Advertise On Your Car

Earn passive income by turning your car into a rolling billboard. Sites like Free Car Media, Wrapify, Carvertise and StickerRide connect car owners with advertisers. In exchange for putting a vinyl decal on your car for an agreed upon amount of time, youll earn a tidy passive income stream, all without disrupting your normal driving routine. Just make sure the platform and campaigns you choose match up with your driving habits. Some require a certain amount of mileage per day or that you be a delivery driver.

Bond Etfs Vs Bond Ladders

A laddered bond portfolio is an investing strategy in which you purchase a series of bonds that mature at different intervals. As each bond matures, you replace it with a new bond that may yield higher returns. Its a popular fixed-income investing strategy and has been frequently compared to bond ETFs.

Bond ladders could generate higher returns for investors, simply because individual bonds generally yield better returns than ETFs. But individual bonds, as mentioned earlier, are often more expensive than ETFs and more difficult to purchase, so theyre not always a good investment option for beginning investors or investors who have less capital to work with.

A bond ETF is a cheaper and more convenient option for investors who want to trade on the stock market.But you dont need to choose between one or the other. Both bond ETFs and individual bonds are good investments for your portfolio. Its tough to build a well-diversified portly without having some bond-related securities.

What Are The Best Ways To Invest Money

Investing your money is as important as earning as investment helps you secure your life financially by letting you achieve your financial goals and helps you generate a parallel stream of income, wealth and to earn returns to beat inflation. Investors want to invest in the field from where they get sky-high returns that too as early as possible. They dont even want to take the risk of losing the principal money, this is the only reason that people keep searching for the best investment opportunity through which they can double their money with minimum or no risk at all. But in reality, this is not possible as if a person wants to earn a higher profit he will have to take higher risk i.e, risks and returns are directly related, the higher the risk the higher the profit the lower the risk the lower the profit.

Recommended Reading: Invest In Stocks With No Money

How Can I Invest In Fixed Income

It’s possible for an individual investor to buy a single bond or other fixed income security. But it requires a significant amount of assets to build a diversified portfolio of individual bonds. What makes it difficult for individuals to buy and sell many types of fixed income securities? High minimum investment requirements, high transaction costs and a lack of liquidity in the bond market.

But individuals can still invest in fixed income through mutual funds and exchange traded funds. BlackRock offers three major categories of fixed income investment solutions:

Actively managed bond strategies, in the form of mutual funds, can pursue the most attractive opportunities in fixed income markets while seeking above-benchmark returns. With experts in every sector of the worlds bond markets, BlackRock combines global reach with local expertise to access opportunities wherever they reside.

Exchange traded funds first appealed to equity investors, providing efficient access to the worlds stock markets. Now ETFs are transforming fixed income investing.

| 1-5 Year USD Bonds |

With you can partner with a portfolio manager to help you build fixed income portfolios through a personal and flexible approach. Whether youre looking for income, less volatility or diversification, SMAs offer a range of taxable and municipal investment strategies that can be customized to your unique investment needs.

Q: What is fixed income?

What Are The Best Fixed Income Investment Options

The best fixed-income investments generate a steady income source for you and have tax benefits. If you are lucky, you can also enjoy a little bit of capital appreciation. In other words, you are guaranteed a level of ROI on fixed income investments, with an option of earning a bit more.

Such fixed-income investments are most useful when you need a stable source of income. For example, after retirement. These investments will let you turn your large corpus into a regular stream of income.

Even better if you can get tax-free income or deduction on the invested amount.

You have several options for fixed income investments ranging from sovereign bonds to diversified funds. However, not one fixed-income investment is the best for you at any given time. The best fixed-income investment for you would be the one which fits your financial needs and goals.

Here are the parameters you would want to check for selecting the best fixed-income investment for yourself:

i. Risk-Return combinationii. Duration or time to maturityiii. Individual security or portfolioiv. Investment sizev.Ease of investment and withdrawalvi. Tax savings and benefits

You must select fixed-income investment plans depending on your financial goals and needs. Capital preservation is one of the essential aspects of investing in fixed income investment plans. If you are close to retirement or want to invest safely fixed income investments are the best option for you.

