A Note About Investment Property Mortgage Rates

Lenders consider rental properties to be a riskier investment than primary residences, and for good reason: If things go south and theyre unable to make payments, a borrower is more likely to default on a loan for an investment property than on their primary residence. As a result, investment property mortgage rates are generally higher than those for residential mortgages. That said, by working with a mortgage broker versus, say, a bank you can ensure that you get the lowest rate possible on your rental property loan.

Leverage Home Equity With A Heloc Or Cash

Using a home equity line of credit or cash-out refinance to buy property is another financing option for existing homeowners.

If you own a home, you may be able to use your homes equity for a down payment on your next place.

One way to do that is by borrowing cash secured against your home equity. Homeowners may be able to obtain a standard home equity loan, or a HELOC, to fund a down payment.

Using a HELOC, you secure a line of credit against your home, and then draw on it whenever you need cash flow. And you can begin paying the loan back with rental income.

Dont Miss: T Rowe Price Invest With Confidence

How Much Does It Cost To Buy An Investment Property

Inflation data is also necessary. Take this one as a sample: suppose you are buying a $650,000 investment property in Sydney with a 20% deposit. With that down payment, you will only need to take out a $520,000 home loan.

Is it worth putting 20% down on a rental property?

All in all, 20% down on a rental property is worth it. Still, if you dont have enough cash on hand, you have other options. Ultimately, what matters with down payments is how they impact your return on investment . To learn exactly how a down payment influences your investment propertys ROI, try Mashvisors real estate investment tools.

You May Like: Real Estate Investment Companies New York

Can You Put Down 10% On A Second Home

In fact, you must often put down a higher down payment for a second home compared to your first. To qualify for a loan on a second home, youll need a down payment of at least 10% on a conventional loan. This type of loan is not backed by the federal government. view details

Since mortgage insurance wont cover investment properties, youll generally need to put at least 20 percent down to secure traditional financing from a lender. see more

Investment Property Credit Score Requirements

When you finance an investment property, lenders generally want to see a better credit score than they do for a primary residence. For instance, Fannie Mae borrowers putting at least 25% down could get approved with a 620 FICO score for a primary home. That minimum credit score increases to 640 for a rental.

If you dont have great credit, you can try an FHA loa the underwriting is much more lenient. FHA loans are available for homes with up to four units, and credit score requirements start at 580. The catch? You must live in one of the units, so the building is still technically a primary residence.

You May Like: Banks Investing In Fossil Fuels

How To Invest In Land

Land investments can be a great way to secure your financial future, but its important to understand the process before you invest. The following steps provide an overview of whats involved in investing in land.

How To Find The Right Investment Property

There are many things you should consider when finding the right investment property for you. Here are a few things to ask yourself:

