Ease Of Forming An Llc

Creating an LLC is a much simpler process than creating a corporation and generally takes less paperwork. LLCs are under the jurisdiction of state law, so the process of forming an LLC depends on the state in which it is being filed. Most states require filing articles of organization with the Secretary of State and some states allow for them to be filled out online. A few states require an additional step of filing a public notice, often in local newspapers. Once these steps are completed, the LLC is officially formed.

Once an LLC is formed, itâs good business practice to set out the roles and responsibilities of the members. The members are individuals with an ownership interest in the LLC. Most LLCs use an operating agreement to define these roles. Drafting an operating agreement is not necessary for an LLC to be valid but it is a prudent course of action. If no operating agreement is created, an LLC is governed by the default rules contained in state statutes.

The operating agreement sets forth the rights and responsibilities of the members. It can define the business relationship and deal with issues of capital structure, the allocation of profits and losses, provisions for the buyout of a member, provisions in case of the death of a member, and other important business considerations.

Frequently Asked Questions About Setting Up An Llc For Real Estate Investing

Why start an LLC instead of opening a joint brokerage account?

The main issue with a joint brokerage account is the lack of liability protection. If you use a joint bank or brokerage account to fund real estate investing, you may be personally liable for any problems that arise, such as previous outstanding property taxes, lawsuits from renters, and so on. When handled correctly, an LLC or limited liability company offers much better personal protection. You can even open a joint brokerage account in the name of an LLC to get liability protection for your investment account.

Can you be personally liable in an LLC?

Yes, there are plenty of situations where a court may hold owners or members of an LLC personally liable for business debt or liability. You limit your exposure to liability by properly managing the LLC and associated business accounts. For more information on ways to limit your liability correctly, consider consulting with a professional advisor for relevant legal advice.

What are the benefits of an LLC?

Do you need a lawyer to set up an LLC?

What are the basic requirements for setting up an LLC?

Costs Of Setting Up A Holding Company

The cost of setting up a holding company for your real estate investments will vary based on which state you live in. If youre setting up the LLC yourself, the average state filing fee is between $10 to $800. If youre working with an attorney or financial planner, they will charge you for their time. In addition, youll be responsible for paying an annual fee, which ranges from $0 to $800 depending on your state.

Read Also: What Is The Best Way To Invest 1000

Llc For Real Estate Investing

By FindLaw Staff | Reviewed by Bridget Molitor, J.D. | Last updated November 18, 2022

Real estate investing is a great way to supplement your income or start an entirely new career as a business owner. Whether you plan to flip houses or manage rental properties, there is a lot of potential in the real estate market.

Creating an LLC for your real estate investing company provides you with a variety of protections and benefits. Follow this guide to learn how to successfully set up and run your real estate investing LLC.

We make business formation EASY. Learn about our DIY business formation services here.

How Does A Real Estate Llc Compare To Other Legal Entities

If you are already a businessman, you might already know about the various number of business entities available to choose from instead of starting a real estate investment LLC. And even though the LLC for a real estate investment business is the most recognizable entity, it is an option from several others.

As a matter of fact, due to it being the most common type, many business owners decide that starting a real estate investment LLC is better just because they do not know much about the other options. And others who know, just assume that an LLC is the best way to go. But it is always a good thing to know the truth and the reason for yourself as to why you need to make a choice. Depending on situation and visions, a different type of entity might be better for you instead of starting a real estate investment LLC.

But the truth is that there isnt even one entity that offers all the best benefits and has no risks at all even though starting a real estate investment LLC is favored a lot. And partnerships and corporations share almost similarities that many dont know, tend to miss or ignore. The following would you a bit:

Also Check: Best Bank To Open An Investment Account

The Bottom Line: Llcs Are Great For Established Investors But Less Useful For New Investors

Members can gain liability protection within their business entity by establishing an LLC. Your state government can give you an overview of your state’s specific LLC laws.

An LLC also offers privacy, limited liability, tax benefits and partnership opportunities. However, you need to watch out for ongoing costs, difficulty getting a mortgage, disadvantages with capital gains treatment and a few other cons.

Rocket Mortgage does not offer loans to LLCs. However, first-time real estate investors may find it more advantageous to buy property in their own name because of the roadblocks and additional costs of buying a home with an LLC. Established investors should also tread carefully. They should consult a business attorney to determine the best legal structure for their investments.