You May Like: Best Place To Invest In Etfs

How To Work Out The Value Of A Bond

Yield to maturity is a useful measure of the value of a bond. It is also a good way to compare what you’ll get by investing in different bonds.

YTM calculates the average annual return of a bond from when you buy it until maturity. It assumes that you reinvest coupon payments in the bond at the same interest rate the bond is earning.

Make sure you always balance the return against any risks before investing.

What Are The Risks

When held to maturity, high-quality issues are generally considered conservative investments. Yet, like any investment, fixed-income securities can be subject to certain risks, including that of price fluctuation. This type of risk arises when you sell your fixed-income investment prior to the maturity date. However, that can also work to your advantage.

As mentioned, bond prices and interest rates generally have an inverse relationship: when interest rates rise, prices on existing bonds tend to fall, and when rates fall, bond prices tend to rise. So if you sell a fixed-income investment before the maturity date and interest rates have risen since your original purchase, you may receive less than your original principal. Then again, if interest rates have fallen since that time, the principal you receive back could be higher.

You May Like: Is Gold A Bad Investment

Why Do People Buy Bonds

Investors buy bonds because:

- They provide a predictable income stream. Typically, bonds pay interest twice a year.

- If the bonds are held to maturity, bondholders get back the entire principal, so bonds are a way to preserve capital while investing.

- Bonds can help offset exposure to more volatile stock holdings.

Companies, governments and municipalities issue bonds to get money for various things, which may include:

- Providing operating cash flow

- Funding capital investments in schools, highways, hospitals, and other projects

How To Make Money From Bonds

There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year.

The second way to profit from bonds is to sell them at a price that’s higher than you initially paid.

For example, if you buy $10,000 worth of bonds at face value — meaning you paid $10,000 — and then sell them for $11,000 when their market value increases, you can pocket the $1,000 difference.

Bond prices can rise for two main reasons. If the borrower’s credit risk profile improves so that theyre more likely to be able to repay the bond at maturity, then the price of the bond typically rises. Also, if prevailing interest rates on newly issued bonds go down, then the value of an existing bond at a higher rate goes up.

Yields, or the interest rate a bond pays, and bond prices tend to have an inverse relationship, meaning they move in opposite directions. If prevailing interest rates increase, prices for existing bonds are likely to fall because the coupon it offers is less valuable compared to new bonds.

With the Federal Reserve aggressively hiking interest rates in 2022, yields have gone up, which means that bond prices have generally gone down.

Not all bonds pay interest. Some bonds, known as zero-coupon bonds, offer a return once theyve matured. Because these bonds dont pay interest, they are usually sold for a deep discount to their face value.

Recommended Reading: What Should I Invest In Cryptocurrency

Ishares Core Us Aggregate Bond Etf

This is the largest bond ETF on the market, a whopping $79 billion fund. The fund contains bonds from across the entire U.S. bond market, with over 8,000 total positions. It includes federal and local government bonds, and corporate bonds from both small and large companies. Its also the most liquid bond ETF, given how large it is.

Fixed Income Investor Guide

The Fixed income investor guide summarises the unique characteristics of fixed income with its various subcategories of issuers and instruments. It helps to explain why fixed income investors should take a bottom-up approach to RI while borrowing from the experiences of other asset classes, such as listed equities.

Don’t Miss: Best Way To Invest 10000 Short Term

Example Of Fixed Income

To illustrate, let’s say PepsiCo issues fixed-rate bonds for a new bottling plant in Argentina. The issued 5% bond is available at face value of $1,000 each and is due to mature in five years. The company plans to use proceeds from the new plant to repay the debt.

You purchase 10 bonds costing a total of $10,000 and will receive $500 in interest payments each year for five years . The interest amount is fixed and gives you a steady income. The company receives the $10,000 and uses the funds to build the overseas plant. Upon maturity in five years, the company pays back the principal amount of $10,000 to the investor who earned a total of $2,500 in interest over the five years .