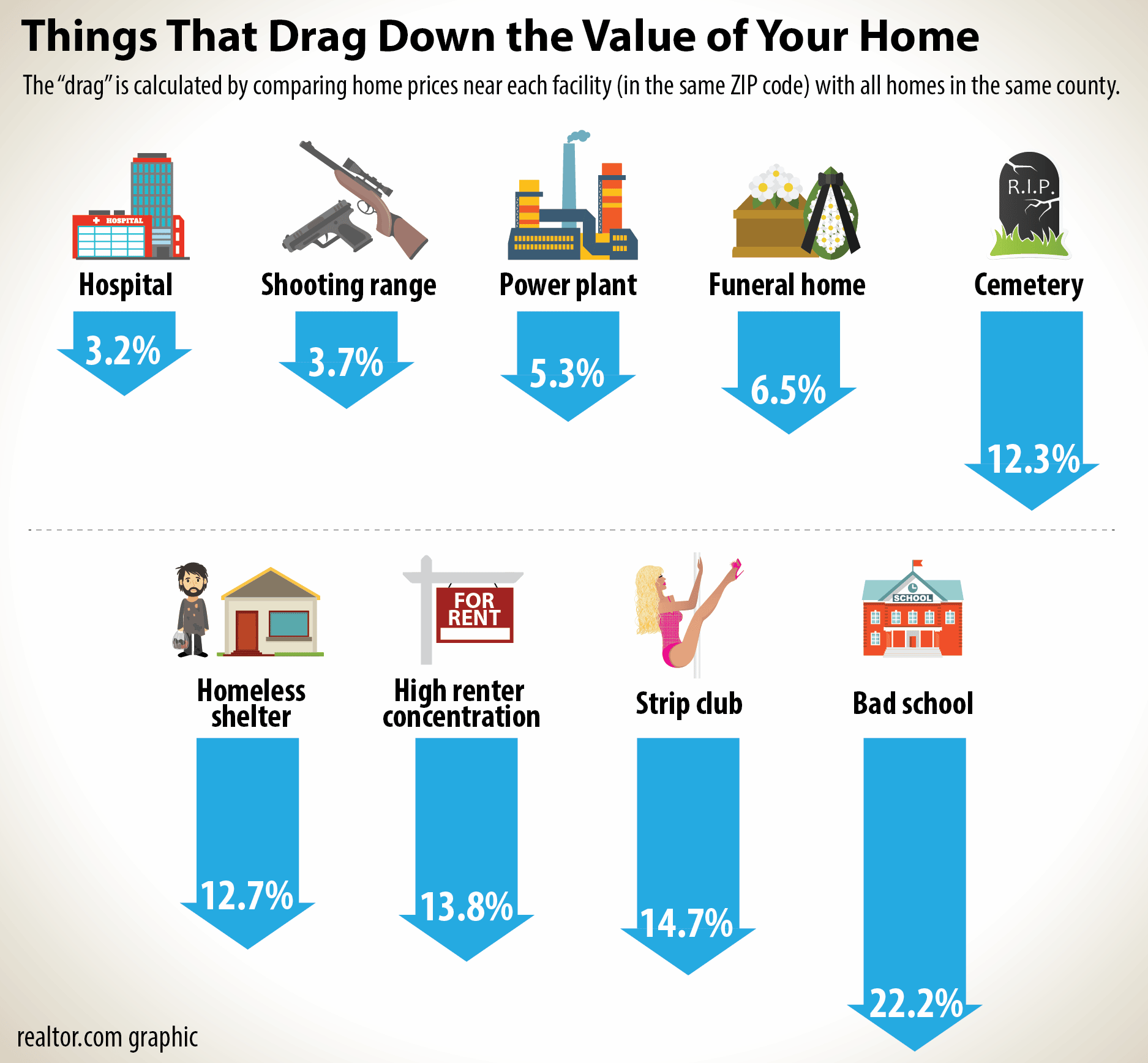

- What does the market look like? It is important to remain up to date with real estate trends.

- Try to make sure youre coming in at a time that is financially sound for you. Acting on emotion is not recommended but remaining proactive and reactive to market trends is.

- Where do you want to buy?

- Where is smart to buy?

- How much can you afford?

- Do you want to invest alone or as a group?

- How much could you charge as a rental?

- How much do other homes cost in the area?

- Does this area have a high rate of appreciation if youre looking to sell?

- What kind of attractions and job opportunities are around?

- Is this a vacation destination? If so, how can you remain competitive with other rental properties nearby?

If you know someone who has invested in real estate, it might be helpful to pick their brain. Knowledge is power!

Don’t Miss: Mortgage Rates Second Home Investment Property

Whats An Investment Property Anyway

Before we get into a discussion of how to finance an investment property, its important to clearly define what an investment property is.

There are three different categories a residential property can fall into:

- A primary residence is a home that you live in. You dont need to live there all year long for example, many people in colder climates live somewhere warmer during the winter months. The point is that a primary residence is your home base. One key point to know is that you can only have one primary residence at a time.

- A second home is loosely defined as a home that you live in some of the time but isnt your primary home. Despite the name, you can have more than one second home. You can rent out a second home when you arent there, but most lenders have minimum occupancy requirements for second homes. Well get into why the definition of a second home can be important for financing later on.

- Finally, an investment property is one that you never live in. Your primary purpose for buying and holding it is to make a profit on it. This doesnt mean a property you buy to fix and flip for a profit. An investment property is one you hold to produce income and long-term capital appreciation, not simply to resell it at a profit.

Also Check: Savings Ira Vs Investment Ira

How To Come Up With The Down Payment For A Rental Property

The decision to purchase a rental property is not typically made overnight. Aspiring investors should spend time weighing their options, and perhaps more importantly: getting their finances in order. The first step is to take stock of your current financial standing. Start by creating a monthly budget and tracking your expenses and income over the course of several months. Pull a copy of your credit report as well. Do not be intimidated by your starting point instead, use it to motivate your future financial goals.

