Think About Yourself First

Even though investing is a good idea, you need to think about yourself first. The last thing you want to do is spend everything you have on investingincluding your time, money, and resourcesat the expense of your studies. You must enjoy the freedom that comes with college life since this is a once-in-a-lifetime opportunity.

Best Budgeting Apps For College Students Summary

Many of these budgeting and money-saving apps for college students offer help to let you build up savings over time.

In fact, these saving apps help change your mindset about money and provide valuable ongoing lessons about financial wellness that can keep you out of debt and on the road to saving more money for today and tomorrow.

Your financial independence completely depends on how you feel about your life. If you dont feel motivated then you need to change something in your life. Your most of life will be utilized in working so better you have something in hand which you passionate about. The life is a roller coaster ride so there will be good days and bad days. To enjoy financial independence, you should have planned for both the situation. The money will play a big role in securing your future. Your focus should be balancing the money and passion equally to live the movement at the fullest.

Leave your thoughts below. Share with me how you manage your financial goal and what is financial independence to you?

Good luck!

Best For Keeping Track Of Student Loans: Mint

Mint is a free app that lets you track multiple accounts in one convenient place, including student loans. Though you may not be making payments while in school, Mint gives you a solid picture of where your debt currently stands and how it will impact your budget post-graduation.

Since Mint links to all your financial accounts, it gives you a constant birds-eye view of the rest of your finances as well. Just connect all your checking, savings, credit card, investment, and loan accounts to maintain a comprehensive view of your balances at all times. You can see your balances in the Mint dashboard.

Additional features:

- Create a custom budget to start tracking spending and saving

- Get personalized insights to help you save more and pay down debt

- Track bills and get notifications of when theyre due and if costs and fees have increased

- Get free access to your credit score and daily credit monitoring paired with advice on how to improve your score

Also Check: Investing In Cryptocurrency For Beginners

Consider Starting With A High

One of the simplest ways to give your savings a boost is to open a high-yield savings account. These accounts pay interest on your deposits at rates far above what is available through traditional savings or checking accounts, while still offering you the ability to make withdrawals at any time. And in 2022, interest rates on these types of accounts are on the rise.

Savers dont often think of bank products as investments, but they are. And theyre some of the safest alternatives around. CDs will pay you a fixed rate of interest in exchange for you committing money to the bank for a specified timeframe. These investments can be a good place to park money that you dont need until a specific time in the future.

For example, if you have money for next years tuition, you probably want that in a super-safe account that wont fluctuate with the stock market. A CD fits the bill for exactly this kind of requirement.

What To Do Vs What Not To Do

Before choosing which investment is best for you, here are a handful of important investing tips to consider.

Do invest oftenSome people think you need $1,000 or $10,000 to start investing. But that’s not true.

You can start with as little as $5 to $10.

And you should so you can start investing ASAP.

The best micro-investing apps make it easy to invest small amounts of money. Some even do it for you automatically.

Since the stock market can go up and down in value unpredictably, by investing often you can minimize the negative impact of the market dips.

Do plan for 20 years from nowA big mistake for new investors is trying to make a lot of money quickly. This can lead to making poor decisions about what to invest in and how much to invest.

On the other hand, if you look for low-risk investments that will grow over 20 years, then you can still make great returns over time.

You’ll also invest money that you won’t need for a while. And have a mindset that can weather the inevitable ups and downs in the market.

Don’t invest more than you can afford to loseInvestments always involve risk. And more risk often means you could make a greater return. This can be a lot of fun when things go well, but if you invest your rent for this month and it doesn’t go well, then investing can become a nightmare.

Pay your bills and living expenses first. Build up an emergency fund for 3 to 6 months. Then invest the extra money you have.

But in most cases, you won’t want to withdraw your money.

Also Check: How To Open Investment Account For Child

Can A College Student Invest In Stocks

Yes, college students can and should learn to invest in stocks. Investing is different than saving. You might put money in a savings account or simply let it accumulate in a checking account. You know precisely what your money will be worth when you use it. However, any growth is minimal. Saving is a wise move for college students, especially if they dont have an emergency fund yet. Still, it isnt the same as investing. When you invest your money, youre making your investment work for you as it earns dividends, increases in value, or both. You dont need a substantial amount of time or money to get started.

You can sign up with an online discount broker by providing little more than your identification information. Many online brokerages charge no fees for buying and selling stocks. These automate your investment portfolio by making contributions into suitable investments meant to align with your financial goals, timeline, and risk tolerance.

Suppose you prefer to have a more self-directed investing experience but still rely on automation to fuel youre investing. In that case, you might consider an app like Ellis. This investing service allows you to design your custom portfolios with pre-made investment selections or your preferred stocks. The service also comes with a bank account and debit card if you sign up for their Ellis service.

How Much Money Do I Need To Get Started Investing

I get it. As a college student with costs of tuition, books, student loans and more, it may seem impossible to even think about investing right now.