Some Best Ways To Invest Your Money Are:

-

Insurance Plans

Insurance Plans are an excellent investment instrument that provides you with a steady source of income and it also serves as a financial cover to cover your family in case of any suffering or unfortunate premature death.

Mutual Funds are one of the most popular investments amongst beginners that offers you the advantage of investing indirectly into the stock market. When you are busy with your jobs and businesses, you can not get time to make any direct investment or to follow the stock market heres where mutual funds come into play.

Some investment avenues offer tax benefits and you need to evaluate the trade off between the benefits of tax and the returns that you get when investing.

-

Fixed Deposits and small deposits

Fixed Deposits and small deposits are safe instruments providing moderate returns and they offer better liquidity and safety. These schemes are also good for beginners to earn a decent income in addition to the employee PF.

-

Public Provident Fund

PPF is a long tenure investment where the impact of compounding of tax-free interest is huge and as the interest earned and the principal invested amount is guaranteed, it is also a safer investment.

When investing in stocks, there is no guarantee of returns, it is difficult to pick up the right stock and timing your entry-exit is also not easy hence, the only silver lining is that is for a longer period and has been able to deliver higher than inflation-adjusted returns in equity.

Read Also: What Is A Spdr Investment

What Is Fixed Income

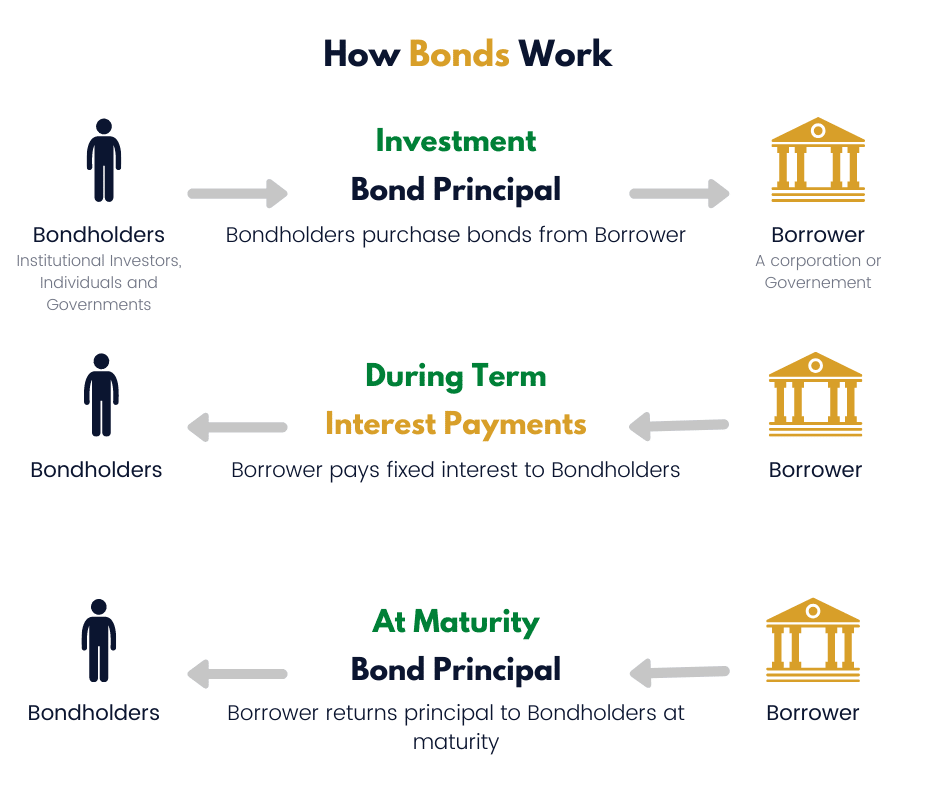

A city wants to build a new school a company is looking to expand production. The federal government needs to support poverty-stricken children. A company needs to expand production.

