecosystem

| Socially responsible investing |

|

| Environmental, social, governance risk factors |

|

| Impact investing |

|

Esg Investing May Lower Your Risk

The same Morgan Stanley study found that sustainable funds consistently showed a lower downside risk than traditional funds, regardless of asset class. The study found that during turbulent markets, such as in 2008, 2009, 2015 and 2018, traditional funds had significantly larger downside deviation than sustainable funds, meaning traditional funds had a higher potential for loss.

ESG funds have even managed to post strong performance during 2020. Of 26 sustainable index funds analyzed by investment research company Morningstar in April, 24 outperformed comparable traditional funds in the first quarter of 2020 .

|

when you fund your first taxable Investment Account |

You May Like: Fidelity Investments Log In To My Account

What Is Environmental Social And Governance Investing

ESG, abbreviated from environmental, social, and governance, is a criterion used to evaluate investment options in these three areas.

The system introduces certain fundamental viewpoints which every company should comply with to reduce risks to sustainability.

Although the concept gained quick popularity in Europe through the GFC, it took time to gain acceptance in the US, attributed to the global financial crisis.

However, throughout the last decade, investors have begun to realize the risks beyond the boundaries of materialism.

For example, if a company theyre associated with brings profit only because they dont dispose of their waste responsibly, theres a risk of legal intervention.

Similarly, if a company you invest in has promoted inequality in terms of race or gender, they could end up facing strikes and lawsuits. This will ultimately harm your financial return.

Now, to give you further insight, lets consider the three aspects of ESG individually. Take, for instance, a company that manufactures and sells sugar.

Esg Investing And Analysis

ESG analysis has become an increasingly important part of the investment process. For investment professionals, a key motivation in the practice of considering environmental, social, and governance issues as part of their financial analysis is to gain a fuller understanding of the companies in which they invest.

Interested in accelerating your career? The Certificate in ESG Investing offers you both practical application and technical knowledge in the fast-growing field of ESG investing.

Privacy Settings

Functional cookies, which are necessary for basic site functionality like keeping you logged in, are always enabled.

Also Check: Best Place To Invest In Penny Stocks

Difference Between Esg Sri And Impact Investing The Final Showdown

In a nutshell, all three of these options let you look at the bigger picture other than material benefits when investing your money. In our eyes, all of these are a way to conduct sustainable investing. Your money should be put to use relative to what you believe, so at the end of the day, your money can deliver benefits and more influence on society.

However, each of them facilitates a different approach. The question isnt about which strategy you should choose. Instead, its about which values you prioritize and which causes you to want to support.

Whether youre looking to reduce the global carbon footprint or thriving to increase workplace equality, youll have to choose your investment option accordingly.

If you want to evaluate the options available thoroughly, go for ESG investment funds. Similarly, if you have a cause in mind that you want to exclude or include in your portfolio, go for SRI or impact investment options.

In any case, keep the fundamental distinctions of these three options in mind before making a choice.

Expect To Hear More About Impact Investing

No, impact investing isnt the same as ESG investing . What you need to know.

If youve been investing for decades or are just starting to think about it, youve probably encountered the terms impact investing, ESG investing, and sustainable investing. These terms may seem interchangeable, but theyre not. And increasingly, youll hear more about impact investing.

You May Like: Cash Investments Accounts Receivable And Inventory Are