But the truth is, you dont need as much money as you think to actually get started investing in real companies. You no longer need hundreds or thousands of dollars to get started investing like you needed to have in the past.

Today there are beginner-friendly investing apps that let you get started investing in stocks with as little as $5. So yes, if you can forego that fancy Starbucks Latte Frappuccino for one day, even you can afford to start investing my friend.

You May Like: How To Invest In Germany

Be Disciplined And Invest Regularly

One of the best ways to build wealth is to invest regularly instead of trying to time the market. By investing a portion of your income each montheven just $5 a weekyoull get to take advantage of strategies like dollar-cost averaging. Plus, youll start building healthy financial habits that will last well beyond your college years.

Why College Is A Good Time To Start Investing

For most college students, investing is probably not something that regularly crosses their minds. And yet, now is the best time to start learning. Thanks to the online apps that we currently have available young college students like us can start investing in the stock market with very little money. Learning about it now while we are still young will put us ahead of most other people who simply choose to ignore it and the potential wealth it brings.

Investing does not require to us have a ton of money upfront. Many brokerages do not require a minimum investment amount. In fact, you can invest with as little as $5. Investing minimal amounts at the beginning of your college career could leave you graduating with a small amount of money.

Don’t Miss: Performance Based Fees Investment Advisor

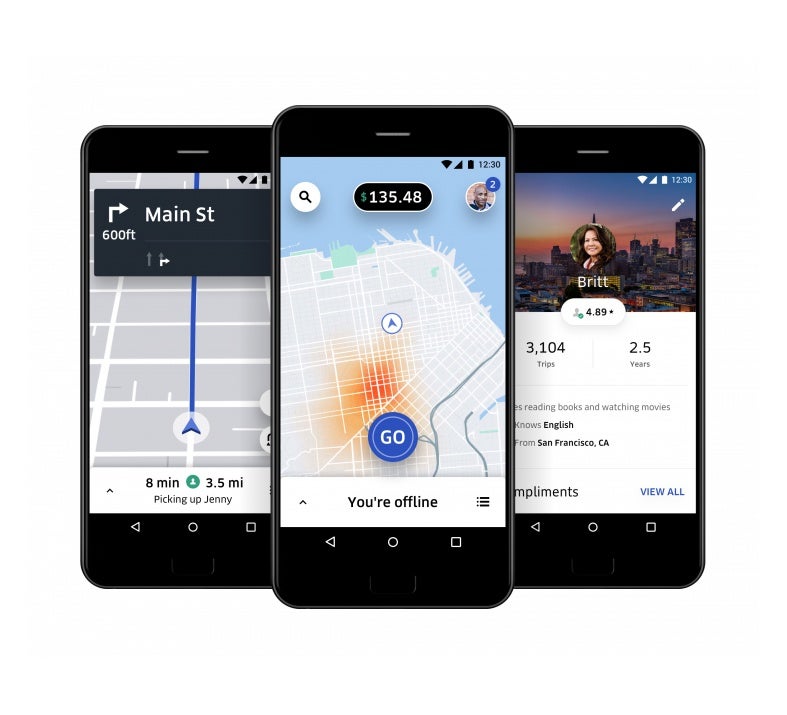

The Best Free Stock Trading Apps For College Students

Investing is vital for long-term financial success. Whether you want to save for retirement, save up for a down payment on a house or car, or just set money aside for a financial buffer, investing is your ticket to success.

But traditional investing has a problem, and its a big one: Fees can really eat into your savings.

This is particularly true for college students who may not be able to invest large amounts of money.

A $7 or $10 fee for each trade may not seem like a big deal, but if youre only investing $100 at a time, thats up to 10% of your money eaten up by fees.

Fees can have a huge impact on your long-term investment returns. Ultimately, the less you pay in fees, the more successful your investing journey will be.

Fortunately, free stock apps have made it much easier and cheaper for college students to start investing.

This guide will explore some of the best commission-free stock trading apps on the market today.

The Best Budgeting Apps For College Students

There are a ton of budgeting apps out there. Our article covers only the top apps most useful for college students.

average return of 397%

Our pick for best overall budgeting app for college students, Digit, is packed with features that put bill-paying, saving, and investing on auto-pilot. That makes it a great pick for those new to budgeting or who want a hands-off approach.

The other apps on this list all shine on one or two key points, such as beginner-friendliness or automated savings features.

For even more ways to help your wallet during your college years, see our article on the best money-saving apps for college students.

Read Also: How Do You Invest In Annuities

Investments Vs Student Loans

Should you invest if you have student loans?

If money’s tight, then your student loan comes first. But if you can meet your monthly expenses and make your student loan payment, then you’ll want to consider investing your extra money.

To make this decision, compare your interest rates.

Most student loan interest rates are very low, usually between 2.5% and 6%. But the stock market has consistently made 10% returns over the course of its history .

Therefore for most people, you’ll make more money by investing your extra money in the stock market, instead of paying down your student loan.

