You Must Keep The Account Open For A Time

Naturally, Chase wants to attract customers who plan to keep and use their accounts after they receive a welcome bonus. In most cases, you must keep your account open for at least six months after you enroll in the promotion in order to hold on to your sign-up bonus. If you close your account within six months, Chase will deduct the account bonus amount from your account at closing.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Charles Schwab Up To $500 Cash Referral Bonus

Open a new qualifying Charles Schwab account with a qualifying referral from an existing Schwab client to earn a cash bonus of up to $500.

To qualify, ask a friend or family member with a Schwab account to send you their unique referral code. Then use the code to open a new Schwab account with an initial deposit or deposits totaling at least $25,000.

Make one or more qualifying deposits within 45 days of your account opening date, and youll receive your cash bonus about a week later.

Your bonus amount depends on how much you deposit during the 45-day qualifying period:

- $100: Deposit $25,000 to $49,999 in new money or assets.

- $300: Deposit $50,000 to $99,999 in new money or assets.

- $500: Deposit $100,000 and above in new money or assets.

Once your account is open, monthly fees may apply. Multiple members of the same household may qualify for bonuses individually, as long as they open separate Schwab accounts.

Read Also: How To Invest In Vti

Chase Private Client $2000 Bonus

You can get a $2,000 bonus by upgrading your account to Chase Private Client. You will need to get a coupon with an upgrade code using our link below before visiting a Private Client Banker.

Once the upgrade is complete, you will have to transfer a minimum amount of $250,000 in new money as outlined below within 45 days and keep that balance for 90 days.

When all the requirements are met, $2000 will be deposited into your account within 40 business days, which you can save or invest. Here are the steps you need to take to qualify for this offer.

How to Qualify:

Chase Sapphire Banking $1000 Bonus For New And Existing Customers

Ready for a BIG bonus? Chase is offering existing and new customers $1,000 to upgrade or open a new Chase Sapphire Banking checking account!

This post may contain affiliate links, meaning I get a commission at no cost to you if you decide to make a purchase through my links. Visit this page for more information. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Also Check: Can You Invest In Ira If You Have 401k

Refer Your Friends Promotion Up To $500 A Year

You can earn up to $500 annually when referring friends or family to join Chase Bank. An existing Chase client with checking and savings accounts and Chase credit cards can invite friends or family members by entering their email addresses.

For each friend you refer, you will earn $50 once your friend opens a new account a Chase Total Checking or/and Chase Savings using the coupon they received from you.

You can invite as many friends as you want, but its worth bearing in mind that you can only receive up to 10 bonuses in a year.

How to Earn $50 Per Friend or Family Member:

Keep in mind your friends can still benefit from any promotions that Chase is offering for opening their new accounts.

Is It Worth It

J.P. Morgan is neither the first company to offer no-fee trades nor is it the most innovative company in the bunch. However, it offers a few unique selling points. The Portfolio Builder tool is an excellent option for people who want to own funds along with individual stock positions. The easy buy and sell buttons make the nuts and bolts of investing easy to manage.The only real drawback to the platform is that it only supports after-tax brokerages and traditional and Roth IRAs. Business owners or side hustlers will need to host their self-employed retirement plans elsewhere.Overall, I dont think I would move my money from another no-fee brokerage to J.P. Morgan Self-Directed Investing. However, it will make top apps for free trades for the foreseeable future. New investors are likely to find that its easy to use, even if it’s a little bit boring. I like that it encourages responsible investing in line with risk tolerances and time horizons.

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Don’t Miss: Can You Invest In Roth Ira And 401k

More Details About Jp Morgan Self

Account minimum: 5 out of 5 stars

J.P. Morgan Self-Directed Investing has a $0 account minimum, making any amount of money youve saved enough to start investing. According to J.P. Morgan, you can invest as little as $1 in no-load mutual funds with no transaction fees.

However, the Portfolio Builder tool is one of Self-Directed Investings bigger selling points, and you will need to have at least $2,500 in your account to use it.

Stock trading costs: 5 out of 5 stars

Like most online brokers today, J.P. Morgan Self-Directed Investing doesnt charge a commission for buying or selling stocks. Although this is a common practice now, it was only a few years ago that buying stocks meant paying a commission on every trade. The decline of stock commissions likely had a hand in the major increase in retail trading activity that started in 2020 and continues to this day.