Remember that it’s normal to feel analysis paralysis! To combat indecision, consider applying for a mortgage in your own name and working your way up to more complex investments.

Ready to apply for a mortgage outside of an LLC for your investment or residence? Were here to help you get started today. You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Fundamental Mistakes To Avoid When Starting An Llc For Real Estate

While forming a real estate LLC is immensely important for protection, the beginning stages of setting it up can also be massively intimidating for beginners. Also, there are several common mistakes that investors make along the way. To better assist in understanding the complexity of a real estate LLC, the following outlines the biggest mistakes people need to avoid when forming an LLC:

Not starting the process of forming your LLC before pursuing new deals.

Selecting the wrong LLC structure for your business.

Commingling personal and business funds, or engaging in unethical practices.

Not consulting a professional on the best corporate and tax structures for your business.

Omitting the proper steps and due diligence recommended when forming an LLC.

Underestimating ongoing costs and maintenance to keep the LLC up and running.

Recommended Reading: How To Invest In Gold Mining Companies

Making An Initial Contribution Is Strongly Recommended

While most people do make an initial capital contribution, legally it is not required. You could simply appoint yourself as the sole member of your SMLLC without making any initial investment. However, youâd probably be taking a significant risk if you didnât invest at least a small amount at the outset. Without any capitalization, your business may not appear to be truly separate from you, personally. In other words, without any initial contribution, if your business is responsible for someone being injured, or incurs a debt that itâs unable to pay, a court might decide that your company suffered from inadequate capitalization. It therefore might allow someone with a claim against your business to âpierce the veilâ of limited liability associated with your SMLLC, and go after you, personally, for restitution.

Making a money contribution can be very simple: You write a check from your personal account and deposit it in your new business account. Moreover, you donât necessarily have to invest a large amountfor some very small businesses, a few hundred dollars might be plenty. The main point is to pay in enough money to meet your initial expenses. Then, going forward, itâs important always to keep enough capital in your business to meet your reasonable, ongoing expenses.

Real Estate Holding Company Example

An example real estate holding company may help illustrate what this business structure would look like. In this example, I want to start Business Holding Company, LLC. After I follow the necessary protocol I decide to purchase an investment property. The property will be owned under Business Holding Company, LLC, with a property manager in charge of operations.

Lets say I purchased an apartment complex before starting Business Holding Company, LLC. In this case study, I now want to move that property into my newly formed LLC. To do so, I would obtain a deed, file the necessary paperwork, and then transfer the property ownership. I would also update any documents that need to reflect the change in ownership, like tenant agreements and leases.

Now, I have two properties operating under Business Holding Company, LLC. The holding companys balance sheet would then reflect the combined operating income, liabilities, and ROI. As an owner, I would be responsible for oversight and support. While this is an oversimplified example, it can serve as an overview of what a real estate holding company might look like.

Recommended Reading: Wells Fargo Real Estate Investment Banking

Create A Business Plan

A business plan allows you to carefully think through your limited liability company investment, estimate costs, understand the market, detail your company structure, identify needs for professional assistance, and plan how you will grow your business.

If you intend to form your LLC with several members, a business plan can help map out each person’s responsibilities.

Maintain Ownership Through Your Llc

If you will be buying real estate, purchase it only in the name of the LLC. This not only prevents the commingling of assets, but it also provides other important protections.

If you own real estate in your own name and transfer it to an LLC, this triggers the lender’s due on-sale provision in the mortgage . These provisions state that if you sell or transfer the property, the full amount of the mortgage immediately becomes due at the time of the sale. Because of this, it is very important to buy property as an LLC and obtain financing in the LLC’s name.

Also Check: Best App To Start Investing

Is There A Perfect Solution

With this structure, is your name still on anything? The answer is yes.

If you used a residential loan, your name remains on the loan documents after you transfer ownership of the property to the LLC. In addition, since youre likely managing your umbrella LLC, your name appears on most of the documents signed by that LLC in your capacity as a manager. Unless you hire an outside person to do that for you.

As with everything, the anonymity isnt perfect. Theres always a chance that you can get sued. Just like there is always a chance that a particularly smart lawyer may be able to find a way around your LLC protections. In U.S. court, nothing is 100% protective. The idea here is to shield yourself the best you can using business entities.