These entities borrow money by selling bonds, which is just another word for fixed income.

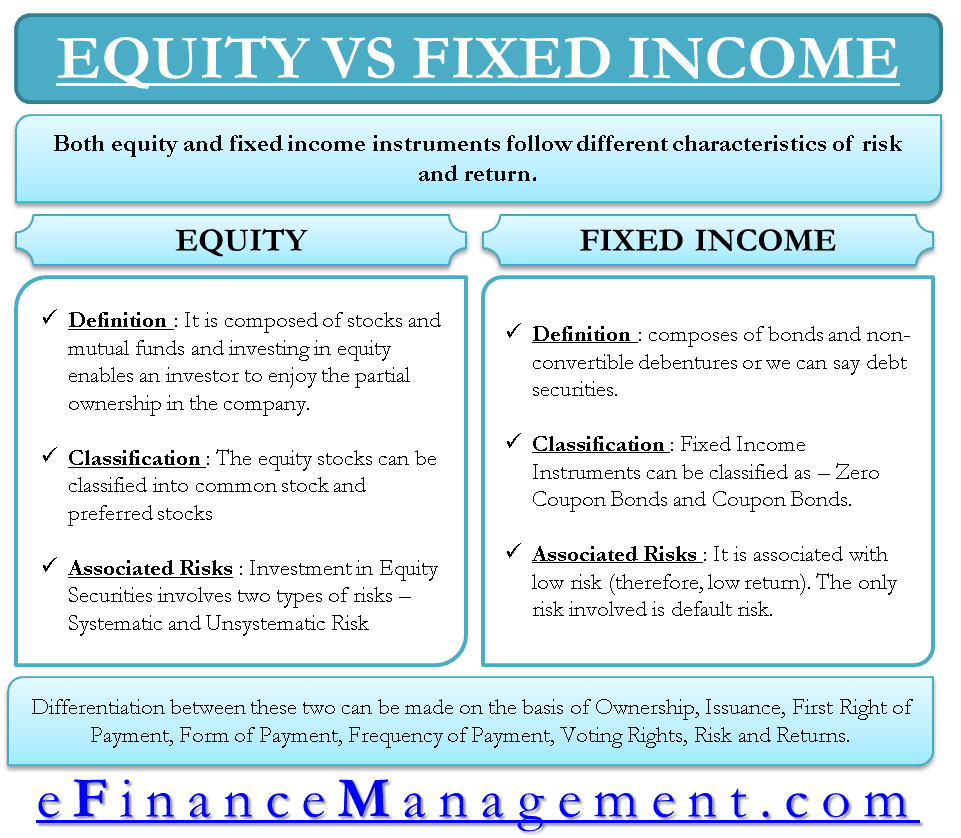

Fixed income debt securities are issued with a specific maturity date and interest rateâthe so-called coupon. During the life of the bond, interest payments are made on a regular basis, typically twice a year. At maturity, the issuer repays the principal, or par value, of the security.

Dependable and timely payments is why fixed income is such a desirable asset, especially for older retirees. Of course, there are trade-offs.

Inflation can eat away the value of the bondâs interest payments, while struggling companies may not make good on their debt obligations.

And if you own a basket of bonds in a mutual or exchange-traded fund, rising interest rates from the Federal Reserve could cause the value of your investment to go down.

Fixed Income Back To Basics

The broad and growing appeal of fixed-income investments has caused an explosion in the type and range of products available. Understanding the vast range of fixed income products can be overwhelming for both new and experienced investors alike.

The best place for most investors to start is at the beginning, with the basics:

- What is a fixed-income Investment?

- Why invest in fixed-income securities?

- What are the risks?

- Important considerations for Canadian taxpayers

Recommended Reading: What’s The Best Way To Invest In The Stock Market

Fixed Income Pros & Cons

-

More stable returns than stocks

-

Higher claim to the assets in bankruptcies

-

Government and FDIC backing on some

-

Returns are lower than other investments

-

Susceptible to interest rate risk

-

Sensitive to Inflationary risk

Some government bonds like Treasury Inflation-Protected Securities are indexed to changes in the inflation rate and protect investors accordingly.