Options trades: 4 out of 5 stars

J.P. Morgan Self-Directed Investings options pricing is pretty standard just like with stock trading, you wont pay a per-trade commission. However, you will pay $0.65 per contract.

Account fees: 4.5 out of 5 stars

You’ll pay a $75 fee for full account transfers . Some brokers, such as Fidelity and Vanguard, don’t charge this fee, but among those that do, $50 to $75 is fairly standard.

Number of no-transaction-fee mutual funds: 4 out of 5 stars

Tradable securities: 3 out of 5 stars

Crypto availability: 2 out of 5 stars

Number of no-transaction-fee mutual funds: 4 out of 5 stars

Jp Morgan Investing: Up To $625 Bonus

Get a bonus of up to $625 when you open a new J.P. Morgan Self-Directed Investing account. See the full details of this promotion below!

For more current bank offers, see our bank bonuses page. The most popular offers are from Chase Bank, SoFi, and Axos Bank.

This post may contain affiliate links, meaning I get a commission at no cost to you if you decide to make a purchase through my links. Visit this page for more information. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Don’t Miss: Socially And Environmentally Responsible Investing

Jp Morgan Online Investing Raises The Bar On New Account Rewards

Offers clients up to $500 when they refer friends for Online Self-Directed Investing

New clients to receive up to $625 bonus

NEW YORK, January 19, 2022—-J.P. Morgan Wealth Management is upping its rewards for new and existing J.P. Morgan Self-Directed Investing clients to promote commission-free unlimited online trading.

Existing customers will receive a $50 bonus deposited to their account for each person they recommend who opens a Self-Directed Investing account through the refer-a-friend link. Existing customers can receive up to a total of a $500 credit in their account a year for the referrals. New clients will have the opportunity to earn up to $625 credited to their account when they open a J.P. Morgan Self-Directed Investing account.

“Growing your wealth on your own is such an empowering experience. When you reach that personal milestone, you want to share your story with your friends and network,” said Paul Vienick, Head of Online Investing at J.P. Morgan Wealth Management. “Investors who use the award-winning Chase app to trade are increasingly happier with their experience as we expand the tools we offer, and we want our clients to share that. Theres no better endorsement than one from someone you know and trust.”

Self-directed investing is becoming more popular with customers who are increasingly engaging with their banks via mobile apps and digitally supported tools. You can read more about this trend in: The rise of self-directed investing