After you establish your current situation, begin looking for new opportunities. Where does the majority of your money go? How much are you contributing to your savings each month? Are you increasing or decreasing your overall debt? Examine each area and form better spending habits for yourself. It may help to set limits within your budget or add an automatic transfer to your savings account on a monthly or bi-monthly basis. Developing sound financial habits will take time, but doing so will help you long after purchasing your first rental property.

Forming better spending habits will get you on track to save up for a down payment, but it is not the only thing you can do. Investors should also look for ways to increase their income in the meantime. Even a small boost will increase the amount you can save monthly, and in turn, speed up your investment timeline.

Dont Miss: Epic Real Estate Investing Podcast

Also Check: What Does A Chief Investment Officer Do

Ner With Friends & Family

Instead of borrowing money from friends and family, you can always bring them into the deal as partners.

They contribute to the down payment for the investment property, and share in the profits as co-investors, rather than just giving you a short-term loan. Remember to always set out clear terms and expectations, as the dreaded mix that is family and money can be a headache if there is anything left in doubt.

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Commercial Rental Growth To Continue

And finally, the strong rental growth seen in the commercial property market is drum roll here to stay. Demand for Australian commercial real estate remains strong, largely thanks to foreign investors looking for a high-yielding asset to place their capital into.

Specifically, office and industrial premises are driving the most demand, with buyers claiming the high income on offer from ironclad lease agreements are offsetting the headwinds of rising interest rates. Not to mention the depreciating Australian dollar against the USD, which is causing many American and Singaporean investors to partake in whatever available high-quality stock they can find.

Also Check: Can You Get A Loan To Invest In Stocks

Strategies For Investing In Land

Buying raw land is one type of real estate investment, but there are several different strategies that you can use for investing in undeveloped property. Often, land is bought specifically for development purposes . Other times, investors buy land to flip it to a specific developer or hold it indefinitely while it appreciates in value.

Heres how each of these strategies works in practice:

Investment Property Loan Rates

Lenders know that investment property loans are riskier than loans for owner-occupied homes. Thats because if a borrower gets into financial trouble, theyll prioritize paying their main mortgage over their investment property mortgage.

As a result, lenders charge a higher interest rate for investment property loans than for ordinary mortgages as well as setting higher barriers to qualifying.

As weve already mentioned, these rates are often 0.50 to 0.75% higher. That will vary by lender as well as your down payment, credit score, cash reserves, and DTI. Youll get the best interest rate on an investment property with a down payment of at least 25%.

To find out more, read: Investment and rental property mortgage rates.