One last personal note about anonymity. I know there are some doubters out there saying, any lawyer can figure out who owns the LLC. While this may be true, anonymity isnt just about lawyers. A story about one of our properties made the newsand not in a good way. Fortunately, our structure kept us out of the limelight. That one incident alone made our asset protection completely worth the investment!

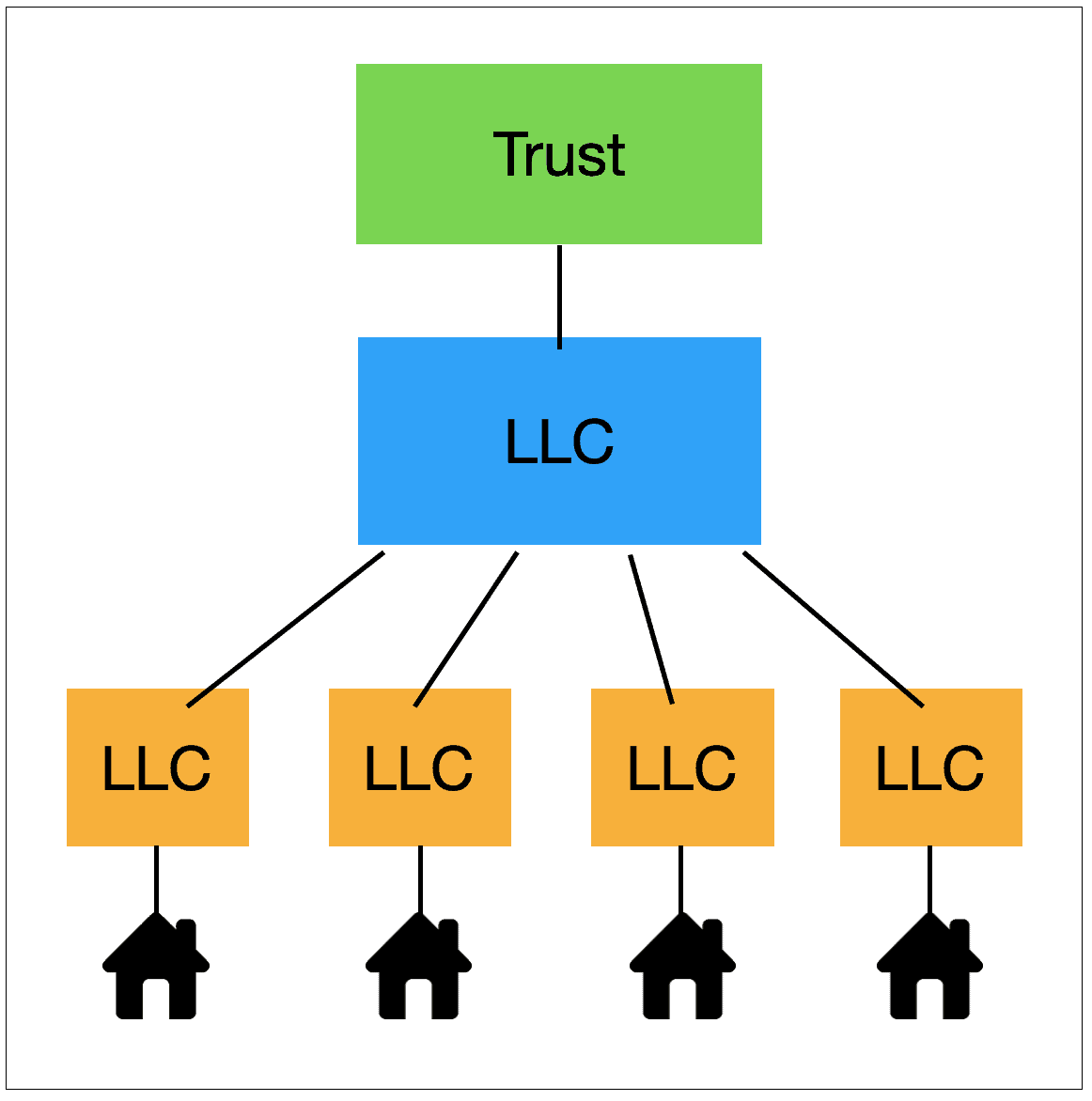

Consider Opening More Than One Llc

If you’re just getting started in real estate investing, opening an LLC may feel like a big step. However, if you are planning to own and manage many properties, there are benefits to creating a separate LLC for each property.