Contacts

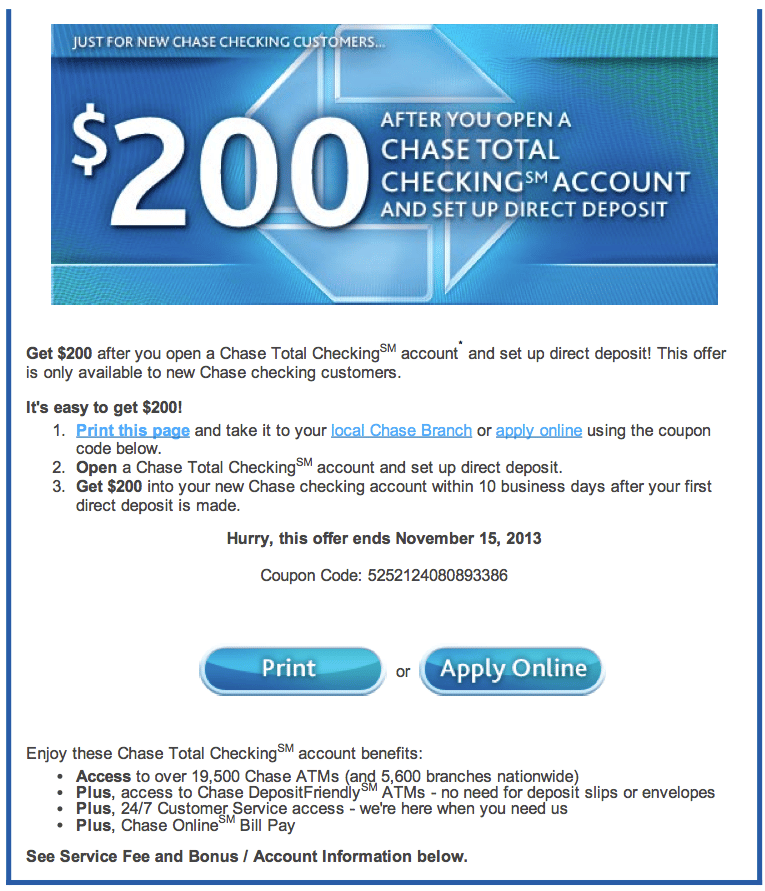

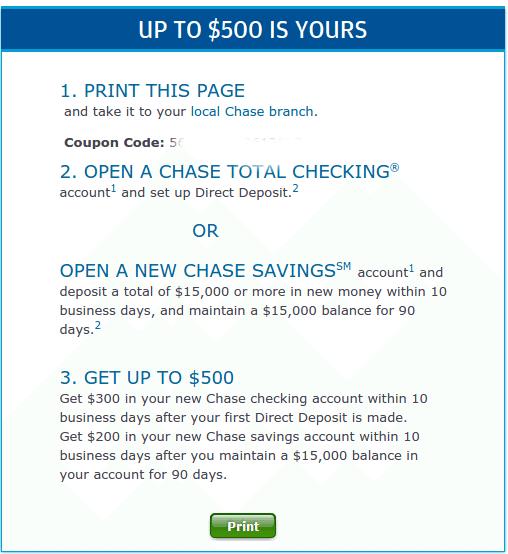

Who Is Eligible For Chase Bonuses

There are rules regarding who is eligible for these offers for each of the checking and savings offers, you cannot get the bonus if youre an existing Chase customer for that product. So if you have an existing Chase checking account, you cannot get the bonus for the checking offer. If you have an existing Chase savings account, you cannot get the Chase savings account offer.

Also, you can only get one new checking and one new savings account bonus every two years based on the enrollment date.

Things like this can invalidate you so make sure to review our guide on bank account bonuses to see what other gotchas other banks may have in their terms and conditions.

Also Check: What Is The Best Investment Website

Chase College Checkingsm $100 Bonus

Chase Bank offers a Chase College CheckingSM Account for college students 17 24 with proof of student status. The Monthly Service Fee is $0 for the 5 years while in college with a $0 minimum deposit. You cant beat that!

Access to more than 16,000 Chase ATMs and more than 4,700 branches.

Chase will also give students a $100 bonus if they open an account and complete 10 qualifying transactions within 60 days of account opening.

Available nationwide.

Fidelity Investments: $100 Bonus

Fidelity Investments is offering clients $100 for funding an account with at least $50.

To receive the award, you must:

- Open a Fidelity account through the official offer page.

- Use promo code FIDELITY100 when opening the account.

- Fund the account with at least $50 from a non-Fidelity account within 15 days of opening.

Youre limited to one award per person, and cannot have taken advantage of this offer when it was previously available. Existing customers are also eligible for this bonus.

The cash will be deposited into your account within 25 days of your account being opened. You must maintain the $100 award in the account for at least 90 days after receiving it.

Read Bankrates Fidelity review to learn more.

Don’t Miss: Variable Annuities May Invest Premiums In Each Of The Following

Are There Any Fees

Stocks, ETFs, options, and mutual funds trade commission-free with J.P Morgan Self-Directed Investing. The options contract fee is $0.65. If you want to buy bonds, youll pay $1 per bond . Fixed income also costs $1 per trade. Transaction fees you may face include:

|

Transaction |

|

|---|---|

|

Broker-assisted trade |

$25-$30 |

Free trades dont run out after an introductory period, making this the perfect app for people who want to buy and hold individual stocks along with ETFs or other assets.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Invest In People Who Invest In You

Few Advanced Trading Options

You can trade stocks, ETFs, mutual funds, bonds , and other fixed income assets with J.P Morgan. And the platform tries to differentiate itself from other investing apps by helping investors keep an eye on their total portfolio while giving them the flexibility to choose from a variety of investments. But it should be noted that while J.P. Morgan Self-Directed Investing is marketed as a trading platform, it doesn’t support foreign currencies, cryptocurrencies, or futures. You also can’t buy or sell fractional shares with a Self-Directed J.P Morgan account or trade on margin .