Don’t Miss: How To Invest In Amazon Without Buying Stock

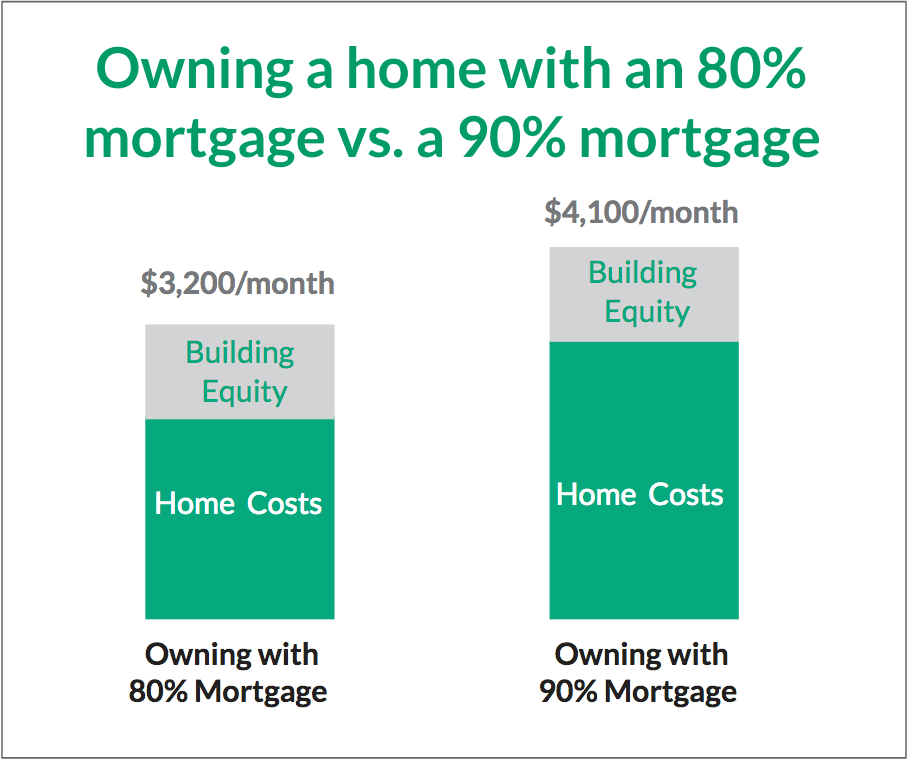

% Down Payment Mortgage Programs: Which Is Best

Imagine you want to buy a home priced at $500,000. That may sound like a lot of money and it is! but in many real estate markets, its only an average price tag.

That makes it tough for the average buyer to save up the recommended 20% down payment before making a purchase. You would need $100,000 in cash before you even start attending open houses.

The good news is you dont have to save a full 20% of a homes purchase price before you get a mortgage. There are plenty of options for hopeful homebuyers who only have enough cash to put 10% down .

Of course, these options come with their own upsides and drawbacks. It can get confusing to sort through the differences, so in this blog post well explain some of the most popular choices and why it could or could not work for you.

Freddie Macs Home Possible Loan Program

Freddie Macs Home Possible Mortgage offers low-income borrowers the opportunity to purchase a home with as little as 3% down. If you wish to use the program to finance an investment property, one of the borrowers must live in the home but co-borrowers may live outside of the home.

Again, your lender may be able to count rental income while calculating your debt-to-income ratio. But the rental income will need to satisfy Freddie Mac guidelines. For example, youll need to prove that your renter has lived with you for at least a year and plans to continue residing at the new residence.

Even with a lower credit score, you may be able to qualify for a mortgage loan through the Home Possible program. But you may need to provide a larger down payment of 5% in this situation.

You May Like: How To Invest In Stocks At 18

Buying A Second Home To Rent

Buying a second home that will be used as a rental property comes with a number of advantages, most notable of which are the tax deductions. But on the flip side, it also means that a buyer will become a landlord and have certain responsibilities that will require time and energy. It is one thing having a second home that you only visit for yearly vacations, and it is an entirely different thing to have a second home that will be rented out.

As far as tax deductions are concerned, there are two conditions under which a property will be considered a second home. They are:

An example of these conditions being met is a second home that you rent out for 200 days in a year and live in for at least 20 days in the year. Meeting these conditions ensures that the house qualifies for a second home mortgage.

Considering that second home mortgages are usually easier to qualify for than investment property mortgages and come with lower interest, it is important for you to carefully evaluate all the criteria involved in meeting them.

Ready to buy a second home? Or maybe you want to purchase an investment property. You need to know the difference between the two, because getting a mortgage loan for one is usually a more complicated and costly process.

How To Apply For An Investment Property Loan

It may take time to fill out your application, so gather any required information and paperwork ahead of time. You may need to provide tax returns and financial statements as well as information about your business.

Once youre approved, youll be given a loan agreement that lists loan terms, including your mortgage rate. If you approve, sign the documents and the funds should be deposited into your bank account.

You May Like: Wells Fargo Refinance Rates Investment Property

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

How Much Do You Have To Put Down On An Investment Property

Asked by: Mrs. Stephania Hill MD

Most mortgage lenders require borrowers to have at least a 15% down payment for investment properties, which is usually not required when you buy your first home. In addition to a higher down payment, investment property owners who move tenants in must also have their homes cleared by inspectors in many states.

You May Like: Will Investment Banking Be Automated

Getting Approved For An Investment Property Loan

In addition to the size of the down payment, lenders also consider factors such as credit score, debt-to-income ratio, and cash reserves when an investor applies for a rental property loan.

According to LendingTree, the chances for getting approved for a conventional investment property loan strengthen when borrowers meet the following loan criteria:

- Minimum of 15% down payment, although some investors use house hacking to reduce the amount of money needed to put down.

- Minimum credit score of 700, although the loans with the best terms and rates are available to borrowers with a credit score of 740 or higher.

- Maximum debt-to-income ratio of 45%, which means that the percentage of gross monthly income used to pay monthly debt can not be higher than 45%.

- At least 6 months in cash reserves is required to buy an investment property, to have funds available to pay the mortgage if the home is vacant for an extended period of time.