Each LLC is then separately contained. If a big loss happens with one property, it won’t wipe out your profits or equity with the others. Additionally, this kind of separation makes it easier to track expenses and financials for each property.

Recommended Reading: Investment Banking At Morgan Stanley

Forming A Real Estate Llc

To form an LLC for real estate investing , youll file formation paperwork with the state. . Once your LLC is formed, youll need the following:

- Deed: If you already have property you want transferred to the LLC, youll need the deed to the property. Should that deed be misplaced or lost, you will need to get a certified copy of the deed from your county recorders office. For a certified copy, youll likely need to pay a fee and provide the full name on the deed, the propertys address, and the year it was purchased.

- Deed Forms: Your county recorders office will also be able to provide you with the forms to transfer your deed to the LLC. You will use either a warranty deed or a quitclaim deedboth of which are valid for the sake of transferring property, but are distinct documents serving different purposes. Whatever kind of deed form you get for your transfer, fill out those forms using your legal name as the grantor and the full legal name of your LLC as the grantee.

- Signature & Transfer: You will need to provide a signature for the transfer. Some states require this to be done in the presence of a notary or other witness. Depending on state law, you may also need a proxy to sign as proxy grantee on behalf of your LLC.

Submit the deed to the county registrar or another relevant local agency that manages real estate records.

Obtain Licenses And Permits

A real estate investment LLC is typically not the only designation you will need to open your doors for business. Almost all states will have separate licenses and permits that are required before conducting business. These can include a general business license, sales tax permit, professional license, and more. Again, your questions on this part of the process can typically be answered with a little online research. I recommend starting with the U.S. Small Business Administrations website and going from there.

Don’t Miss: How Do I Invest In Cryptocurrency

Is Delaware The Best State For My Real Estate Investment Company

As with any business formation, you can choose which state in which to file. The most popular choices include Delaware, Wyoming and Nevada. Of course, many investors choose their home state, since they have to pay taxes to that state to operate. However, the three aforementioned states and Delaware, in particular offer some great additional benefits.

What sets Delaware apart from other states is its Court of Chancery. Delaware relies on experienced judges , and not juries, to rule on corporate law cases. This is the primary reason why more than two thirds of Fortune 500 companies are Delaware corporations, not to mention the tens of thousands of other companies that file in Delaware each year.

Another benefit of choosing Delaware is that Delaware allows LLCs and corporations to file privately, without the names of the owners on public record. This is ideal for separating yourself from your business operations.

Should You Put Your Real Estate Investments In An Llc

With the residential market continuing its surge, a number of people are turning to real estate as a way to diversify their investment portfolio. We are seeing more and more clients with a variety of legal issues related to the acquisition and development of rental properties.

One of the main questions that we hear is whether there is an overall benefit to using a limited liability company to hold an investment property. While LLCs can be a great way to limit any personal liability, it is important to consider a few different issues before taking that step.

Many real estate investors are drawn to using LLCs because they are easy to use, and they limit the exposure of any personal assets from claims related to the property. Unlike corporations, limited liability companies are fairly straightforward in their structure and allow for maximum flexibility for business and tax planning purposes. However, similar to corporations, LLCs provide their owners with a great deal of protection from various claims arising for the development and leasing of the property. As a result, holding this high-risk asset in a separate LLC can be ideal for individuals who want the benefit of simplicity while still providing that added layer of protection.

In any event, it is important to consult with an attorney to ensure that the proper steps are taken that will minimize your costs while securing the protection that you need to maximize the return on your investment.

You May Like: Stone House Investment Management Llc

Establish A Business Bank Account

The biggest benefit of an LLC is that it shields you from personal liability from debts of your company. However, for this to be effective, you have to completely separate your personal funds from your business funds.

You should open a business bank account and business credit card. Funnel all business expenses through these accounts only. If you start to pay business expenses out of your personal accounts or directly deposit business income into your personal accounts, you commingle the funds and blur the lines between your company and your personal financials.

Once you cross this line, it makes it easy for litigants to pierce the corporate veil and access your personal funds to pay for company liabilities. Keeping your business financials completely separate provides you with the full protection of your LLC.