Where Jp Morgan Falls Short

Tradeable assets offered by J.P. Morgan are limited. You wont be able to trade in futures, crypto, commodities or forex. Additionally, some of its fees are higher than the industry standard. Youll be charged for each option contract and bond trade that you make.

The Automated Investing account utilizes J.P. Morgan ETFs only and theres a minimum deposit of $500 to access the managed portfolios. Maintaining this account will set you back 0.35% of your account balance annually, which is higher than others in the industry. Its worth pointing out that youll also need to keep the account maintained with at least $250, or risk having the account terminated. J.P. Morgan also doesnt support margin accounts.

Also Check: Phoenix Real Estate Investment Group

Trading Fees & Commissions

Clients benefit from a transparent pricing model at JP Morgan Chase.

There are no charges to open an account. There are also no commissions for online stock and ETF trades, however, a transaction fee between $0.01 and $0.03 per $1000 in principle applies.

Options contracts are also commission free, however, investors will be liable for a +$0.65 charge per contract in addition to the transaction fee listed above. Call-in trades cost between $20 and $25.

Fixed-income bonds, US treasury bills, and new issues such as corporate bonds and municipal bonds can also be traded without commissions. Secondary market investments will be liable for a $10 fee per trade +$1.00 per bond over 10.

Other fees to be aware of:

- Stop Payments $30 per item

- Late Payments PRIME + 4.75%

- Retirement Account Termination $75

- Bank Wire Transfers $25

An annual 0.35% advisory fee applies for Automated Investing profiles, meaning costs will vary by account balance. For example, an account balance of $50,000 will incur a monthly charge of $14.58.

Note, you will need to adhere to the minimum deposit requirement of $500 and you must maintain at least $250. Email alerts are activated if a profile balance falls below $300.

Jp Morgan Frequently Asked Questions

You don’t need any money to start investing with the J.P. Morgan Self Directed Investing. Plus, you can exchange commission-free stocks, ETFs, options, and mutual funds.

Its automated account, however, requires a minimum deposit of $500, and you’ll need to maintain a minimum account balance of $250 to keep utilizing its services.

You May Like: Best Credit Union For Investment Property

What Is Jp Morgan Self

J.P. Morgan Self-Directed Investing is a no-frills investment app designed to serve long-term investors. Its ideally suited for people who already have a lot of their financial life in the J.P. Morgan Chase world. If you already have the Chase App downloaded, opening an investment account is as simple as tapping a few buttons.The Self-Directed Investing app allows investors to buy and sell stocks, ETFs, mutual funds, and bonds with no commissions. It also offers investors the ability to buy and sell very low-cost options. The app itself allows users to keep watchlists and investigate individual investments. But the default views are on portfolio totals. This prevents investors from losing the forest for the trees. Dont expect gamification or flashing lights when you download the app. Its simple, streamlined, and almost old-school in its approach. But under the hood, youll find a powerful app that can give investors access to the most important aspects of the financial markets.

Note: J.P. Morgan also offers “Automated Investing” for those want robo-advisor wealth management. The company’s managed portfolios have 0.35% advisory fees and require $500 minimum investments.

Types Of Accounts Offered

J.P. Morgan offers several account options under the self-directed trading umbrella. Depending on your needs and goals, you can choose from:

- Individual taxable investment accounts

- Traditional IRAs

Taxable investment accounts allow you to trade stocks and other securities, with no annual contribution limits. If you sell investments at a profit, capital gains tax applies.

IRAs, on the other hand, are tax-advantaged.

- Traditional IRAs allow for tax-deductible contributions. Qualified withdrawals are taxed at your regular income tax rate.

- Roth IRAs don’t offer deductible contributions. But qualified withdrawals are always 100% tax-free.

There’s no option to open a SEP IRA, which is something you might be interested in if you’re self-employed. But you can open any of these accounts with a $0 minimum deposit.

That’s an advantage over other brokerages which may require you to have $1,500, $2,000 or more to start investing.

You can also choose from taxable accounts or IRAs if you’d rather choose automated investing with J.P. Morgan. The minimum investment for automated investing is $500.

Don’t Miss: Wells Fargo Refinance Rates Investment Property