Want to get out of debt as fast as possible?

How do you invest and manage student loan debt?

You can pay for essentials and your student loan payment first. Then invest a portion of your extra money. Here’s a real-world example to show you how that could pay off over time.

Let’s say your student loan is $10,000. The interest rate is 5% and the monthly payment is $200.

If you had an extra $100 and used it to pay more on your student loan each month, then you’d save ~$450 over the course of your loan. And you’d pay it off in just under 3 years.

On the other hand, if you invested that extra $100 in the stock market and the returns were 10% per year, then you’d have made ~$600 in 3 years’ time. That’s 33% more!

For most people with student loan interest rates under 6%, it’d make sense to invest your extra money in the stock market.

Recurring Investments Let You Invest On A Schedule

Once youve had the round-ups activated for a few months, youll eventually realize that, though theyre a great way to mindlessly save and invest, on their own they are not going to be enough to let you hit your investment goals, especially if youre investing for something big like retirement or buying a house. The good news is, if you decide you want to invest more money, you canthrough either a lump sum or recurring investments.

A lump sum investment is exactly what it sounds like: A one-time investment into your account. Theyre great when you come into some money and want to put it to work growing for you.

Recurring investments, on the other hand, are a regularly-scheduled deposit into your account. You choose how much you want to invest, when you want to invest , and thats it. The app will do the rest of the work for you, investing the money for you as scheduled until you turn off the recurring investment.

Recurring investments are another great way of automating your investments so that you can help your money grow without actively having to think about it. If you have room in your budget, I highly recommend you turn on a recurring investment for whatever you can afford. Not only will it help you grow your money now, but it will help get you in the mindset of automatic investing which will be helpful in the future if you land a job that comes with 401k opportunities.

You May Like: T Rowe Price Personal Investing

A Small Emergency Fund

A small emergency fund could be the perfect place to start investing as a college student. Putting $500 to $1,000 in a savings account builds a buffer to help cover unexpected emergencies that could otherwise put you into credit card debt. While that may not seem like much money, it can help replace a flat tire on your car or pay for that medication you need to recover from an unexpected illness.

You can even earn money by saving the money in a high-yield savings account. These accounts pay higher than the usual interest rates youd receive at a national brick-and-mortar bank.

Waiting Too Long To Get Started

Its never too late to start investing. But the sooner you start, the more time youll give your investments to grow. In other words, you increase your potential for earning a lot more if you start now rather than later.

Just take a look at the difference 10 years can make in the chart below.

The investment portfolio of the person who started investing at 25 is more than 2x the portfolio value of the person who started at 35! And its more than 5x the portfolio value of the person who started at 45!

The key takeaway: take your time to research what you want to invest in and then get started ASAP.

You May Like: A Type Of Income Investment

What Is Your Investment Goal

If youre new to investing, its essential to ask yourself what your investment goal is. Are you looking to save for retirement? A down payment on a house? Or just wanting to grow your money over time? Knowing your goal will help you determine the best way to invest your money.

For example, if youre investing for retirement, youll want to focus on long-term growth investments like exchange traded funds , index funds or mutual funds. However, if youre looking to save for a down payment on a house , you may want to consider investing in a short-term goal like a CD or savings account.

A good rule of thumb:

- If you need the money in under a year, place it in a safe low risk spot

- If youve got a long term goal in mind, you can afford to be a bit riskier and invest in exchange-traded funds , index funds or mutual funds

Final Thoughts On Trading Apps For Students

Everyone has different trading goals and experience. Think about what you would like to get out of the app and test a couple out before investing your own money.

Overall, as a student, the sooner you start, the better it is to form a sense of financial management. During university, you should actively learn the knowledge of investment and financial management, and have a better understanding of various investment and financial management tools.

Don’t Miss: Marcus De Maria Investment Mastery

Forgetting To Simultaneously Invest In Yourself

As a beginner investor, you may find yourself wanting to put all of your time and energy into building a strong portfolio. But as Warren Buffet, one of the worlds most successful investors, once said: Ultimately, theres one investment that supersedes all others: Invest in yourself.

What are some ways you can invest in yourself? Well, for one, your education! By learning new things, in and out of school, you gain the power to enrich your life in a multitude of ways. Plus, it can give you more earning power and the opportunity to enhance your financial literacy.

Its also a good idea to invest overall in your health, general well-being, and happiness. Because without any of those things, how would you even enjoy any of the money you make from investing?

Recommended Reading: Apps To Invest In Stock Market

Invest In Stocks Etfs And More With No Surprise Fees

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. With a variety of convenient services at low fees, these investment appsthe best weve seen that are available todaymay help investors save money and improve their portfolios.

While you used to have to pick up a phone and call a stockbroker to make a trade , you can now pick up your smartphone, tap your screen a few times, and trade almost instantlyoften for free or at a relatively low cost.

After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today.

You May Like: Prosper Peer To Peer Lending Investing