While Different From Equity Investors Who Own A Share Of The Entities In Which They Invest Fixed Income Investors Also Play An Important Role In Promoting The Responsible Investment Agenda

Considering ESG factors can enhance risk assessments and as lenders of capital, fixed income investors can contribute to funding more sustainable business and growth models. The resources below can facilitate the incorporation of ESG factors in fixed income analysis and inform engagement on ESG topics within fixed income asset classes. To hear more about our fixed income work, .

Read Also: What Cryptocurrency Should I Invest In Now

How To Invest In Fixed Income And Whether You Should

Some investors need a relatively conservative investment strategy and less risk than with stock market investments. For those with that goal in mind, fixed income might be a good fit.

Fixed income includes assets and securities that provide the investor with a steady stream of income. With fixed income, the investor generally receives a set amount back at regular intervals. The payments include the principal plus interest.

How Fixed Income Works

To illustrate how fixed income securities work, letâs assume Acme Corporation needs to raise capital for a new production facility.

Acme has the highest possible bond rating and needs $10 million in funds. The company prepares to sell bonds with a par value of $1,000.

If an investor purchases a bond directly from Acme, they pay the face value. Bonds trade in the secondary market, and may trade above par, at a premium, or below par at a discount.

Letâs assume we buy the bonds directly from Acme and hold them to maturity. The bonds pay 4% semiannually on the face value of $1,000 and mature in 10 years.

Under this scenario, each bond pays $40 annually in two payments of $20 each. At the end of 10 years when the bond matures, the bondholder will be repaid the $1,000 principal and will have earned $400 in interest.

Also Check: Passive Real Estate Investing Examples

What Seniors Should Look For When Investing

When determining the safest ways to invest, you should consider the following:

- FDIC-insured accounts: Get peace of mind knowing that your deposits are federally protected. The insurance amount is currently $250,000 for certain investment options.

- Low-risk, low-return investing: If youre not a risk-taker, thats okay. Safe investment options may offer low risk and low returns, but its helpful if youre looking for a way to generate passive income long-term without rolling the dice.

- Diversification: For low risk, focus on the future of your long-term investments. Consider diversifying your investment portfolio with multiple safe investment options like high-yield savings accounts and bonds instead of relying on Social Security or retirement savings. Its always better to have more options when it comes to retirement income.

- Safe investing apps and resources: Educate yourself by downloading safe investing apps and resources or speaking with a financial advisor.

Did You Know: Diversify your investment portfolio. If youre not into stocks, low-risk investments such as high-yield savings accounts and CDs can be great alternatives.

Spotlight: The Case For Core Fixed Income

If you have been following our commentary, it probably wont surprise you that investment grade fixed income is one of our top investment ideas. In fact, we think investors could potentially earn equity-like returns through a diversified portfolio of fixed income assets. In todays note, we want to address the two most common concerns that we hear.

The first is, “I think the Fed is going to continue hiking rates. Why would I buy longer dated bonds while we are in a hiking cycle?”

The first thing to remember is that interest rates already embed the expectation that the Federal Reserve raises rates to almost 4%. The actual rate hikes therefore wont be enough to push long-term rates materially higher. Second, we think the Fed is very close to the end of the hiking cycle. Interest rates are already slowing activity in the manufacturing and housing sectors and inflation markets have already reverted to levels that are consistent with the Feds mandate. Finally, the yield curve is deeply inverted. In the last three rate hiking cycles, inversion of the 2-year 10-year yield curve has preceded the end of the Feds tightening cycle by an average of four months. We are two months in this time.

Strengthening your core: The case for fixed income

The second is, “Why would I want to own corporate and municipal bonds when we are heading into recession and defaults will rise?”

You May Like: Compare Investment Property Mortgage Rates